Fast-moving technological advancements in the zero-emission on-road vehicle sector are resulting in significant progress in the challenging space of off-road equipment electrification. There are also signs of real progress in the electrification of off-road machinery, including light forklifts, airport ground support vehicles, and yard trucks.

Although zero-emission technology for many lighter vehicles is now relatively mature, obstacles to the electrification of heavier vehicles still exist in the form of market barriers, technological challenges, and end-user attitudes. But the game is on, and electrification technology is gaining a firm foothold in heavier-duty scenarios such as construction, mining, and agriculture.

Penetration is slow, but the potential is huge

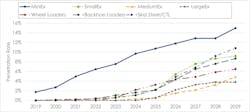

The construction equipment market can be divided into seven main categories: mini excavators, small excavators, medium excavators, large excavators, wheel loaders, backhoe loaders, and skid steer/compact track loaders. As expected, the smaller equipment is seeing the most significant penetration of battery-electric technology.

Battery-electric mini excavators accounted for 5 percent of the U.S. market in 2021, and this figure is expected to rise to 15 percent by 2029. Other machinery categories with the highest rates of projected electrification penetration by 2029 are small excavators (9 percent), wheel loaders (6 percent), backhoe-loaders (9 percent) and skid steer/compact track loaders (11 percent). These numbers indicate plenty of potential for further electrification in the construction sector.

On the global stage, 23 OEMs are producing light battery-electric excavators (less than or equal to 8 tons). Their excavators are increasingly being deployed to replace diesel excavators, reducing air pollution, greenhouse gas emissions, and cost. Electrified compact loaders are in the early stages of commercialization, such as Bobcat’s battery-electric CTL. Outside the United States, battery-electric technology has greater penetration into the construction equipment sector, with demonstrations and early commercial conversions across Europe and Asia.

Another zero-emission technology, hydrogen fuel cells, lags battery electric in terms of research, innovation, and deployment. Some OEMs are developing their own hydrogen-powered products, but multiple challenges lie ahead for the technology. In terms of hybrid electric (mild or full), wheel loaders are the only construction vehicle category where this technology is expected to come anywhere close to battery-electric’s marketplace numbers by 2029. These machines have used diesel-electric drivetrains for several years.

Notwithstanding the barriers to penetration of the heavy-duty construction equipment, they will ultimately have to decarbonize. This will likely happen through a process known as the Beachhead concept.

The Beachhead concept

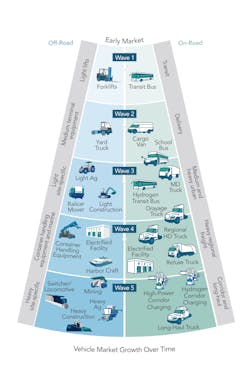

The Beachhead concepts envisages transformation through technology transference. As mentioned earlier, on-road vehicles are leading the charge toward electrification. These vehicles—by nature of their stable power demand, application, work cycle, business case, and technological readiness—are the easiest vehicles to electrify. But the resultant evolution in technology, coupled with increased volumes of components at reduced cost that are useable across machinery types (along with the development of supply chains and expansions in infrastructure), will enable technology crossover into other equipment categories (see nearby illustration).

In Wave 3, for example, medium and heavy urban on-road vehicles offer work-cycle, business, and technological characteristics that apply to light site-specific vehicles (including light construction vehicles), whereas further along the development route, the technology involved in electrification of long-haul trucks is expected to spill over into the heavy construction sector.

Barriers to electrification of heavy equipment

Where equipment operators are concerned, there is still much to be done to convince them of the advantages of electrification. Foremost among these barriers is the up-front cost. Such costs will diminish as production ramps up.

Alongside the financial disincentive to electrify, there are doubts as to whether electrified equipment is not up to the job, at least where larger machinery is concerned. The concern is that electrified powertrains do not have sufficient power to drive a machine through a full work cycle. This is indeed the case in the largest machines that consume the most energy, but there are examples of large, electrified equipment that in fact can operate effectively across a full shift.

Incentives May Pave the Way

At CALSTART, we believe incentives will offset the comparatively high cost of initial off-road electric equipment purchases. If state and federal governments are serious about decarbonizing a sector that is recognized as being responsible for high levels of pollution and greenhouse gas emissions, then financial support in the initial stages of zero-emission vehicle and equipment adoption is likely the only way forward.

California is the leader in the U.S. with its Clean Off-Road Equipment Voucher Incentive Project (CORE), which was established to encourage off-road equipment users in California to buy or lease zero-emission off-road equipment. This $125-million streamlined voucher incentive project offers a discount on the sale or lease price of zero-emission equipment. There is no scrappage requirement, and there is additional funding available for charging and fueling infrastructure, as well as for equipment deployed in disadvantaged communities, where pollution is high.

California has further announced that sales of off-road equipment in the state will be required to be entirely zero-emission by 2035, which is expected to have an impact on such sales across the entire country.

Access to charging infrastructure is also a key issue for operators, more in the case of remote locations than urban scenarios, with heavy equipment posing the added problem of requiring high charging rates often not commercially available.

And then there is the issue of charging downtime, a major challenge for users of machinery that must operate for extended work cycles. But technology is evolving, and innovative solutions are being developed.

Concerns about the technology persist, however. There will undoubtedly be some types of heavy equipment for which the pure electric option will not be viable for the near future. Battery electric may simply not offer sufficient power density or range for machinery doing heavy work across long duty cycles, especially if they are in remote locations where high-power charging is not an option.

Such equipment may be better served by hydrogen fuel cell technology. Several OEMs have an array of fuel-cell-powered heavy construction equipment in the demonstration phase, including tracked and wheeled excavators, articulated dump trucks, and large rock drills. Much will hang on issues regarding the generation, transport, and storage of hydrogen gas, although some hydrogen infrastructure is being developed for medium and heavy duty on-road vehicles.

There is no reason why we shouldn’t expect the Beachhead model to be emulated here, too, as infrastructure technology inevitably goes off-highway.

Operator concerns regarding the decarbonization of vehicles and equipment will be dispelled as the technology develops. The energy density of batteries continues to increase, resulting in a corresponding increase in their range, which is already up to 8 hours in smaller machinery. Recharging infrastructure is proliferating and becoming more sophisticated, offering rapid, high-power charging and, for remote locations, battery-swapping solutions are also an option.

About the Author

Jacob Whitson

Jacob Whitson is the CORE Program Manager at CALSTART, the national U.S. clean transport nonprofit.