Manufacturers call it a demand problem, but equipment managers seeking to acquire new equipment cannot always find it. Supply or demand, the problem is forcing managers of the nation’s fleets to look for other ways to field the machines needed to accomplish the projects their organizations undertake.

See the complete 2023 Annual Report & Forecast

Demand is not only pent up from a two-year battle with restrictions imposed during the pandemic. Demand for replacement machines is also increasing as fleet age has advanced beyond what many managers consider healthy.

A healthy business environment also pushes demand. Business in 2022 was “very good” for construction equipment fleets, better than expected at the end of 2021, when respondents forecast a “good” year. Expectations for 2023 have returned to “good,” although they differ by fleet size. The larger the fleet, the more optimistic the forecast. The smallest fleets, with equipment replacement values (ERV) less than $500,000, forecast business for 2023 to be “average.” The largest fleets (ERV greater than $10 million), estimate the year to be “very good.”

Contract volume expectations also vary by fleet size. For all fleets, the net for revenue changes (the percentage increasing minus that decreasing) falls from 35 percent in 2022 to 16.5 percent in 2023. The smallest fleets record a net of 0 percent, that is, the same percentage expect revenue to increase in 2023 as expect it to fall. The largest record a net of 26.5 percent.

Fleet trends

Regardless of fleet size, respondents recognize that new equipment availability continues limited for 2023. In some equipment categories, order lead times extend into 2024. Inflation adds more strain to 2023 new-equipment budgets, as prices are increasing at rates not seen for years. Tight supply and high costs couple with economic circumstances that do not easily fit into past patterns to make 2023 planning even uncertain at best.

Equipment managers, however, must not only plan, but they also must handle current fleet needs. When asked how they would respond to the ongoing disruptions in supply, 44 percent said they would increase maintenance budgets in 2023 in order to extend useful life, up from 39 percent in 2022. Some 28 percent of managers said that they will accelerate purchasing plans for equipment to ensure they have what they need when their organizations need it. This percentage is also greater than 2022, when it was 20 percent of respondents.

Parts supply is also strained. Some 28.4 percent of respondents said that they will increase in-house stock of key parts in 2023, compared to 31.7 percent in 2022.

Rental, historically a solution to new-equipment problems, dropped a bit as a strategy for 2023. One in five (21 percent) said that they expect to rent more rather than buy, compared with 25.6 percent in 2022. The use of short-term rental (in terms of rental machine hours) increased for 35.6 percent of respondents in 2022, and about half (52.1 percent) said it stayed the same.

The rate at which equipment managers are replacing fleet has dropped from a healthy range of 9 percent to 10 percent seen from 2015 through 2020. Expectations for 2022 were that fleets would replace 8.4 percent of machines; instead the rate was 8.1 percent. Respondents expect to be able to replace 8.6 percent of machines in 2023.

Fleet expansions also fell short of expectations in 2022. Measured as a net percentage of those expanding the number of machines in their fleets minus those contracting, net fleet expansion in 2022 was 23.2 percent, compared to a forecast net of 27.7 percent. About half (52.4 percent) of respondents said fleet size remained the same compared to 2021.

The forecast for 2023 is even lower, with a net of 21.4 percent. About one-third (29.3 percent) expect to add machines, and 7.9 percent expect to decrease fleet size. About two-thirds (62.8 percent) expect to keep the same sized fleet. For the smallest fleets, the net falls to 12.1 percent with 75.8 percent keeping fleet size where it is. For the largest, the net is 26.5 percent with 57.1 percent keeping fleet size stable. In both cases, the net percentages are lower than reported in last year’s study: 16 percent and 48 percent, respectively.

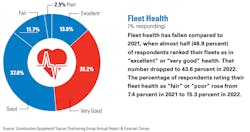

The problems facing fleets in 2022, 2023 and perhaps beyond are evident in the terms respondents use to describe fleet health. In 2021, 48.9 percent said that fleet health was “excellent” or “very good.” In 2022, that number dropped to 43.6 percent. In 2020, more than half (52.7 percent) rated their fleet in those terms. The percentage of respondents rating fleet health as “fair” or “poor” increased to 15.3 percent in 2022, up from 7.4 percent in 2021 and 9.4 percent in 2020.

Those ratings also vary by fleet size. Among the smallest fleets, one-third said fleet health was “excellent” or “very good,” compared to half of the largest fleets responding. About one-fifth (18.1 percent) of small fleets said that fleet health was “fair” or “poor,” with 8.2 percent of large fleets saying the same.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.