Leasing Volume Decreases in August

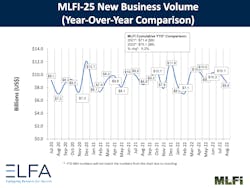

New leasing business volume shrank 13 percent in August compared to July, according to the Equipment Leasing and Finance Association. Volume is up 4 percent compared to August 2021, and is up 5 percent cumulative year to date.

Overall new business volume for August was $8.8 billion. Credit approvals totaled 75.2 percent, down from 78 percent in July.

ELFA’s Monthly Leasing and Finance Index (MLFI-25) reports economic activity from 25 companies representing a cross section of the equipment finance sector.

“August origination volume reflects an equipment finance industry that is fueling continued growth and expansion of businesses throughout the U.S,” said Ralph Petta, president/CEO, in a prepared statement. “Up to this point at least, steadily rising interest rates do not appear to dampen enthusiasm of businesses that prefer the utilization of productive assets versus their ownership, which is the essence of the equipment finance sector. With the Fed’s most recent 75-basis point jump in short-term interest rates, and the prospect of a hard landing, time will tell whether—and to what extent—these same business owners continue to grow and invest in equipment.”

Said Thomas Sbordone, managing director and national sales manager, BMO Harris Equipment Finance, in a statement:

“While the economic data may be construed in any number of ways and can feel, at times, unsettling, the fundamentals of our equipment finance business remain strong. Companies invest in capital equipment, throughout all cycles, for a myriad of reasons and equipment obsolescence is certainly real. Productivity gains require capital and business owners are always seeking an edge on the competition.

“Once decision-makers get past the initial ‘sticker shock’ of seeing how their financing rates have climbed over the past year they make rational choices based on their individual circumstances,” Sbordone said. “The August MLFI results look positive, generally, given the market environment with continued high inflation, supply chain issues and other challenges. It will be interesting to see the September end-of-quarter MLFI results when the effects of the Fed’s latest interest rate hike are clearer. A ‘wait and see’ approach never feels great, but we’re reminded that patience is a virtue.”

Source: ELFA