January Used Equipment Report: Inventory Drops Across Key Construction Segments

The January used equipment data from Sandhills Global delivers a familiar mixed bag of information. I’ve tried to make sense of it all for our fleet readers. Below I’ve broken down trends for the top five categories of used equipment, mostly with a construction-focused bent. Inventory continues to shrink across most construction and truck categories. Prices remain under pressure. Still, several markets posted month-over-month value gains. For fleet managers and operators, Sandhills Global’s data on used equipment for January holds some interesting insights. But before we dig in...

If you don’t know, Sandhills Global is an information processing company headquartered in Lincoln, Nebraska. It gathers, processes, and distributes information through print publications, websites, and auction platforms. It basically connects buyers and sellers of construction, agriculture, trucking, and other types of equipment. They own stuff like TractorHouse and Machinery Trader. As a result, Sandhills Global has access to some pretty interesting data, which they share in these monthly reports. SO, below is a quick look at five used equipment and truck categories from its latest recap. All the numbers come from that report. Got it? Now, let’s dig in.

Used heavy-duty construction equipment inventory keeps shrinking

Used heavy-duty construction equipment inventory fell again in January. This marks the seventh straight monthly decline. Inventory dropped 2.6 percent M/M and just over 13 percent YOY. Wheel loaders saw the sharpest contraction. Wheel loader inventory fell nearly 4 percent from December and more than 14 percent compared to last year. Asking values for all equipment types rose 1.93 percent M/M but dipped 2.87 percent YOY. Crawler excavators led the pricing improvement. M/M asking values for crawler excavators was up 2.6 percent. Auction values followed. From the press release: “Auction values rose 2.91 percent M/M in January but decreased slightly YOY at 0.35 percent, also maintaining a sideways trend. These changes were led by used crawler excavators, up 4.93 percent M/M, and used crawler dozers, down 1.13 percent YOY.”

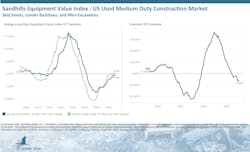

Used medium-duty and compact equipment inventory tightens

Medium-duty construction equipment followed a similar inventory path. Supply fell more than 2 percent M/M and nearly 13 percent YOY. Backhoe loaders continue to disappear. Backhoe inventory dropped more than 6 percent from December and almost 25 percent YOY. That category keeps tightening. Asking values rose modestly in January but still extend an 11-month downward trend. Compact track loaders remain the weakest pricing segment (down 1.85 percent YOY), which is interesting for such a hot category of equipment. From the press release: “Auction values have now been trending down for six consecutive months. The used loader backhoe category led the pack, delivering the biggest M/M auction value gain at 5.18 percent and the largest YOY rise at 1.56 percent.” Go backhoe loaders.

Aerial lifts show growing supply and uneven pricing

The used aerial lift or MEWP market broke from the equipment pattern. MEWP stands for mobile elevating work platform. Inventory increased 0.99 percent M/M and 3.62 percent YOY. Slab scissor lifts drove those monthly inventory gains. Slab scissor M/M inventory increased by 3.04 percent, according to Sandhills Global, while the used rough-terrain scissor lift category led in YOY gains (up 13.75 percent). Asking values jumped 5.06 percent M/M, but they remain lower than last year (down 1.89 percent YOY). Also interesting (directly from the press release): “Used rough-terrain scissor lifts led other categories in M/M asking value increases, up 6.81 percent.”

Telehandler inventory is down, and prices are rising

Used telehandlers delivered one of January’s cleaner signals. Inventory fell nearly 3 percent M/M. Prices responded. Asking values were up 4.49 percent M/M and 1.07 percent YOY. Auction values surged more than 9 percent month over month, but they have been pretty flat over the last year. This marks a meaningful shift. Fleets watching this category should pay attention. There’s some momentum changing here.

Medium-duty trucks struggle to find traction

Used medium-duty truck inventory inched up slightly in January. From the press release: “Inventory levels in this market inched up 0.94 percent M/M in January but fell 5.7 percent YOY and continued a 5-month-long downward trend.” Pricing stayed the same M/M, but fell 6.61 percent YOY. Auction values rose 1.85 percent M/M but were down 6.81 percent YOY. Supply tightened over the past year, but demand has not followed. It will be interesting to see where this market goes.

About the Author

Keith Gribbins

Keith Gribbins is the head of content at Construction Equipment, where he leads editorial strategy across print, digital, video, and social channels. An award-winning journalist with more than 20 years of experience, Keith has won 17 national and regional editorial awards and is known for his hands-on reporting style, regularly visiting manufacturers, operating equipment, and covering major industry events worldwide.