Construction markets delivered on expectations in 2022, calling it a “very good” year for business and an improvement over the “good” business reported in 2021. It is more of the same, according to respondents, for 2023. The business forecast is “very good.”

No surprise is the performance among home builders, who continue to see demand for new housing into 2023. Nonresidential construction has also been strong, with a “very good” 2022 expected to taper slightly in 2023. Water infrastructure continues to struggle. The market fell short of expectations in 2022 of a “good” year, instead rating business as “average.” The forecast for 2023 is “good.”

2023 Construction Reports

Transportation, arguably the market most affected by federal spending included in the Infrastructure and Jobs Investment Act (IIJA), reported a “good” year in 2022—which was expected—and forecasts a similar 2023 business climate.

Contract volume trends did not meet expectations last year, however. The forecast for 2022 was a net of 41.1 percent (the percentage expecting increased volume minus the percent expecting decreased), but the actual net for the year was 13.3 percent. Individual vocations varied greatly. Strong nets were reported among fleet managers (35.0 percent) and nonresidential (34.1 percent), but transportation reported a negative net—meaning a greater percentage saw volume drop than rise—of -4.5 percent and home building reported a net of 8.9 percent.

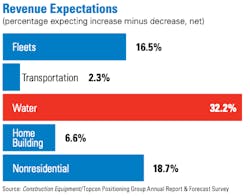

Volume trends for 2023 indicate a net of 9.2 percent, led by water infrastructure expecting a net of 32.2 percent. Transportation (2.3 percent) and home building (6.6) expect a flatter trend in contract volume growth.

Material price inflation remains a concern for respondents, with nearly two-thirds (63.8 percent) expecting costs to increase in 2023. Water infrastructure has the highest expectation, with 93.3 percent expecting material pricing to increase. Nets indicate trends, and those vary across vocations. Overall, the net for 2023 is 42.8 percent, which is down from last year. The large number of home builder respondents in this year’s survey are affecting overall trends. For home building, the net for material pricing is 33.4 percent. Compare that to the 93.3 percent for water infrastructure and 74.1 percent for transportation, and inflationary pressures are more evident.

Bid price expectations reveal similar variances. As an industry, the net for bid pricing in 2023 is 36.7 percent. Among home builders, the expectation is a net of 23.4 percent. All other vocations are substantially higher: Transportation expects a net of 75.2 percent; water infrastructure 90.0 percent, and nonresidential construction 63.2 percent.

Historical Construction Business Reports

Two-thirds (68.3 percent) of respondents face “intensely” or “very” competitive markets, comparable to numbers reported last year. Competition among transportation respondents dropped from 79.7 percent of respondents noting “intensely” or “very” competitive markets to 72.2 percent.

Firm health in 2022 also maintained similar marks compared to the previous year. Seven of 10 (70.5 percent) of respondents described the health of their firm as “very good” or “good” in 2022. This is still below the pre-pandemic level of 80.0 percent. The healthiest firms are in the transportation market (74.1 percent “very good” or “good”), and water infrastructure recorded 45.0 percent describing firm health as such.

Annual Report & Forecast Methodology:

Construction Equipment partnered with several magazines in the construction sector. Participants in the 2023 Annual Report & Forecast asked their subscriber bases about not only overall construction trends, but also trends specific to the sector in which they work. Each publication sent email invitations to its subscriber base, inviting participation in an online survey. Over 2,100 responded. Respondents by market include fleet managers, 164; transportation, 136; water infrastructure, 60; nonresidential, 212; and homebuilders, 1,590.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.