2010 Economic Outlook

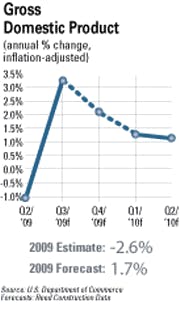

Construction spending growth for both heavy/engineering and nonresidential building projects dropped sharply in 2009 after three years of strong expansion. Meanwhile, the long housing recession finally ended in the spring. Construction spending will continue to decline into the winter of 2010, although most of the decline in this cycle has already occurred. The cumulative decline will be 24 percent measured in current dollars and more than 30 percent after adjustment for project cost inflation.More forecasts: Contractors, Nonconstruction, Government, Rental Dealers, Distributors.

Contractors and their suppliers will continue operating in subpar economic growth through 2011, which means better pricing and availability for off-site purchases. Supply conditions are still loosening for labor, materials and equipment bought in the depressed domestic market but have already begun tightening for imported materials, especially metals. This is due to rapidly expanding foreign economies and the falling U.S. dollar. Temporarily, prices of imported materials are also being boosted by the substantial absorption of excess inventories built up earlier in the year.

A few projects are still being delayed or cancelled due to lenders’ inability to finance loans they would like to make. But this problem largely ended last spring. Most loan denials now are due to the applicants’ distressed financial condition and the lenders’ assessment that cash flow from the project cannot service the loan. That said, some homebuilders and developers are unable to get good loans funded because the local regional lenders they use have failed or are about to fail from the pressure of defaulted real estate loans. This problem is most serious in the industrial Midwest, the Southeast and Southwest but is occurring across the country. This problem will worsen well into next year before it begins to fade.

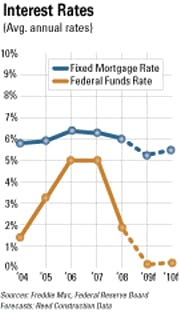

Still, credit is generally adequate for construction and other loans in the economy. This is temporary. Loan demand is depressed after a deep recession. As early as the end of 2010, expanded loan demand in a stronger economy will strain the now reduced supply of lendable funds. Money available for private lending has been reduced by loan defaults, reduced financial leverage, and massive federal borrowing. By next summer, the Federal Reserve Board will be withdrawing the emergency liquidity it put in the economy from September 2008 through spring 2009. This is necessary to avoid later inflation. The consequence for borrowers will be even tighter lending approval standards and rising credit costs. The consequence for the economy is sluggish growth for several years. The usual sustained 4-percent-plus burst of GDP growth after a recession ends is unlikely in this recovery period.

There are serious risks to the modest outlook for economic growth and construction spending in the next few years. Proposals are pending to expand federal deficit spending further. Already, the federal deficit tripled in the last fiscal year. More spending and/or taxes are being requested to expand healthcare services, reduce coal and oil usage, and subsidize the consumer and housing costs of low and moderate income households. Although this would provide a temporary boost to spending and GDP, it would come with ugly consequences for future economic growth and inflation. What Congress decides to do is the biggest uncertainty in the economic outlook.

Construction Markets

Each sector of the construction market is in a different position in the business cycle and will react differently to improvements in the underlying economic environment that has recently begun.

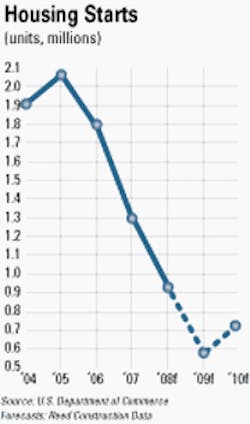

New single-family home construction is six months into the expansion phase. Improvements in confidence and income will produce quick and pronounced gains in housing starts. Residential remodeling is later in the business cycle and still in the decline phase for at least six more months. Gains in confidence or income will have a modest immediate impact on remodeling spending until the improved economic environment produces a sustained rise in home sales.

Multifamily home construction is always later in the cycle than single family building. It will be later than usual in this cycle because the condo market in major housing markets was so much overbuilt in the last expansion cycle. The apartment market will also be later than usual since jobs will return slowly and what had been the hottest apartment markets are now suffering population losses from the exodus of immigrant workers.

The developer-financed portion of the nonresidential building market will be declining for a few more months. Low rental and occupancy rates are still falling. However, this sector will experience a relatively modest recession because the recession began before significant space surpluses occurred.

The outlook is mixed for the institutional portion of this market. The recession will be long and deep for projects financed by state and local taxes which are suffering the worst decline in more than fifty years. Most of this decline is still ahead for K-12 schools, public safety buildings and government office.

Institutional projects financed with user fees or federal grants, including stimulus plan funds, will experience a mild recession. Most of the decline is still ahead in the next year. The outlook for the heavy sector is also mixed. The small private portion, mostly in power, transportation and communication, is shrinking quickly from the same overcapacity pressures that afflict commercial buildings. Growth has stalled in the larger public portion where stimulus funds are boosting road work but the collapse of state and local finances is depressing other work. Overall, growth is stalled for most of a year with no prospect for a significant improvement until late next year.