Remodeling Growth Spurt Could Rise to 2006 Levels

By the end of this year, spending on home remodeling should come close to the pre-recession 2006 peak of $145 billion, according to figures compiled by the Joint Center for Housing Studies at Harvard University. Remodelers report more leads, larger projects by volume, and an overall upswing in demand. According to our 2014 Market Survey, 68 percent of respondents had a “good” (38 percent) or “very good” (30 percent) year.

“Things are better than they’ve been for quite a while,” says Len McAdams, owner of McAdams Remodeling & Design, which serves the Seattle metro area. But McAdams tempers that statement with this one: “It’s not 2007, but it’s for sure not 2011 either.” While acknowledging reasons for optimism, McAdams and many other company owners who weathered the Great Recession say they will still tread cautiously into 2015.

More Annual Report & Forecast

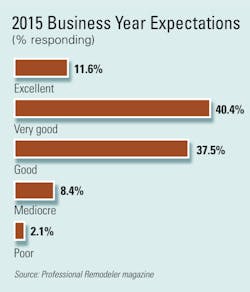

In a recent Washington Post Wonk Blog, Matt O’Brien writes that based on Congressional Budget Office predictions, “The economy will never get back to its pre-crisis trend. Instead, it will stay stuck in a ‘new normal’ of slow growth that feels like a slump—forever.” Putting aside that last note of pessimism, remodeler Dave Merrick, owner of Merrick Design and Build in the Washington, D.C. metro area, believes “slow growth is good. Everyone can grow a little bit at a time. It may not be as dramatic as doubling your business every year, but it’s better.” And reports from the field suggest slow, consistent, profitable growth in remodeling: 57 percent of our survey respondents report increased revenue from 2013 to 2014; 38 percent expect to add employees in 2015; and 77 percent say 2015 will be a “good” (37 percent) or “very good” (40 percent) year.

“The No. 1 sign that it was a good year for the industry is a pretty healthy recovery in house prices across the country,” says Kermit Baker, director of the Remodeling Futures Program at Harvard’s Joint Center for Housing Studies. Baker says that home prices are back to “normal, sustainable prices.” People who bought during the recession are now seeing some equity built up in their homes. “People are moving again,” says Gary Rochman, founder of Rochman Design-Build in Ann Arbor, Mich. “They’re more confident they’ll recoup some investment down the road.”

Pent-up demand has accompanied that confidence. John Gemmi, president of Gemmi Construction in Mechanicsville, Pa., calls it “the slingshot” effect. “I’m getting calls from people I spoke with in 2011 and 2012,” he says. “People feel held back and they’re ready to explode.”

Despite the forward motion on home values, Baker says that “banks haven’t loosened up on credit; about 90 percent of them are not easing home equity lines of credit at all, even as they say demand for them has increased.”

Economic tire kicking

Although 54 percent of those reporting say leads are up, and 55 percent are seeing larger job sizes (60 percent expect to see job sizes increase in 2015), remodelers told us they see a bit of a recession hangover. “There is a lot of economic tire kicking,” McAdams says. He and others report spending more time qualifying leads. Now, at least, many have longer backlogs and the luxury of saying “no” to jobs.

Although respondents say they will spend more of their marketing dollars on their website (20 percent), networking (19 percent) and social media (13 percent), most of them (67 percent) will not be increasing their overall marketing budget.

“We’re getting more Internet leads and more of those are panning out,” notes Merrick. “I think customers are counting more on online reviews and referrals. Gen X and Gen Y don’t like talking with people; they put more stock in online reviews.”

An overwhelming number of respondents (98 percent) felt that the markets in which they do business are “intensely” (12 percent), “somewhat” (22 percent), or “very” (64 percent) competitive. This seems at odds with the high number of remodelers who responded that they won’t be increasing their marketing budget.

Rochman, who does plan to step up his overall marketing and is looking to rebrand, theorizes that a lot of remodelers might be getting caught up in the good times. “The phone is ringing off the hook for a lot of people,” he says. “They’re flush with work so they want to save on marketing.”

Despite the rise in leads and increase in job sizes, only 38 percent of respondents said they will add employees in 2015, and 59 percent said there will be no change in their employee numbers. It’s unclear whether that’s because they feel they can continue to produce the increased number of jobs with their current employees or because they believe they cannot find people to hire. Other factors include the time investment needed to find good people and the burden of enticements, such as health insurance benefits, needed to attract qualified employees.

Labor is a real challenge, says Baker. “The labor force has gotten smaller and older, and there are fewer foreign-born workers. The scale back in immigration has hurt [the construction industry],” he says. “The industry will have to do a lot better in recruiting a work force and providing training programs to support that.”

Another top challenge cited by respondents is that most (85 percent) anticipate a rise in material costs and know that they will have to work hard to maintain their margins to be profitable. Some, like Merrick worry that “the people in Washington will do something [like encourage inflation] to screw up this steady growth.” McAdams, too, is wary about possible “wage-price inflation.”

For these remodelers, it’s important to keep the memory of the recent recession in mind without letting it co-opt their thinking. “We’re working on getting some money into savings and keeping in the back of our minds that things could fall apart,” Rochman says.