In early November, Congress passed a $1.2 trillion infrastructure package, delivering $110 billion for roads, bridges, and major infrastructure projects, as well as $40 billion for bridge repair, replacement, and rehabilitation.

Jenkins is managing editor of Roads & Bridges

The Infrastructure Investment and Jobs Act (IIJA) is likely the largest dedicated bridge investment the country has seen in over half a century, when the interstate highway system was constructed. The bill also includes $11 billion for transportation safety. Overall, it will deliver $550 billion of new federal investments in America’s infrastructure over five years.

This is a crucial investment considering the American Society of Civil Engineers gave the nation’s infrastructure a C- score earlier in 2021.

“The IIJA is the culmination of decades of advocacy by American Society of Civil Engineers (ASCE) members who worked tirelessly to educate Congress about the role infrastructure plays in supporting the economy and our quality of life,” Dennis D. Truax, ASCE president, said in a prepared statement. “ASCE’s Infrastructure Report Cards have sounded the alarm on our nation’s infrastructure conditions since 1998, with new reports being released every four years. While all categories of infrastructure have been the cause of some concerns, the common denominator behind each category’s struggles has been a backlog of projects, overdue maintenance, and a need for resilience.”

For the roads and bridges construction industry, it’s a time for optimism. This past summer, Roads & Bridges conducted a multi-part state of the industry survey.

Respondents represented highway/heavy construction (64 percent), both building and highway construction (16.9 percent), general building construction (10.9 percent), technology development (4.9 percent), and material production (3 percent).

And their mood was positive before the bill even passed. Of the 267 respondents, 42.3 percent rated 2021 as a “good” business year for their company. More than 33 percent of respondents thought the industry was “very good” or “excellent” for their companies this year.

Looking forward, 41.9 percent thought 2022 was going to be a “good” year, and 34 percent said “very good.” Those numbers might be higher now, given the amount of money being injected into the roads and bridges construction industry, thanks to this bipartisan bill.

“The Infrastructure Investment and Jobs Act is the most significant measure in more than 50 years to meaningfully address the condition and performance of the U.S. transportation network,” American Road & Transportation Builders Association (ARTBA) president/CEO Dave Bauer said in a statement. “The transportation construction community now welcomes the opportunity to use these historic investments to deliver infrastructure outcomes that will improve the quality of life for all Americans.”

Perhaps some had assumed the bill would pass. Given the poor state of the country’s roads and bridges, there has been a greater focus on improving infrastructure from voters and politicians. According to a 2020 report by ARTBA, 94 percent of all transportation investment ballot measures nationwide were passed in last year’s election cycle.

Read the complete industry report in 2022 Annual Report & Forecast.

That represented $14 billion in one-time and recurring revenue for transportation improvements, and it was the highest level of such approval in the 20 years ARTBA has tracked such statistics.

“More than ever before, these results prove that improving transportation infrastructure is something Americans voters strongly support,” ARTBA SVP and chief economist Alison Black said in a statement following the 2020 election results.

However, the RB state of the industry survey showed this optimism only goes so far. Over 60 percent of respondents described the industry as “very competitive,” while nearly 18 percent called it “intensely competitive.”

This amount of pressure matters because the prices for materials are going up, and roughly 87 percent of respondents anticipate facing this issue. This is happening throughout the country as several industries have been impacted by global supply chain problems. However, for the roads and bridges construction industry, it means higher bid prices, and 87 percent responded to the survey saying they expect bids to go up.

Prices for asphalt, steel, and cement are expected to rise the most.

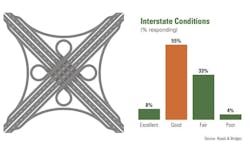

With prices going up, one big question is this: Where should the focus be in regards to infrastructure improvements? Respondents to the Roads & Bridges state of the industry survey were evenly spread out across the country, and the general consensus was that America’s highways are in “good” shape.

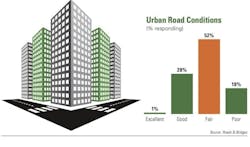

Urban and rural roads and bridges? Not so much. Roughly 19 percent said rural roads were in “poor” condition and 69 percent reported that those roads were declining. Urban roads received almost identical responses.

Improving the nation’s infrastructure is going to take time, maybe a decade or more. Contractors and DOT engineers now have the funding to design, approve, and build the projects that this country desperately needs.

Last year, there seemed to be shakiness and uncertainty in the industry because of how Covid-19 had impacted the economy. But now, especially after the passage of this massive investment in America’s infrastructure, optimism grows. Now, it’s time to get to work.