'Carfax' Approach Boosts Residual Values for Ryan Central

Key Highlights

In this article, you will learn:

- How to use machine data to increase residual value.

- What type of machine information boosts resale value.

- How to use an Equipment Information Portfolio.

More asset management

- Ryan Central’s vendor reviews help prevent dealer deterioration.

- Defer machine replacement, but don’t deny it: Vorster.

- Apply a financial-investment strategy to equipment fleet assets.

- Extending the sweet spot on machine life.

Imagine being on a used car lot. You’ve narrowed the choices down to two vehicles.

One looks good, but also gives you access to years of thorough service records. The other car looks good too, but there is little or no indication as to how or when it’s been serviced.

“Just look at that wax job!” the salesperson bellows.

Which car are you more likely to buy?

This is the premise behind 2025 Construction Equipment and AEMP Fleet Masters large fleet award winner Ryan Incorporated Central’s “Equipment Information Portfolio” (EIP), a standardized package of service records akin to the “Carfax” vehicle history reports advertised on television.

How to increase equipment resale values

Ryan, an earthmover based in Janesville, Wisconsin, has a fleet of more than 700 machines with an estimated replacement value above $150 million. The company strives to keep its fleet relatively new so it can take advantage of the latest technology.

Keeping a newer fleet with a lower average age, however, means a higher turnover of equipment. That more frequent asset disposal has brought several issues with it.

“Selling our owned assets at auction, turning in leased assets at lease maturity, sometimes trading assets to dealers; in each of these scenarios we were realizing purely wholesale residual numbers,” said Aaron Mayer, director of finance and equipment for Ryan Incorporated Central.

“Over the past couple of years as equipment values have started to soften, there has been a lot more volatility in equipment values,” Mayer said. “This has translated into lower residual values on leases, lower auction values on equipment, and less appetite for dealers to take machines in on trade at competitive prices.

“In short, the spread between our acquisition price and disposal price has increased, which has put upward pressure on our equipment rates,” Mayer said.

But the roots of the EIP go back even further, over 10 years, as a result of an unsatisfying auction experience.

Left: Mayer explains the Ryan Central approach to dealing with current tariff uncertainty.

“In 2013 or 2014 we were coming out of a downturn and starting to replace equipment again, so we had equipment we were going to be turning out,” Mayer said. “Historically, we had almost always just sent things to auction.

“We ended up sending some items to an auction in the MidAtlantic,” Mayer said. “They came off a job that was very muddy, and [the auction] ended up taking pictures of the units when they were muddy. We had paid for them to be cleaned, but they never updated the pictures from the inspection. The machines sold for values that were a lot less than we expected—just because of the pictures.”

Ryan Central talked to the auction company about the situation and found them to be ambivalent at best, with a touch of arrogance.

“We decided that we could figure out how to do this better,” Mayer said. “Coming out of the downturn, we were also adding to our fleet. When we look at used machines, we want to know how they’re spec’d, the maintenance and repair history, the average duty cycle, all to figure out what it’s going to take to alter the specs to meet our spec and what’s the likely operating cost to the end of the first life we want.”

Mayer was not seeing enough of the information that he wanted.

“We happen to have a lot of that information through our internal processes and basically put together the EIP,” Mayer said.

At the same time, Ryan secured a domain name to sell its used equipment, set up Auction Time and Machinery Trader accounts, and started selling through those platforms. “We also did some testing, selling through Iron Planet, Ritchie Bros., and some other auctions, taking the exact same spec machine, somewhat the same hours, a similar [model] year, to see who did better,” Mayer said.

“And we did a lot better.”

How the Equipment Information Portfolio works

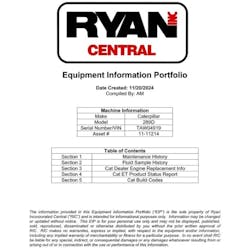

The EIP behind those better results is a thorough report that can run dozens of pages. A sample report given to Construction Equipment ran 22 pages for a Caterpillar 289D compact track loader—not exactly an old model.

“What we include is the maintenance history, the fluid sample history, and if there are any major component replacements such as engine, transmission, final drive, we would include an invoice with the prices redacted to show what the scope of work was,” Mayer said.

Ryan adds the ECM download to show configuration information and the duty cycle that the machine ran under. “It also shows that the hour meter is accurate, because there’s a lot of hour meter fraud out there, believe it or not,” Mayer said.

“Lastly, we include build codes, so if someone wants to see exactly how a machine is configured—whether it’s the undercarriage, drivetrain, powertrain—all that information is there,” Mayer said.

Prospective buyers can see not only the maintenance performed, but also all the defaults, if you will, that the manufacturer had set. The ECM download is one of the last things done before putting a machine on the market.

“The downloads are as close to the time of sale as possible, just so people don’t perceive we’re hiding something,” Mayer says. “If you were to do that ECM download, say, two months before you sold it, you would hear ‘Why? What happened at two months?’”

Mayer said lessening the perceived risk of buying Ryan’s used equipment increases the price at sale.

“If you have information that makes you more comfortable, makes you more confident, you reduce that risk premium and you’re willing to pay more,” Mayer said. “A lot of the customers we've had over the years have found that, yes, this is a used piece of equipment, but that we also have a very good maintenance program that makes our equipment reliable.”

Benefits of the EIP

A number of benefits have proven the EIP approach works.

“At the onset of the project, we thought the EIP would increase residual values by around 5%,” Mayer said. “Since we have been using the EIP, we have found that it has improved the residual values of our assets by an average of 10 to 15% as compared to sales where no service records are provided.”

Realizing more money at disposal has also allowed Mayer to lower his equipment rates for his clients in operations.

“Usually the largest cost in rates is ownership; depreciation, lease payments, interest, etc.,” Mayer said. “In a very simplistic way, your ownership rate is your buy price minus your sell price divided by the number of hours you put on, and you apply interest in between. So, if you can take your sell price and you can make it 5, 10, 15% better, that makes that difference smaller, which in turn makes the rate less.”

Lower equipment rates help lead to more accurate and lower bidding. “You don’t want a lot of volatility in your rates because you might be bidding on something a year or two years out,” Mayer said.

An alternative benefit has been that Ryan has developed a large pool of secondary market customers who actively seek out its used equipment.

“That has further improved the net residual values because we are able to sell to these customers quickly and directly and not incur the make ready for sale, advertising fees, and holding costs associated with a typical asset disposal where it is taken out of service, made ready for sale, advertised, and sold within 90 to 120 days,” Mayer said.

The beauty of all of this is it uses fleet data and reports that already exist.

“We were able to leverage the extensive amount of data and reports we use in the day-to-day management of the fleet to create a product we can share with the secondary market that lessens the perceived risk of buying our equipment, which in turns increases the prices it sells for,” Mayer says.

“These increased prices have reduced the life cycle costs for assets in our fleet, making us more competitive.”

About the Author

Frank Raczon

Raczon’s writing career spans nearly 25 years, including magazine publishing and public relations work with some of the industry’s major equipment manufacturers. He has won numerous awards in his career, including nods from the Construction Writers Association, the Association of Equipment Manufacturers, and BtoB magazine. He is responsible for the magazine's Buying Files.