Managers Rate Dealers Lower on Technology: Survey

Increasing customer expectations appear to be driving downward their perception of construction equipment dealers’ ability to meet their needs regarding technology, according to exclusive research from Construction Equipment.

The results are part of the 2021 Annual Report & Forecast, in which Construction Equipment asks those in charge of fleets of construction equipment and trucks how this year performed and how they expect 2021 to look. The survey is conducted in partnership with Case Construction Equipment, and will be published in January 2021. (Click here for the 2020 Annual Report & Forecast.) About 400 equipment professionals responded to the survey.

The percentage of fleet managers who rate their primary equipment dealer as either “excellent” or “very good” in their understanding of the technology in the machines that they sell declined in 2020 to 53.2 percent. Last year, 64.6 percent rated their primary dealer as “excellent” or “very good.” Those rating their dealer as “good” when it comes to understanding machine technology rose considerably, from 28.7 percent to 40.1 percent. None, again, rated their primary dealer as “poor,” and the percentage rating them “fair” also remained the same: 6.8 percent.

As manufacturers add technology to machinery, equipment dealers become responsible for making sure end-users understand how it works. Because the technology is often touted as productivity- and efficiency-enhancing, end-users expect dealers to ensure their operators know how to use the tools. Many, in fact, team up with manufacturers’ product support personnel to offer on-site training to customers who purchase new technology-laden equipment.

“This rising expectation coupled with the sheer amount of technological advancement may be shifting perceptions from the high end of the scale toward the middle,” says editorial director Rod Sutton. “Fleet managers accept the value proposition, but they expect dealers to be proficient in helping them gain full value from the technology, whether it’s productivity-boosted software or machine data.”

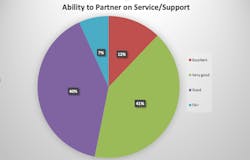

Respondents were also asked to rate their primary dealer’s ability to partner with them on fleet service and support. Machines produce data that can enhance product reliability, but only if and when the data translates into information upon which a fleet or service manager can act.

As manufacturers enhance data monitoring capabilities, construction machinery dealers are uniquely positioned to help remove that barrier by aiding end-users in managing maintenance and making productivity decisions within a fleet.

Tyler Equipment, Construction Equipment’s 2020 winner of the Dealer Excellence Award, is an example of a smaller dealer leveraging machine data for customer support. Tyler Equipment works with its customers as well as its manufacturer partner Volvo Construction Equipment to help fleet managers run more productive and efficient equipment using machine data insights.

As these services become more available, end-user expectations are growing. Some 12.4 percent of respondents rate their primary dealer as “excellent” in this area, statistically the same as in 2019. The percentage rating their dealer as “fair” or “poor,” however, increased from 8.2 percent in 2019 to 11.4 percent in 2021.

“Fleet managers understand the value of machine data and technology in fielding efficient, reliable machines for their operations,” Sutton says. “The challenge for manufacturers and dealers is to meet those needs in both product support and service.”