Fleets Improve in Slower Year

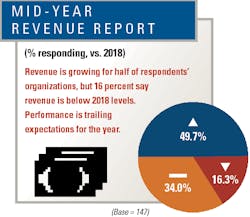

Fleet managers report revenue growth far below forecasts made in our Annual Report and Forecast half-way through 2019. In fact, revenue growth is on track to be lower than 2018’s performance. Even so, equipment pros have expanded fleets and improved overall condition as expected.

Construction Equipment sent email invitations to select members of our audience who buy, specify, or influence purchases of equipment. We asked about business and equipment-fleet trends. Results and analysis are provided as a service to the industry through the partnership of Construction Equipment and Case Construction Equipment.

Fleet condition was scored as either “excellent” or “very good” by 54.2 percent of respondents, up from 44.5 percent in 2018.

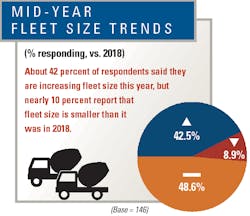

The percentage of respondents who have expanded fleet size matched the projections for the year, at 43 percent. The net expansion (the percentage reporting increases in fleet size minus decreases) at this point in the year is 33.6 percent, due to more reductions than expected. Although this is up from 2018, it trails the forecast of 38 percent. The fleet replacement rate, at 14 percent mid-year, is meeting expectations.

Business conditions are not meeting expectations. Revenue is up for half of respondents through mid-year, far short of the 62.4 percent who forecast growth for 2019. At the same time, the percentage reporting decreases in revenue is double that who projected drop-offs this year: 16.3 percent compared to 8 percent. As a result, the net for revenue (the percentage reporting increases minus decreases) is 33.4 percent. The forecast net for 2019 is 54.4 percent.

The percentage of respondents rating the business year as “excellent” or “very good” is 49 percent, compared to a forecast for 2019 of 52.5 percent.

Mid-year Survey