Back-to-Back Sales Dips for Rental Dealers

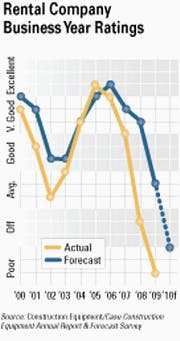

Rental dealers expected 2009 to improve when they responded to our survey near the end of 2008. Although they acknowledged the business disaster that had swept in on them, they did not anticipate the depth of the flood. Rental dealers expected an “average” 2009; they experienced “poor.” The outlook for this year is also “poor,” although the raw ranking is slightly higher.More forecasts: Economic, Contractors, Nonconstruction, Government, Distributors.

Sales volumes plummeted in 2009, the first time in the history of the Annual Report & Forecast that dealers have reported back-to-back negative numbers. The 2008 net was -20 percent; 2009 came in at -68 percent (8 percent reported an increase in sales minus 76 percent that reported a decrease). A third negative drop is not anticipated: 30 percent expect 2010 sales to increase minus 11 percent that expect sales declines for a net of 19 percent.

Hardest hit were new-equipment sales, with 67 percent reporting significant decreases. Short-term rental volume decreased for 41 percent of dealers, rent-to-buy business was down for 46 percent, and 44 percent reported de-clines in leasing volume.

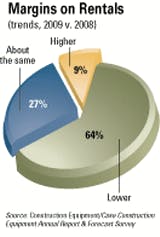

Although 27 percent of respondents reported that they maintained margins, 63 percent saw margins fall. For per-spective, 33 percent reported fallen margins in 2008. This year, though, one in three rental dealers said margins were “much lower” than 2008 margins.

Rates decreased through 2009 for 65 percent of rental dealers, and 5 percent were able to increase rates. Last year, only 10 percent anticipated that rates would fall in 2009. The serious nature of the construction equipment depres-sion has not been lost on rental dealers: only 15 percent anticipate being able to raise 2010 rates for short-term rentals. One in five report that rates will decrease this year.

As rental dealers head into 2010, recession loomed large as a pressing business concern for 79 percent, with declining construction markets close behind at 69 percent. Declining rental prices (64 percent) and declining rental demand (52 percent) are also causing concern.

Rental dealers expected 2009 to improve when they responded to our survey near the end of 2008. Although they acknowledged the business disaster that had swept in on them, they did not anticipate the depth of the flood. Rental dealers expected an “average” 2009; they experienced “poor.” The outlook for this year is also “poor,” although the raw ranking is slightly higher.

Rental dealers expected 2009 to improve when they responded to our survey near the end of 2008. Although they acknowledged the business disaster that had swept in on them, they did not anticipate the depth of the flood. Rental dealers expected an “average” 2009; they experienced “poor.” The outlook for this year is also “poor,” although the raw ranking is slightly higher.