Work Truck Management Trends

Trucks are the unsung workhorses in a construction equipment fleet, moving personnel, tools and materials, and equipment to and from job sites. They travel on- and off-road, and although managers apply the same fleet-maintenance practices, some differences exist.

And they are a part of almost every equipment fleet, regardless of the vocation in which it is employed or the estimated replacement value.

We divide work trucks into two categories: medium- and heavy-duty. Medium-duty trucks include Classes 4-6, which represent gross vehicle weights (GVW) between 14,001 and 26,000 pounds. Heavy trucks, Classes 7 and 8, have GVW above 26,000 pounds.

The editors of Construction Equipment surveyed subscribers to determine how many work trucks are in fleets, how they are acquired and maintained, and how long trucks are kept in a fleet. Seven out of 10 Construction Equipment subscribers have trucking and hauling equipment in their fleets, so we targeted this portion of our base. We sent emails to this group, inviting them to participate in an online survey, and 115 completed the entire survey.

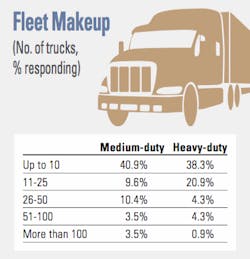

Half and nearly 60 percent of respondents, respectively, say they have 25 or fewer medium- and heavy-duty trucks in their construction equipment fleets. For those with larger numbers of trucks, 7 percent of respondents said they have more than 50 medium-duty trucks, and 5.2 percent have more than 50 heavies.

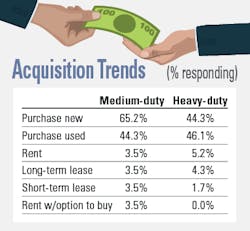

Fleet managers tend to purchase trucks both new and used, whether they be medium- or heavy-duty. Although a smaller percentage of respondents buy new heavies than those that say they buy new medium-duty trucks, the percentages are the same when it comes to used trucks. Less than 10 percent lease either size class of truck, whether it’s a short-term lease under a year or a long-term lease.

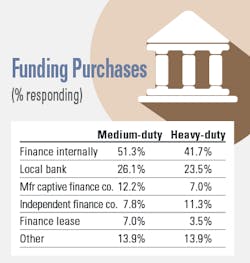

The most popular method of funding a truck purchase, whether new or used, whether medium- or heavy-duty, is through internal financing. About half use it for their medium-duty purchases, and 41 percent for heavy trucks. Bank financing is the second most common funding avenue, for about one in four respondents.

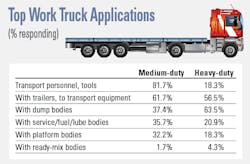

Truck application varies by size of work truck. For medium-duty trucks, transportation of personnel and tools is the most common application. For heavies, the use of dump bodies leads, with 63.5 percent citing that application. Slightly fewer, 56.5 percent, use heavy trucks with trailers to transport equipment, and 61.7 percent of respondents use medium-duty trucks for this task.

Most respondents keep routine service in house for both truck categories, and about half say they keep more major service, such as component rebuilds, in the hands of their own service staff. Independent service retailers and OEM dealers account for nearly the same usage rates, regardless of truck size.

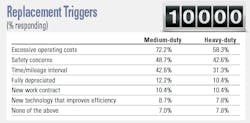

Respondents say they will replace a truck when it starts recording excessive operating costs: 72.2 percent with medium-duty trucks and 58.3 percent for heavies. Other key replacement triggers are safety concerns and time/mileage intervals.