Technology integration advances in construction

Construction continues to lag other industries in technology adoption, but whether it was Covid-19 or other influences, integration within the equipment department continues to grow. Organizations that use construction equipment in their businesses are discovering the value of machine data not only for asset management, but also for overall organizational efficiency and financial performance.

An organization’s fleet of construction equipment is its largest financial asset, and its performance directly affects bottom line profitability and project efficiency. As equipment managers become more adept at using data to make sound decisions, upper management is recognizing the value it adds to cost development, estimating accuracy, and site performance.

Construction Equipment published its first Technology in Construction report in 2017. This year, we have partnered with Topcon Positioning Group to shed light on current trends in technology both in equipment management and construction as an industry. We invited a select group of the Construction Equipment audience to complete an online questionnaire; 68 responded.

For a more detailed look at the results, click here.

Construction Equipment has closely watched the evolution of digital technology in equipment asset management over the past decades, from early GPS-guided machine control to development of the ISO telematics standard to today’s exploration of data-driven service scheduling and predictive maintenance. Equipment managers understood early that the new information coming off their machines could be helpful not only to their department’s performance, but also in aiding the enterprise to meet its financial goals.

Machine data

We define machine data as information specific to a piece of equipment that can be gathered digitally—such as hours, idle time, and fuel consumption—and transferred using telemetry. The industry uses the broad term “telematics” to describe the transmission of this data into a management format that allows it to be used.

The number of equipment asset managers who see value in machine data continues to grow, even though the implementation is not. Few doubt that knowing what is happening on a machine increases the manager’s ability to make decisions that will ensure productive use of that machine. To take full advantage of the data, however, a fleet needs an analytic infrastructure designed to collect and interpret it.

For many years, fleet managers have found that their departments lacked the resources to build this infrastructure, turning to third-party aggregators or trying to manage dashboards from each brand in the fleet. Concurrent to this, the number of manufacturers and distributors investing in their own analytics infrastructure continues to increase. These investments are driven not only by customer demand, but also by the value data management has for service revenue. For many fleet managers, such systems provide opportunities to partner with their dealers on maintenance management while avoiding investments in in-house technology.

Other fleets, particularly those with larger estimated replacement values, have benefited from upper management that recognized the value of incorporating better machine metrics into cost management of projects currently underway as well as those waiting to be bid. These organizations have invested in their equipment department’s analytics infrastructure.

Data can drive equipment efficiency and performance, and its integration into the financial side of asset management benefits corporate goals by accurately tracking and estimating the costs of applying equipment to the projects the organization builds.

One of the most encouraging trends for equipment managers in recent years is the amount of dealer investment in data support. Although all are supported by their manufacturers, dealers know that their service personnel are the face of the brand, and they also now that service revenue is profitable revenue. The return on investment for a dedicated data manager can easily be justified.

In 2019, we launched the Dealer Excellence Awards to showcase dealers that are investing in technology to support their customers. In each case, customer relationships are being strengthened and their fleet performance improved with data-management partnerships. Last year’s winner, Bobcat of North Texas, exemplifies how smaller fleets benefit when a dealer partners on maintenance management.

Connected machines

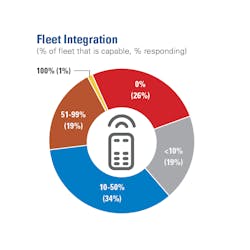

More machines integrated into the nation’s fleets are capable of transmitting data, according to our study. In 2020, 59 percent of respondents indicated that fewer than 10 percent of their machines had telematics capabilities. This year, that percentage declined to 45 percent. This shift is accompanied by a jump in the percentage of respondents saying 10 to 50 percent of their machines are capable, from 20 percent in 2020 to 34 percent this year.

This, of course, only measures the ability to transmit machine data. When asked if data is actually collected or monitored, 43 percent of respondents said their equipment data collects data, and an additional 15 percent say their dealers monitor and advise them. Combined, these data points indicate that more than half of fleets are using machine data in their equipment management functions.

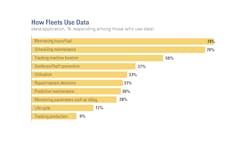

The most common ways equipment managers use machine data are for monitoring hours or fuel and for scheduling maintenance, with 74 percent and 70 percent responding, respectively. These types of data directly influence maintenance management and are seen by many as the low-hanging fruit as fleets begin using machine data. Of course, this also allows dealer partners to monitor and even manage preventive maintenance programs.

Machine data also has value outside of the equipment department. Organizations recognize that machine data can drive profitability and influence acquisition decisions, but more are noting how data can help mitigate risk. Monitoring data that indicate operator behavior, for example, can lead to coaching opportunities. In accidents, data can help reduce or free the organization from liability. Over time, insurance premiums may be negotiated to more favorable terms.

Emerging technologies

In the past few years, construction firms have begun accessing and using emerging technologies. Equipment departments, for example, use mobile apps more consistently than in the past, specifically for maintenance functions. About half (51 percent) use these apps for equipment inspections, a key element to maintaining reliability and uptime. Some are able to attach photos to work orders.

Other apps that have gained acceptance among construction firms are management tools and safety management.

The use of data in site or project management has become a goal for many construction firms, yet the realization of integrating data across various areas of the organization remains elusive. About one in four (37 percent) said that their organization has implemented such sharing technologies. Half are using data within various departments, including equipment, but have not integrated the means for sharing it.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.