Key Highlights

In this article, you will learn:

- How tariffs have affected equipment and parts prices.

- How fleet asset managers have responded.

- Effects on fleet health.

We’ve tracked estimated replacement value for decades as a guide to understanding our equipment-management audience. The measurement places a financial aspect on fleet size beyond the purchase or acquisition costs; it considers residual values, inflation effects, and investment in repairs and maintenance.

An equipment appraiser responded to a recent column, “Tariffs, Consolidation, and Branding,” with this comment: “Not only are the amounts of tariffs somewhat unknown, but valuations of existing assets are more uncertain.” He cited a recent example where the cost of an imported machine increased 29% when tariffs were applied. For a $500,000 machine, that works out to an extra $145,000.

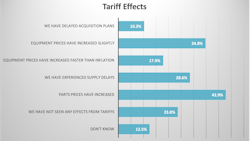

For a fleet running this machine, value fluctuations caused by tariffs wreak havoc on replacement plans. Preliminary data from our 2026 Annual Report & Forecast seem to support this tariff effect: 10% of respondents report that they have delayed acquisition plans because of tariffs.

That number represents whole goods, equipment acquired to either expand fleets in preparation for new work or to replace machines that have reached either the end of useful life or the point where replacement outweighs continued repair.

Equipment prices are increasing due to tariffs, according to about half of respondents. One-third say prices have increased slightly, and 18% say prices have risen faster than inflation. One in four (23.8%) report seeing no tariff effects and 13% don’t know how or if tariffs have affected their fleets.

Other preliminary data indicate that tariffs are affecting parts prices (42.9% report increases) and supply (28.6% have experienced delays).

Tariffs upset fleet-management planning, and 2025 has seen almost monthly fluctuations in how tariffs are applied and to what and whom they are applied. Managing in this environment tests the best.

The good news, at least so far, is that fleet health seems to be stable. Preliminary data indicates that the percentage of equipment managers rating their fleets as “excellent” or “very good” remained constant in 2025 compared to the previous year.

Organizations that deploy construction equipment to do their work depend on sound financial management of those assets. The past year has challenged equipment professionals, which places even more importance on financial discipline resting on sound data and data analysis.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.