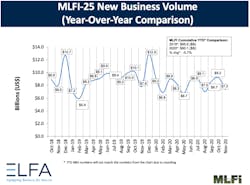

New Leasing Index Down in November

Overall new leasing business was down 21 percent in November to $7.3 billion, after posting $9.3 billion in October. Business was down 7 percent compared to November 2019, and cumulative volume is off 6 percent to 2109.

The numbers are part of the Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25). The index reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector.

“With a tumultuous election season behind us, the equipment finance industry reports slightly lower volume totals for the month,” said Ralph Petta, president/CEO, in a prepared statement. “The effect of the Covid-19 pandemic on the U.S. economy surely has taken, and will continue to take, a toll on some members’ business operations.

“But, overall, the broader industry is performing well, with delinquencies and losses in very acceptable ranges,” he said. “And, the roll out of vaccines should inject a renewed sense of optimism and hope by consumers and businesses alike, which will only bode well for our industry in the months ahead.”

Rick Matte, president and chief commercial officer for Encina Equipment Finance, said in a statement:

“As we can see from the data in this month’s report, Covid-19 continues to cause disruption in the equipment finance marketplace. We have seen some industries perform very well while others have essentially fallen off a cliff. Capital spending has been cut dramatically by most businesses as they look to preserve cash or re-evaluate their future growth prospects. With all that said, now that the election is behind us combined with the delivery of two FDA approved vaccinations, the market sentiment has begun to shift despite increasing Covid cases.”

Source: ELFA