Key Highlights

In this article, you will learn:

- How tariffs are impacting replacement and expansion plans.

- The current state of fleet health.

- How fleet size affects 2026 outlooks.

- 2026 expectations for equipment replacement.

- Current strategies for acquisition.

An equipment appraiser summed up the type of uncertainly equipment managers faced in 2025 and continue to face as the new year unfolds: “Not only are the amounts of tariffs somewhat unknown, but valuations of existing assets are more uncertain.” Value fluctuations wreak havoc on replacement plans. Data from our 2026 Annual Report & Forecast seem to support this tariff effect: 10% of respondents report that they have delayed acquisition plans because of tariffs.

That number represents whole goods, equipment acquired to either expand fleets in preparation for new work or to replace machines that have reached the end of useful life or the point where replacement outweighs continued repair.

More on tariff effects

Sibling publications within our parent, Endeavor Business Media, report on tariffs.

- Tariffs threaten PPE from EHS Today.

- Heavy truck orders tumble, from Fleet Owner.

- Construction costs update, from Building Design + Construction.

- Where is the housing market headed, from Pro Builder.

Equipment prices are increasing due to tariffs, according to about half of respondents. One-third (34.8%) say prices have increased slightly, and 17.9% say prices have risen faster than inflation. Data also indicate that tariffs are affecting parts prices (42.9% report increases) and supply (28.6% have experienced delays).

Tariffs upset fleet-management planning, and 2025 has seen almost monthly fluctuations in how tariffs are applied and to what and whom they are applied. Managing in this environment tests the best.

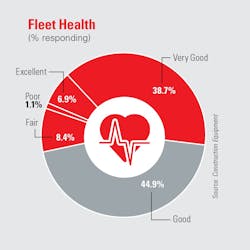

The good news, at least so far, is that fleet health seems to be stable. The percentage of equipment managers rating their fleets as “excellent” or “very good” remained constant in 2025 compared to the previous year.

How do equipment managers rate business?

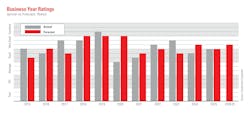

Business ratings for 2025 met expectations as fleet managers said it was a “good” year. Expectations for 2026 are up, with the group expecting a “very good” business year. The larger the fleet, as measured by estimated fleet replacement value (ERV), the more positive the outlook. Fleets with ERV greater than $1 million were solidly “very good,” but smaller fleets stayed in “good” territory.

Expectations for 2026 are highest among general building contractors—those who do both highway/heavy and general building construction—followed by highway/heavy construction respondents.

Contract volume trends were positive for 2025, although far below expectations. Four in 10 (43.1%) reported increases in revenue for the year, but when the 24.8% that reported declines are subtracted, the net is 18.3%. Expectations for 2025 were for a net of 31.6%, with the difference being in the percentage of declines: Only 13.7% expected 2025 revenue to decrease compared to the 24.8% who reported actual decreases.

Fleet managers expect a strong bounce back in 2026, however. Nearly half of respondents (48.9%) expect contract volume to grow this year. Only 10.3% expect a decline, leaving a net of 38.6%. This is the most positive forecast since 2019, the year before the Covid economic hit.

Again, optimism grows with fleet replacement value. More than half of fleets with ERV above $1 million expect contract volume to grow in 2026. Among those less than $1 million, that number drops to about one-third. Nets by ERV are 6.5% for fleets less than $1 million, and 30.3% for fleets greater than $1 million.

Trends in equipment management

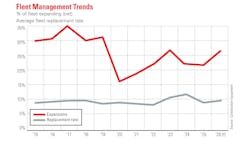

Fleet manages replaced machines at a rate less than expected in 2025. Respondents reported that 9.2% of their fleet was replaced last year, significantly below the expected rate of 10.9%. The rate in 2024 was the highest of the past decade: 11.0%. Tariffs, it seems, did indeed affect replacement plans for fleets. For 2026, expectations are that machines will be replaced at a rate of 9.7%.

The largest fleets, with ERV above $10 million, reported a 2025 replacement rate of 11.0%, compared to a rate of 7.6% for the smallest fleets, with ERV below $500,000. For 2026, fleets with ERV between $1 million and $10 million expect to replace machines at a rate of 11.4%.

Fleet expansion—measured by the percentage of respondents saying that the numbers of machines in the fleet will increase or decrease—fell just shy of expectations last year. For the fourth consecutive year, however, the net expansion was above 20%. For 2025, the net was 21.5% (31.4% saying the number of machines grew minus 9.9% saying it decreased). The projected net was 24.9%, and the net in 2024 was 23.7%.

Expectations for 2026 fleet expansion are 26.4%, with 31.5% of respondents planning to expand fleet size minus 5.1% expecting to shrink it. Large fleets (ERV above $1 million) expect the greatest level of expansion: 39.3% expect to increase the number of machines in their fleet minus only 4.1% that expect it to decrease.

As noted, 10.3% of respondents said tariffs have caused them to delay acquisition plans. Tariffs seem to be affecting the largest fleets, with ERV above $10 million. The percentage delaying acquisition plans is 14.0%, and 24.6% report price increases above the inflation rate compared to 17.9% of all fleets. Delays in supply has affected these large fleets more, also: 45.6% say they have experienced supply delays compared with 28.6% for all fleets.

When it comes to acquisition strategies in 2025, the portion of respondents who purchase outright increased from 51.1% in 2024 to 60.2% last year. This is the highest percentage reported in recent years. Rental-purchase and short-term rental declined from 16.7% and 14.4%, respectively, in 2024 to 13.0% and 10.0%. About one in five (18.6%) said that they had decreased the use of short-term rental—measured in machine hours—in 2025.

Fleet health continues to weaken. Only 6.9% of respondents rated their fleet as “excellent,” the lowest percentage since 2019. The percentage rating fleet health as “good” increased from 35.2% to 38.7%. For trending purposes, we combine “excellent” and “very good,” which gives us 45.6% in 2025 compared to 42.7% in 2024. This percentage is more in line with 2023 results, when 46.1% reported “excellent” or “very good” fleet health.

Equipment challenges

More than half of equipment managers say that finding skilled technicians for shop and field will be a challenge this year, and 19.9% say that dealer support with machine data is a difficulty.

A fleet’s relationship with its primary dealer/distributor directly affects efforts to maintain fleet health, utilization rates, and reliability. As labor shortages ramp up, fleets compete with dealers for technician talent. Machine data management is critical to fleet performance, and partnering with dealers for maintenance support will lessen the pain of technician shortages. Almost half (44.8%) of respondents said that they would rate their primary dealer’s ability to partner with them on service/support of their fleet as “excellent” or “very good.” On the other hand, 12.3% rated them as “fair” or “poor.”

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.