Construction markets faced several challenges in 2025. Although we cannot draw direct lines, anecdotal input and news coverage over the course of the year suggest that tariffs and immigration put pressure on construction costs and labor.

More on 2026

Parent company Endeavor Business Media covers myriad industries. Here are outlooks from our siblings publications.

- Tariffs tough on 2026 planning for construction equipment fleets, Construction Equipment.

- Trucking's year in review: Uncertainty, Fleet Owner.

- Signs of growth for fluid power in 2026, Power & Motion.

Respondents in various construction markets surveyed for our 2026 Annual Report & Forecast seemed to have factored in those challenges as they entered 2025. At the end of 2024, the business outlook for 2025 had been for a “good” year. At the end of 2025, the overall result for construction was a “good” business year. Expectations for 2026 are similar.

Infrastructure markets were the most optimistic heading into 2025, but both transportation and water fell slightly short. Outlooks for 2026 continue tempered. Home building reported an “off” 2024, as that market was pummeled by interest rate pressure in addition to prices and labor. Residential builders are more positive for 2026, although “average” in this case may be relative. Managers of the nation’s fleets of construction equipment are the most optimistic among the 600-plus respondents, expecting a “very good” 2026. Of course, equipment is deployed in every construction segment, so managers must be ready to support all projects.

Contract volume trends in 2025 were off substantially from expectations. The overall net (the percentage of respondents expecting increased volume minus the percentage expecting decreases) was 17%. Expectations for 2025 had been a net of 35%. By vocation, transportation was the closest to meeting expectations with a net of 23% (39% reporting increases minus 16% reporting decreases), and home building fell into negative territory with a net of -15% (33% increasing minus 48% decreasing).

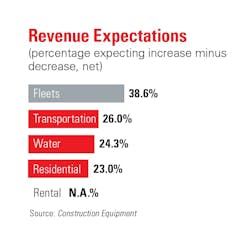

Expectations for 2026 are hopeful, with an industry net of 35% (49% expecting increased revenue minus 14% expecting a decline). Again, fleet managers hold the most positive view of this year with a net of 39% (49% expecting an increase minus 10% expecting a decrease). Transportation expectations are a net of 26% (40% minus 14%).

Inflation concerns for material prices show no signs of abating with the net rising from 72% last year to 76% (79% expect prices to increase minus 3% expecting decreases). The highest net (84%) is recorded in the water infrastructure space, with 87% expecting material price increases minus 3% expecting a decrease.

Bid prices are expected to increase in 2026, also. Infrastructure markets report the highest expectations, with nets of 76% in transportation and 78% in water. The industry net is 72% (75% expecting bids to increase minus 3% expecting decreases). Among equipment managers—who manage the largest component of a bid cost—price expectations are a net of 70%: 73% expect bids to increase minus 3% expecting decreases.

The competitive landscape within construction markets is “intensely” or “very” competitive for 63.5% of respondents, up from last year’s study. The most competitive are transportation (15.6% “intensely”) and home building (16.4% “intensely”).

Firm health is “very good” or “good” for 75.4% of respondents, up slightly from last year yet still off from the pre-pandemic level of 80%. Firms in the residential construction market were less positive, with 68.9% reporting “very good” or “good” health.

Annual Report & Forecast Methodology

Construction Equipment partnered with magazines within its parent company, Endeavor Business Media, that cover infrastructure and equipment. Participants in the 2026 Annual Report & Forecast asked their audiences about not only overall construction trends but also trends specific to the sector in which they work. Each publication sent email invitations to its audience, inviting participation in an online survey. Over 600 responded. Respondents by market include fleet managers, 275; transportation, 179; water infrastructure, 83; home builders, 61; and equipment rental firms, 60.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.