Nonresidential: Upbeat about 2014, Rosy Outlook for 2015

The market is looking brighter for U.S. architecture, engineering, and construction, with a majority of industry firms reporting higher revenues, strong forecasts, and sound financial health, according to Building Design+Construction’s forecast survey.

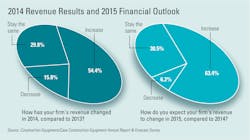

More than half (54.4 percent) of the AEC professionals who responded reported that revenues had increased at their firms in 2014, and 63.4 percent are forecasting revenue growth for 2015. This represents a sizable uptick from 2013’s survey, in which 46.1 percent of respondents reported higher revenue for the year and 56.8 percent predicted growth for 2014.

More Annual Report & Forecast

Asked to rate their firms’ overall financial health, 72.6 percent responded either “good” (50.4 percent) or “very good” (22.2 percent), compared to just 55.5 percent in last year’s survey. Only 8.8 percent indicated that their firm is in a weakened state financially.

Firms are looking to bolster growth during the next two years through a variety of business-development strategies, including strategic hires (48.8 percent rated it as a top tactic for growth), increase in marketing/public relations efforts (46.2 percent), staff training and education (41.9 percent), technology upgrades (41.9 percent), and launching a new service or business opportunity (33.4 percent).

Top concerns heading into 2015 are general economic conditions (54.9 percent ranked it as a top-three concern), competition from other firms (47.7 percent), and managing cash flow (29.4 percent).

Healthcare, multifamily grow

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” (Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

- For the second consecutive year, the healthcare sector ranked as one of the most active, with 63.6 percent of respondents in the good/excellent category, compared to 62.5 percent in 2013 and 58.8 percent in 2012.

- Multifamily saw a nice bump in activity in 2014, thanks primarily to the nation’s continued rental housing boom. Some 62.3 percent gave the sector a good or excellent rating, up from 56.1 percent in 2013.

- As more Baby Boomers leave the workforce and enter their retirement years, the demand for senior and assisted-living facilities is expected to spike. This trend is reflected in the survey results, with 59.2 percent of respondents indicating good/excellent prospects for this sector in 2015—which is actually down from the 2013 survey (66.0 percent), but up from the previous year (50.5 percent).

- The data center sector continues to be a powerhouse market for AEC firms, as data center providers, corporations, institutions, and government agencies try to keep pace with the boom in mobile and cloud computing. The majority of respondents (58.2 percent) had either good or excellent prospects for the sector for 2015, up from 56 percent in 2013 and 45.2 percent the year before.

- The industrial/warehouse and office building sectors saw the greatest year-over-year jump in activity. Some 43.3 percent ranked the industrial sector in the good/excellent category, up from 33 percent last year, and 35.4 percent said they were upbeat about the office sector, versus 26.9 percent the previous year. Other sectors with sizable year-over-year percentage growth are retail (up 6.5 percentage points to 37.9 percent), multifamily (up 6.2 points to 62.3 percent), and K-12 schools (up 5.9 points to 36.8 percent).

Following three years of relatively stagnant growth in the adoption of BIM/VDC software tools, this segment saw a modest uptick in 2014. Eighty percent of respondents said their firm uses BIM/VDC tools on at least some of their projects, up from 77.3 percent in 2013. The number of BIM power users increased, as well: 17.3 percent indicated that their firm uses BIM on more than 75 percent of projects, up from 12.2 percent last year.

Respondents include architect/designers (45.3 percent), contractors (19 percent), engineers (16.7 percent), owner/developers (7 percent), consultants (4.1 percent), and facility managers (3.8 percent).