Despite a steady decline in funding, the water industry remains positive-thinking and poised for growth. This positivity, however, is a muted shade of the assurance noted a year ago.

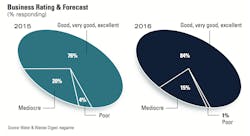

Last year, Water & Wastes Digest’s 2014 State of the Industry report showed a modest upswing in the works; however, that optimism was quieter in the 2015 State of the Industry. Seventy-six percent of respondents called 2015 good to excellent, while 80 percent stated last year that 2014 was good to excellent. It appears as though 2015 fell short of last year’s expectations, too, as 86 percent of last year’s respondents thought 2015 was going to be good to excellent.

Construction Sector Reports

Although 2014 saw 44.1 percent of respondents’ revenues increase, 2015 yielded only 31.6 percent of respondents with the same good fortune. The portion of respondents who claimed a revenue decrease remained the same between 2014 and 2015—18.9 percent. There is markedly less confidence in next year panning out to be a good year than was noted in last year’s survey: In 2014, only 6.9 percent of survey respondents predicted a revenue decrease for 2015; but in this year’s survey, 12.6 percent of respondents think their revenue will decrease next year. Similarly, the number of respondents reporting a good or very good overall firm health dropped about four percentage points between 2014 and 2015, with 69 percent of respondents claiming good to very good overall firm health, compared with 73 percent who claimed the same thing in 2014.

Almost one-third (30 percent) of respondents are planning construction of new water/wastewater facilities within the next 24 months. An additional 10 percent have new construction plans within 36 months. More than half (55 percent) are planning to upgrade their facilities. This number is slightly down from last year, when it was 59 percent of respondents planning an upgrade.

The largest percentage of respondents’ budgets will be invested in pipe/distribution over the next 24 months. This will account for 12 percent of budget expenditure. Sewer/collection and pumping equipment are the next-highest expenditures, with 10 percent of budget allocated for each over the next 24 months.

Almost three-quarters (72 percent) of survey respondents are involved with determining needs, 50 percent evaluate brands, 62 percent specify products and vendors, and 39 percent have authorizing and approval responsibility. Overall, 87 percent of respondents are involved in the buying process.

What keeps the water industry up at night? According to WWEMA, it’s funding—or, more accurately, the lack thereof. In June, Senate Appropriations Committees approved FY16 federal spending bills for the Department of the Interior, which includes funding for the Clean Water and Drinking Water state revolving loan funds (SRFs). Not surprisingly, funding levels for both were decreased as compared to their FY15 levels: at $1.853 billion for FY16, down from $2.35 billion in FY15.

The SRFs have always been important to water and wastewater projects, but as the amount of money in those programs continues to decrease each year, industry members must seek new and creative ways to support the needs of communities.

In 2014, The Water Resources and Reform Development Act (WRRDA) prompted a flourish of optimism in the industry. WRRDA established the Water Infrastructure Finance and Innovation Act to provide low-interest federal loans and loan guarantees for water infrastructure projects. The act also created the Water Infrastructure Public-Private Partnership Program for the Army Corps of Engineers to lead to increased financing of critical infrastructure projects through the use of P3s.

One year later, an American Society of Civil Engineers (ASCE) analysis concluded that much has been done since WRRDA was signed, but much work lays ahead. There is still a $60 billion backlog of projects at the Army Corps and skepticism remains that WRRDA’s P3s can help reduce the backlog. ASCE reported, “President Obama’s proposal for new public infrastructure financing still needs support in Congress. We hope Congress will stick to its goal of passing a WRRDA every two years. In the meantime, they should appropriate funds for the programs that were authorized in the last WRRDA.”

W&WD’s survey indicated an average respondent age of 55, an ever-so-slight decrease from last year’s average age of 56, indicating that the workforce is getting younger as professionals retire and make way for young, or younger, professionals. There will be a notable generation gap between exiting industry professionals and the new slew of their younger counterparts.

As the average respondent age declined, this year’s survey also indicated a boost from 2.9 percent in 2014 to 6.7 percent of respondents in the age group of 35 to 39, as well as a slight bump in the number of respondents under the age of 30.

One of the biggest questions the water industry must ask itself is, how are they going to pass on precious industry knowledge to those much younger and less experienced? This is going to be a real and tangible issue for the water industry to grapple with as it loses more and more of its wise workforce.

The water industry also must feel as if it is competing for its chance to serve the American people. A little campaigning may be in order. In November, the House approved a bill to spend up to $325 billion on transportation projects. If there is money for roads, there is money for water, and perhaps water as an industry should do as the loudest presidential candidates do in order to make a splash: Scream, shout and make some noise in the name of water infrastructure.