Roads, Bridges Rely on Locals

Most department of transportation buildings do not have a door marked PRIVATE.

Since one figuratively does not exist, either because there is no interest in working with the private sector or it is simply not feasible, it is hard to see how President Trump’s proposed $1 trillion infrastructure plan would help the transportation building industry. Most of the money in the plan, about 80 percent, is expected to come from private investors. There are only a few DOTs that play that game, and one state, Texas, used to roll the dice, but no longer does.

Construction Sector Reports

“I think there is a lot of money out there that is making itself available, but there are a lot of variables that determine whether a P3 is going to move forward,” Brian Deery, senior director of the Highway & Transportation Division for the Associated General Contractors of America, said. “There have been a couple of recent failures that put a damper of it. The tax reform bill—that is going to eliminate private activity bonds which are a big part of the whole public-private partnership (P3) component.”

In late November, the tax reform plans working the room of the House and Senate did not even have a transportation funding component. According to Deery, 253 members of the House sent a letter to Rep. Kevin Brady (R-Texas) pushing for a fix of the Highway Trust Fund, which will fall into a $100 million hole in 2020. Compounding the funding problem in the road and bridge industry is the fact that the first part of FAST Act was funded, but the final portion is not. The federal contribution provided little boost for contractors in 2017 because the money was part of a continuing resolution, so states did not receive it until just recently. It all calculates into a flat market, with little growth forecast for 2018.

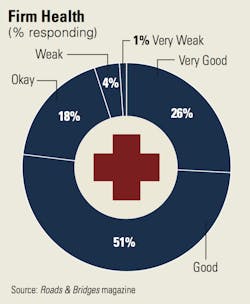

The states are stepping in to help highway and bridge contractors. Elevating the gas tax, sales tax, and certain fees continue to be a popular move. The funding increase, and the fact many contractors do more than just road work, has resulted in a stable market. Some may say it is on the rise. According to the latest Roads & Bridges survey, about 43 percent of respondents said this year was a “good” year and just over 30 percent said it was a “very good” year. Over 36 percent say 2018 will be “very good,” while just under 40 percent are rating it “good.” Almost 60 percent have indicated their revenue will increase next year.

The guy next to you in the bidding room, however, continues to have a knife at his disposal, and is willing to use it to cut away at the bid price. Seventy-two percent of survey respondents said the competition is fierce, which means bid prices remain extremely low. Johnny Walton, president and owner of the John G. Walton Construction Co. in Mobile, Ala., continues to get pinched. In October his company went after a road project in Baldwin County, Ala., that involved widening a two-lane highway to a five-lane highway in just 18 months.

“It just wasn’t enough time and I added a bunch of money in liquidated damages to cover myself, and we were $2.7 million over the low bidder,” Walton said.

Business has been relatively steady for John G. Walton Construction, which does mostly public work at the city, county, and state level. The contractor started out specializing in grading work, but six years ago expanded into the asphalt paving business. The next 12 months, however, are a little cloudy. The state of Alabama borrowed $1 billion for road work five years ago, resulting in an annual boost of $200 million, but the deal expired at the end of 2017. State officials also are predicting a $120 million debt service in 2018, which would be devastating to the Alabama DOT.

The Mobile area, where Walton does most of its work, is booming. Airbus built a plant downtown, and a Super Walmart distribution center, covering 56 acres, is under construction. Amazon also is building a warehouse. The economic surge is due to the expansion of the Panama Canal and more activity at the Port of Mobile, which will put more wear-and-tear on the road and bridge network. The George Wallace Tunnel needs a stress reliever. There is a constant bottleneck to go under the Mobile River, and there is talk of a P3 building a bridge to lessen the traffic tension. Tolls would then be collected for anyone crossing the bridge or using the tunnel. Walton is hoping he will be able to land work building the approaches to the bridge, which could be a $20 million contract. It would be the first P3 project in the state of Alabama.

“What we have talked about is there are all of these red states that voted for Trump and there is no P3 investment in any of those states,” said Walton.

The city of Mobile also will be receiving some of the settlement money from the BP oil spill in 2010. About $150 million will be spent on road projects.

“There are several projects slated for next year so that is going to help,” said Walton.

“It’s a huge amount of money for our system, so Caltrans is just now trying to get projects on our street early so the citizens of California can see,” Tom Foss, chairman and CEO of Griffith Co., said. Griffith Co. has been around for 115 years and focuses on bridge work, concrete, and landscape work.

SB 1, however, could be in jeopardy. According to a recent survey conducted by USC Dornsife and the Los Angeles Times, just over 54 percent of registered voters said they would cancel the tax and fee hikes. Two groups are putting together initiatives on the November 2018 ballot that would allow the voters to reject SB 1.

Los Angeles also is bracing for another Summer Olympics in 2028, and infrastructure projects are already starting to trickle in. Griffith Co. is doing utility relocation, road relocation, and geotechnical investigation for a people-mover project and a rental car renovation at LAX, and both contracts are valued at over $2 billion. Los Angeles, Orange County, and other areas also increased sales taxes to make up for the lackluster financial support at the federal level. Even though 2017 was a relatively flat year for Griffith Co., Foss said he believes the next year could be fairly lucrative.

“I think everything will pick up,” he said. “While we passed a federal bill two years ago, the back end of the bill is not funded. Congress only funded the first part of it, so I think people are worried where the money is going to be.”

Depending on where you are standing, there is money for highway and bridge construction in the state of New York. Unfortunately, Union Concrete, located in western New York, has its feet in the wrong place. The money is downstate, leaving other areas relatively dry.

“There have been few initiatives that the legislature has added,” Carley Hill, safety and risk management director for Union Concrete, said. Union Concrete is a family business that does primarily road and bridge work for the New York State DOT and the New York Thruway Authority. It also does some county work. “The unfortunate thing is there is a mechanism in place where the state follows the federal action.”

Work has been flat in the western New York region for the past year, and 2018 does not look much better.

“In Buffalo, the vertical construction, no doubt about it there has been a big boom, but on the horizontal side it has been absolutely flat . . . maybe a decrease,” said Hill.

Hill said private investment has potential, and pointed to the success in the power industry. She would not mind to see a similar approach in the highway/bridge sector.

“The perspective of a private entity over a municipal leads to more efficiency and the opportunity to develop new technologies that moves those systems forward into the 21st century.”

Voters in 20 states approved more than 80 percent of 215 transportation investment ballot measures on Nov. 7, mostly at the local level, according to an analysis conducted by the American Road & Transportation Builders Association’s Transportation Investment Advocacy Center (ARTBA-TIAC).

The approved measures will support $2.9 billion in new transportation investment revenue and $1.3 billion in continued funding through tax extensions or renewals.

The largest number of measures were in Michigan and Ohio, representing over two-thirds of the initiatives tracked by ARTBA-TIAC. Many of these were smaller property tax measures to renew local funding for roads, streets, and bridges over a five-year period.

Voters in Pinal County, Ariz., approved a half-cent sales tax that will total $640 million for highway construction over the next 20 years. Renewal of a one-cent countywide sales tax in Pinellas County, Fla., will generate $412 million for road, bridge and trail projects.