The construction equipment industry enters 2022 not sure what to expect. Responses to the Covid-19 pandemic shifted everything, affecting us personally, corporately, and globally. As 2021 wound down, the only certainty for 2022 was that things would never be the same.

Last year, fleet managers told us business suffered greatly as the pandemic wreaked its havoc, dropping from an “excellent” 2019 to an “average” 2020. Contract volume trends also fell off the table. The net average (those expecting an increase minus those expecting a decrease) for contract volume went from 29 percent in 2019 to -12 percent in 2020.

Fleet managers adjusted their forecasts for 2021, expecting both business and contract volume to improve. They did, barely.

How does 2022 look for equipment fleets?

Equipment managers said 2021 was a “good” year for business, just slightly above 2020 but slightly below expectations. Fleet managers in the highway/heavy construction vocation rated the year as “average,” but other vocations were solidly in the “good” range for business ratings. Fleet size differences were more evident. Fleets with equipment replacement values (ERV) less than $500,000 said 2021 was a “average” year. Managers of the nation’s largest fleets, those with ERV greater than $10 million, rated 2021 as a “very good” business year.

Forecasts for 2022 split fleets between the largest fleets and the rest. Large fleets anticipate 2022 to be an “excellent” year for business; small and medium-sized fleets expect 2022 to be similar to this year: “good.” As a group, equipment managers expect 2022 to mirror 2021 as a “good” year. Levels of uncertainty remain high, however, with several factors fogging fleets’ ability to see far into 2022. Our survey was conducted in the heat of congressional battles over infrastructure and a multi-trillion-dollar spending package. Even though the infrastructure bill was signed into law late in the year, unknowns persist regarding supply and labor shortages.

Contract volume in 2021 decreased compared to 2020 for slightly more than one-quarter of respondents. Subtracting this percentage from the 42.1 percent expecting volume to increase, the net was 14 percent. Although this net is in positive territory after the -12 percent net reported for 2020, it is the lowest net recorded since 2013. Differences are evident among fleets of varying ERV, with the smallest fleets reporting a net of 9 percent and the largest a net of 34 percent for contract volume.

See the construction industry report in the 2022 Annual Report & Forecast.

For 2022, 50.4 percent of respondents expect contract volume to increase over 2021. When the 13.9 percent who expect it to decrease is deducted, the net for 2022 is 38 percent. Among small fleets, 47.8 percent expect volume increases for a net of 38 percent. Large fleets report a net of 40 percent.

Expectations for bid pricing are the highest since 2018. Four of five (80.2 percent) expect bid pricing to increase in 2022 compared to 2021, and 4.9 percent expect it to decrease for a net of 75.3 percent. Expectations for both 2020 and 2021 were measured by net percentages of 56 percent and 52 percent, respectively.

When asked about the health of their firm, 76 percent of respondents labeled it either “very good” or “good,” up from 71 percent last year. Among the largest fleets, 90 percent said their firm health was “very good” or “good.” The smallest fleets are slightly less optimistic, with 61 percent ranking firm health as “very good” or “good.”

Construction equipment fleet trends

Fleet expansions match what was reported in 2020, when the net percentage was 16.1 percent. The net for 2021 was 17 percent, with 27.4 percent reporting fleet expansion and 10 percent shrinking their fleets. About two-thirds of respondents (62.6 percent) said fleet size did not change in 2021. For this year, that percentage remains similar, but 32.7 percent expect to increase the number of machines in their fleet with 5 percent citing a decrease for a net percentage of 28 percent.

More than half of large fleets—ERV greater than $10 million—expect to add machines to their fleet, and one in five of small fleets—ERV less than $500,000—expect to add machines for net percentages of 48 percent and 16 percent, respectively.

How fleets rate their equipment dealers

The machine replacement rate in 2021 dropped to 8.2 percent from the 9.3 reported in 2020 and forecast for 2021. Equipment managers expect to replace machines at a similar rate this year: 8.4 percent. Machine replacement rates have been in the 9 percent range for several years and haven’t been this low since 2013.

Fleet managers’ ability to execute expansion and replacement decisions will be affected by supply. Supply chain challenges began crimping plans in the second half of 2021, and at this writing there were few indications that this would change. Semiconductor availability will continue to lag demand as products from toasters to mining trucks become “smarter.” Manufacturers across industries are looking to tighten supply chains, even bringing back on-shore production that had become global over past decades.

Equipment managers, however, must not only plan, but they also must handle current fleet needs. When asked how they would respond to the ongoing disruptions in supply (see above), 39 percent said they would increase maintenance budgets in 2022 in order to extend useful life of the machines currently in their fleets. Some 32 percent said that they plan to increase the level of in-house stock of key parts. One in five managers said that they will accelerate purchasing plans for equipment to ensure they have what they need when their organizations need it.

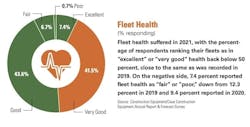

Any attempt to extend useful life carries risks, including lost residual value, productivity losses, and unplanned downtime. At the beginning of 2021, 53 percent of equipment managers labeled their fleets in “excellent” or “very good” condition. This year, 49 percent said that their fleets were at this level. Looking at health from an ERV perspective, 40 percent of small fleets rank their fleets in “excellent” or “very good” condition. Among those with ERVs greater than 10 million, that percentage is 62 percent.

On the other end of the health scale, 10 percent of fleets with ERVs less than $500,000 say fleet health is “fair” or “poor,” compared with 7 percent across all fleets.

Equipment acquisition strategies

Outright purchase of equipment continues to be the most-used strategy for acquisition, climbing a couple of percentage points in popularity from last year. Nearly 50 percent of respondents purchase outright, up from 48 percent last year and the highest percentage since 2017. Financing equipment purchases dropped in usage to 34 percent, down from 39 percent in 2020. The use of short-term rental increased to 16 percent, up from 14 percent last year.

When asked specifically about the use of short-term rental in 2021 compared to 2020, about one-third of respondents said that they had increased use in terms of total rental machine hours. This is the highest percentage reported for more than 10 years. More than half (54 percent) reported using the same number of rental machine hours in 2021 as they had in 2020.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.