Ready to Go to Work

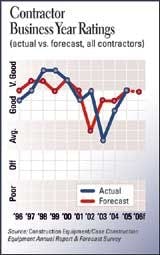

Last year, we reported contractors' penchant for patience in forecasting business performance for 2005. A delayed Federal transportation bill and a contentious Presidential election were keeping a lid on expectations.

They were right, and the 2005 business year played out according to their forecast: "good."

Contractors remain cautious looking into 2006. The transportation bill passed, but late in the year; cleanup activities for Hurricanes Katrina and Rita are pulling new equipment out of the pipeline; and tire shortages and diesel fuel prices are playing havoc on machine costs. These factors are keeping contractors cautious, leading them to forecast 2006 as a "good" business year even as markets stay strong.

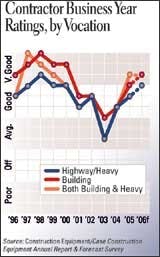

Highway/heavy contractors were and are slightly less optimistic than their building and diversified siblings. In fact, building and diversified contractors expect this year to be "very good."

Newly funded highway construction is certainly not going to come on line until late in 2006, maybe even 2007. Adding to that is continued strain on state transportation budgets that may delay or prevent much-needed highway work because states cannot allocate matching funds. Yet heavy construction markets show promise, as our economist, Jim Haughey, outlines in his overview. Of particular promise are transportation, power, and water and sewer work. Total heavy-construction spending is expected to rise 11 percent this year.

Building and diversified contractors can point to a resurgence of nonresidential sectors, specifically office and education projects. Haughey forecasts total nonresidential to increase by 11.9 percent in 2006.

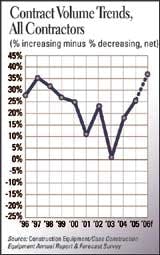

Contract volume grew overall for contractors in 2005. Some 46 percent reported growth in volume over the previous year. Subtract from that the 20 percent that reported a decrease in contract volume, and the net is 26 percent. This is the highest net since 1999, when it was 27 percent, but it falls short of the expected net of 38 percent. For 2006, though, contractors' expected net for contract volume is 37 percent.

General building contractors expect even greater volume growth this year, with a net of 45 percent. Some regions, too, have higher expectations. Mountain volume forecast is a net of 56 percent; it is 52 percent for Southern Plains and 48 percent for South Atlantic.

Competition for these volume increases remains heated. Almost three-quarters of contractors describe competition in their construction markets "very" or "intensely" competitive. Only 4 percent labeled it "not very" or "not" competitive.

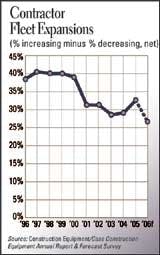

Fleet growth, measured in number of machines, is maintaining levels held since 2000. The net for fleet expansion was expected to be 30 percent in 2005; the net came in at 33 percent (39 percent reporting growth minus 6 percent reporting shrinking fleet sizes). For this year, the net is 27 percent for growth: 32 percent expect to expand minus 5 percent that see fleet size decreasing.

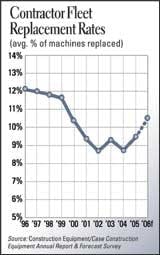

Last year, contractors replaced machines at the rate they forecast: 9.5 percent, up from 8.8 percent in 2004. Contractors have delayed fleet replacement in light of recent economic uncertainty, but this increase in rate seems to indicate they are now ready to cycle less-productive machines out of their fleets. The current machine shortage may put a crimp in these plans, but the expected replacement rate for 2006 jumps a full percentage point, to 10.5 percent. Regions where even greater activity is expected are Mid-South, predicting a 12.5-percent rate of replacement, and Pacific, 12.8. Northern Plains fleets say they'll replace machines at an 8.7-percent rate.

Fleet condition reports seem to support the rate resurgence. In 2001, 47 percent of contractors said their fleets were in "excellent" or "very good" condition and, in 2004, that had dropped to 40 percent. Last year, fleet conditions of "excellent" or "very good" were reported by 42 percent of contractors. One in 10 say fleets are in "fair" or "poor" shape.

Contractors favor the purchase strategy when acquiring major machines, those with a sticker price greater than $25,000. Half of contractors cite outright purchase, and half use financed purchases as acquisition strategies. These preferences increase as estimated replacement value of the fleet increases: of the largest fleets (ERV greater than $25 million), 81 percent report outright purchase as a strategy.

We continue to monitor the use of short-term rentals as an acquisition strategy and note that two-thirds of contractors used it last year. Among the largest fleets, usage jumps to 84 percent. One-fourth of contractors say they've increased their use of short-term rental, as did 40 percent of the large fleets.

Light earthmoving equipment is by far the most-often rented machine type, favored by 62 percent of contractors and 84 percent of the large fleets. Other machines, in order of preference: light equipment (47 percent), compaction equipment (39 percent), air compressors and generators (39 percent), heavy earthmoving machines (29 percent).

On the new-equipment side, 52 percent of contractors characterize competition among suppliers as "intense" or "very" intense. We defined competition in terms of pricing, model selection, and the number of quality brands available.

We also asked contractors to evaluate competition in the construction markets in which their firms operate. Some 72 percent described markets as "intensely" or "very" competitive.

Slightly more fleet managers rated their firm's health as top-notch, or "very good," in 2005: 26 percent vs. the 23 percent in 2004. Add the "good" ratings, and nearly three-fourths of contractors say their firms are healthy. Only 4 percent called firm health "weak" or "very weak."

Half of contractors kept staffing levels stable, while 35 percent hired more and 17 percent reduced their staff. Service/maintenance staffs were expanded by 18 percent of contractors, reduced by 11 percent. And equipment operators were added by 23 percent of contractors, reduced by 11 percent.

Subtracting those who reduced their staff from those who expanded, the net is 18 percent. Not surprisingly, operator and mechanic availability is a major problem for about one in five contractors.

Labor is even more of a concern for contractors in the Mountain region. Some 36 percent report operator availability as a major problem, and 32 percent say it's a problem finding mechanics.