By all indications, 2015 was another solid year for U.S. architecture, engineering and construction firms. Despite facing a litany of market impediments—the still-sluggish economy, construction labor shortages, the slow-to-recover education and healthcare markets—the majority of AEC firms saw revenues grow in 2015, and an even greater number expect earnings to rise in 2016, according to a survey of AEC professionals by Building Design+Construction.

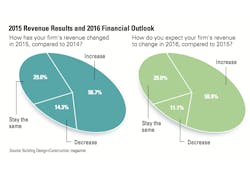

Nearly six out of 10 survey respondents (56.7 percent) indicated that revenues had increased at their firms in 2015, and 59.9 percent expect income from nonresidential building work to rise this year. This represents a slight uptick from 2014’s survey, when 54.4 percent reported higher revenue for the year.

Construction Sector Reports

About half of the respondents (45.7 percent) rated their firm’s 2015 business year as either “excellent” or “very good,” and just 2.1 percent said it was a “poor” year. Looking to 2016, 52.7 percent believe it will be “excellent” or “very good” from a revenue standpoint. Nearly three-quarters (71.4 percent) rated the overall health of their firm either “very good” or “good.”

Asked to rate their firm’s top business development tactics for 2016, respondents noted strategic hiring (56.7 percent rated it as a top tactic for growth), marketing/public relations (54.6 percent), and technology upgrades (49.3).

Among the top concerns for AEC firms are competition from other firms (58.2 percent ranked it as a top-three concern), general economic conditions (50.4 percent), managing cash flow (30.3 percent), and softness in fees/bids (27.6 percent).

The adoption of building information modeling (BIM) and virtual design and construction (VDC) tools and processes continues to grow. More than eight in 10 respondents (82.1 percent) said their firm uses BIM/VDC tools on at least some of its projects, up from 80 percent in 2014 and 77.3 percent in 2013.

Healthcare sector rebounds

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” (Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

The multifamily boom continues, as the Millennials and Baby Boomers gravitate to rental housing and an urban lifestyle. Multifamily ranked as the most active sector, with 69.7 percent of respondents rating it in the good/excellent category, up from 62.3 percent last year and 56.1 percent in 2013.

The healthcare market is starting to stabilize and grow, as hospitals and healthcare providers adjust to the post-Affordable Care Act world. The sector ranked as the second most active; 68.0 percent gave it a good/excellent rating, up from 63.6 percent in 2014 and 62.5 percent the previous year.

Other active sectors include senior/assisted living (63.1 percent rated it in the good/excellent category), office interiors/fitouts (62.4 percent), and data centers/mission critical (59.3 percent), higher education (48.6 percent), and industrial/warehouse (46.7 percent).