Water, Sewer Industry Gears Up For Modest Growth

After what seemed to be a more positive year, the water and wastewater utility sector is preparing to face yet another year of continuous cuts to the Clean Water and Drinking Water State Revolving Fund programs: $500 million below 2014 funding levels. As levels of public funding continue to fall, the growing gap between the need to fund our country’s aging water and wastewater infrastructure is starting to resemble a canyon.

But this doesn’t mean gloom and doom for the industry in general.

More Annual Report & Forecast

Last June, President Obama signed into law the Water Resources and Reform Development Act of 2014 (WRRDA): the first water bill since 2007. Although the WRRDA does not offer a complete funding solution to meet the nation’s water infrastructure needs, it authorizes funding for more than $12 billion worth of new water infrastructure projects by establishing the Water Infrastructure Finance and Innovation Act to provide low-interest federal loans and loan guarantees for major water infrastructure projects. The act also creates the Water Infrastructure Public-Private Partnership (P3) Program for the Army Corps of Engineers that should lead to increased financing of critical infrastructure projects through the use of P3s.

This new source of funding infuses optimism into the industry by promoting new jobs and economic growth, and by kick-starting more projects.

Aside from funding, the municipal water and wastewater sector currently is ill-prepared for the departure of a large segment of its workforce, which is quickly reaching retirement age and is expected to exit the field in the next decade. This depletion of experienced professionals creates an urgent need to attract both maintenance personnel and high-tech skilled workforce alike.

The challenge is that there is a lack of interest in field installation and maintenance-type work among younger people entering the workforce. Additionally, many facilities are turning to automation and implementing advanced technologies in order to meet more complex regulatory requirements. This necessitates a more skilled workforce; however, there is little awareness of the field in general, and these positions tend to be less competitive in comparison to other job sectors. To solve this problem, the industry will have to find ways to attract more skilled workforce with competitive salaries, attractive benefits packages and job stability.

Water supply obstacles

Population growth, development and climate change continue to present obstacles for the water supply sector, especially in drought-plagued areas of the country.

In 2014, California was crippled by extreme drought that devastated its $45-billion agriculture and $12-billion livestock, dairy and poultry sectors.

Although this drought crisis seemed regional in nature, its implications were felt in the form of domestic food price increases nationwide: up 3 percent to 6 percent on average this year. It also led to a drilling frenzy among farmers looking to gain access to groundwater.

Debates over how to manage California’s critically dry water supplies will extend into 2015 and beyond. The issue, however, will continue to drive the development of new technology solutions to capture, save and reuse water more efficiently. Despite its somewhat controversial reputation, water reuse will be an important factor in solving not only California’s water crisis, but also in expanding our nation’s water supply.

The 2014 Water & Wastes Digest State of the Industry Report reflects these issues, as well as the sector’s optimistic outlook for 2015. Our survey covered different market dynamics, including professional and business demographics; budget and purchasing involvement and expenditures; and importance of industry issues.

Survey results indicated that average municipal water and wastewater budgets in 2014 for water-related products and services remained stable—$2.8 million—and 47 percent of survey respondents are projecting a budget increase for 2015, which likely will come from jumps in service rates.

For a second consecutive year, the largest percentage of respondent’s budgets will be invested in sewer collection systems, pipe and distribution, and monitoring systems over the next 24 months, accounting for a total of 35 percent of their budget expenditure, up from 31 percent in 2013. It is likely that we will continue to see this trend as water and wastewater utilities tackle aging infrastructure with much-needed system rehabilitation and upgrades.

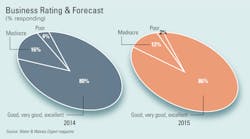

Although 58 percent reported a 10-percent increase in total municipal operating costs in 2014, overall industry optimism continues an upward trend. Eighty percent of respondents rated this year as “good,” “very good” or “excellent”; and even more (86 percent) expect that 2015 will be a “good,” “very good” or “excellent” business year.

Whether or not this optimism is based on already low expectations from sluggish to nonexistent growth in the past few years, if the rise in municipal spending matches survey respondents’ upward projections, the water and wastewater sector might indeed witness a modest upswing in 2015.. The largest percentage of states, however, are not doing anything.