Contractors Pessimistic About 2010

Our survey had already been returned when the recession had been pronounced “over” by some economists as third-quarter GDP showed positive growth. Yet no one in construction believed that was the case for our industry. Double-digit unemployment, slow-moving stimulus funds, and a transportation reauthorization bill delayed by a Congress consumed by health-care reform all kept construction from any sort of rebound. As work in the pipeline kept many contractors occupied for most of 2009, that pipeline is decidedly quiet heading into 2010.More forecasts: Economic, Nonconstruction, Government, Rental Dealers, Distributors.

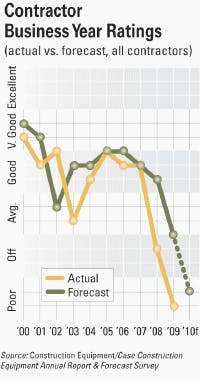

Respondents to this year’s Annual Report & Forecast survey rated 2009 “poor,” below their expectations of “off” recorded at the end of 2008. The realities of 2009, though, have not begun to ease, and contractors are not at all optimisitic about 2010. Their forecast is for another “poor” business year.

Slow to nonexistant stimulus funding coupled with the agonizing refusal of Congress to address the transportation issue have conspired to dampen hope for at least the first three-quarters of 2010.

Little Federal stimulus money trickled to contractors last year, with 84 percent receiving no money from the program. Some 16 percent said stimulus money funded projects on which their equipment worked, but only 2 percent said the money was used to rent, lease or buy equipment. Even with dollars targeted for emissions compliance, only 1 percent reported being able to use stimulus funds to upgrade machines.

When Congress finally settles in to discuss infrastructure, the new and dangerous levels of deficit threaten to temper that legislation. Indeed, many in the industry are calling on Congress to consider transportation reauthorization as a jobs bill and as a second stimulus in order to remind legislatures of the key national need for improvements.

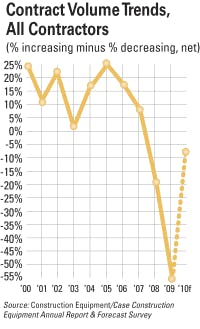

Contract volume dried up for contractors as 2009 wound down. Two-thirds, 66 percent, reported decreases in volume as compared to 2008 levels. Only 11 percent reported volume increases, for a net of -55 percent. The trend for this year is still negative, with 41 percent anticipating no changes in volume for 2010. The net is -7 percent, as 26 percent expect increased volume and 33 percent expect it to decrease.

A few regions buck the trend. Mid-Atlantic contractors report a net of 9 percent (33 percent expecting increases minus 24 percent expecting decreases), Southern Plains have a net of 7 percent (38 percent increasing minus 31 percent), and Northern Plains report the most positive outlook of 12 percent (39 percent increasing minus 27 percent decreasing). On the negative side, Mountain states are the most pessimistic with 28 expecting volume increases and 39 percent expecting decreases for a net of -11 percent.

With fewer jobs, more contractors are bidding on the existing projects. Competition has intensified. Some 77 percent report competing in “intensely competitive” or “very competitive” construction markets. Less than 5 percent said their market is “not very” or “not at all” competitive.

Ratings of overall company health declined this year, with 17 percent of contractors reporting “weak” or “very weak” firms. This is twice as many as 2009. By vocation, 21 percent of general building contractors reported “weak” or “very weak” firms, 15 percent of diversified (both highway/heavy and building), and 13 percent of highway/heavy contractors. About 46 percent of contractors says their company health is “very good” or “good.”Fleet Trends

Emissions compliance continues to be an issue for contractors, but uncertainty remains as to how individual states and municipalities will deal with regulations. California remains on the vanguard, and CARB did back down a bit in the face of the dire economic situation in that state.

Yet 40 percent of contractors responded that either nobody has official responsibility or they don’t know who has responsibility for emissions compliance within their organization. For most, 39 percent, the responsibility has fallen to the equipment manager. On a positive note, although the number is far too low, 1 percent have designated an environmental/emissions manager within the equipment department.

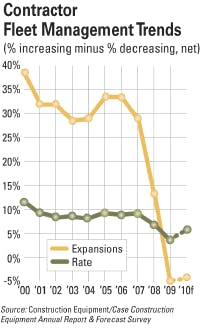

Fleet expansion trends indicate reductions in contractor fleets last year. About 16 percent increased the number of machines in their fleets, but 21 percent reduced for a net of -5 percent. Continued contraction is forecast for 2010, with a net of -4 percent: 11 percent will grow fleet minus 15 percent decreasing fleet size. The percentage of managers who stood pat with existing fleet size is 64 percent in 2009, and 74 percent say they will hold fast for 2010.

Replacement rates, a measure of how managers are updating their fleets, dropped considerably last year to a level more than half of what they were in 2007: 4.7 percent. Historically, replacement rate has been around 10 percent, and contractors were hoping to replace fleet at a 7.1-percent rate in 2009. With a gloomy outlook in construction, fleets do not expect to return to historical rates this year, instead forecasting a rate of 5.4 percent for 2010.

Contractors have maintained fleet condition, however, with 36 percent reporting “excellent” or “very good” overall condition for their fleet. The percentage of managers reporting “fair” or “poor” fleets has also remained consistent at 14 percent.

Contractors reduced workforce last year to offset the effects of the recession and market slowdown. Half reduced total workforce while 10 percent increased personnel numbers. Service and maintenance personnel were cut by 36 percent of contractors, equipment operators by 43 percent, and other hourly labor by 48 percent of contractors.

Our survey had already been returned when the recession had been pronounced “over” by some economists as third-quarter GDP showed positive growth. Yet no one in construction believed that was the case for our industry. Double-digit unemployment, slow-moving stimulus funds, and a transportation reauthorization bill delayed by a Congress consumed by health-care reform all kept construction from any sort of rebound.

Our survey had already been returned when the recession had been pronounced “over” by some economists as third-quarter GDP showed positive growth. Yet no one in construction believed that was the case for our industry. Double-digit unemployment, slow-moving stimulus funds, and a transportation reauthorization bill delayed by a Congress consumed by health-care reform all kept construction from any sort of rebound.