Federal Funds Dry Up for Water Infrastructure

Last year, President Donald J. Trump’s infrastructure plan was yet to be realized. This year, there was movement. In October, Trump signed the America’s Water Infrastructure act, which calls up on the U.S. Army Corps of Engineers to develop five-year plans through 2024 for water projects. The bill also provides $3.6 billion for the Water Infrastructure Development Act, which can be used to institute workforce development programs.

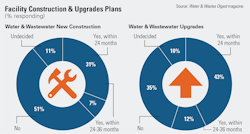

According to the Water & Wastes Digest survey, half of respondents said new construction was not on the table, but nearly 70 percent said upgrades are planned for the next 36 months. This simply could be ongoing maintenance planned a decade ago, but the volume of upgrading suggests that municipalities see a need for new equipment but not new facilities.

The approximate annual budget for upgrades highlights another take on the matter of upgrades or new construction. Respondents fit into a budget category of $1 million or more with 47 percent, but the middle range of $100,000 to $499,000 makes up another 22 percent of respondents. Despite that budget availability, 48 percent of respondents also note that the budget has generally remained the same from the previous year.

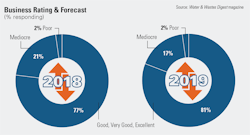

With a review of the survey conducted last year in which 50 percent of respondents said revenue increased, this year’s study suggests there has been a plateau in revenue relative to the previous year. Looking at the political climate around infrastructure funding and how little was known until the last quarter of the year, this makes sense. Uncertainty abounded for most of the year, and the steel and aluminum tariffs added pressures on manufacturers for which they had not been entirely prepared. And for those importing from China, an increase on tariffs will start Jan. 1. Despite that, some manufacturers have seen strong years, with several in the industry hitting record sales, and those manufacturers are anticipating that trend will continue into 2019.

Lastly, the items that respondents deemed most important for the coming year are state and federal regulations and compliance issues, funding, maintenance and upgrades, workforce development and preliminary wastewater treatment such as headworks and screens.

Two-year plans do not include new construction for half of respondents, and 35 percent do not expect to do upgrades in that time frame.

Although segments of the municipal market have struggled to invest in infrastructure, spending and budgeting for necessary projects has not faded entirely. John Masters, Danfoss vice president of sales - water, said much of that spending has been in energy efficiencies, particularly as it relates the purchase of drives. By investing in improved efficiencies, municipalities are thinking about long-term payoffs.

“The overall construction market for water has continued to grow this year, too,” Masters said. “Of course we had the issues with the hurricanes and so forth, and that unfortunately—as unfortunate as that is—has contributed to some additional opportunities to support the rebuilding of that infrastructure.”

Paul Turgeon, WWD editorial board member and CEO of Anue Water Technologies, said overall, public utilities are finding it difficult to reinvest but that private sector investment is starting to make an appearance.

“We’re beginning to see some private sector interest in filling that gap, and at the same time the billing and use is growing with growth in the overall market and need for water, but the infrastructure is not so that’s where private industry—private investment at least—is saying, ‘Hey, there’s a gap here we could potentially close and fill in,” Turgeon said. “We’ve seen a couple of instances with that practically with Anue Water and we’ve heard from other players in the market that that’s an impactful trend.”

Additionally, hurricanes and other disasters in the past year have contributed to necessary spending from municipalities regionally, and Masters said 2019 with bring an increased focus on state-level funding from revolving loans because of the passing of AWIA. For projects that have been on the backburner, Masters said the state revolving loan funds may be the catalyst to get projects completed.

Ryan Godfrey, U.S. Water VP operations, said getting state legislatures engaged will be an important aspect of securing funding for projects because of the projected increase in state revolving loans.

“We can very safely expect that it is going to be very state level focused,” Godfrey said. “The federal government having little involvement going forward is pretty clear. I have seen extra conversation and discussion happening in a number of state legislatures talking about what they can do from a funding perspective. If we start to get state legislatures more engaged, these issues these municipalities are struggling with, we might start to see some better options coming out at the state level.”

Godfrey and Masters said that public-private partnerships are effective, but only when municipalities or companies are large enough. Masters said that companies like Veolia and Suez that provide the operation services for large facilities have been effective, but the smaller utilities have not been as effective.

Respondents ranked top factors for this year, and regulations were at the top of the list.

Impact of tariffs

One of the greatest impacts on the industry this year has been the introduction and implementation of steel and aluminum tariffs. There have been several separate determinations throughout the year. A 25 percent tariff on steel and a 10 percent tariff on aluminum were both instituted in most countries in March and those tariffs were extended to the European Union, Canada and Mexico in June. Then in July, a 25 percent tariff on 800 goods from China was instituted, which also impacted manufacturers.

The implications for this include price increases in equipment, disruption to delivery of equipment and delays in manufacturing. John Ballun, president of Val-matic, said the intent of the tariffs did not match with the end goal.

“While we support the intentions of the 301 tariffs, their sudden and unpredictable end make for some difficult decisions, both logistically and strategically,” Ballun said. “It may produce reshoring, but that is a difficult challenge given the temporary nature of the tariffs. Also, the domestic foundries are swamped right now and can’t take on more work.”

The result of the tariffs, he said, was an increase in price on all affected products, meaning municipalities—and ultimately taxpayers—are absorbing the cost of the tariffs. He said this was similar for the tariffs instituted on Chinese imports.

“Our China sourced parts saw a 25% cost increase,” Ballun said. “The tooling associated with these parts represents several million dollars, which is difficult to transfer back to the US or to another country. We have decades-long partnerships with factories in China.”

Ryan Godfrey said the struggle for municipalities to find funding is compounded by the tariffs.

“We know the quantity [of needed work] out there and it’s an ongoing struggle [to fund it]... That struggle is being compounded by some of the inflationary pressures out there in the marketplace. The tariffs and that are having a trickle down effect and will continue to have a trickle down effect,” Godfrey said.

In January, Chinese tariffs will increase from 10 percent to 25 percent. It is not clear if more are on the horizon or if any instituted in the past year will be reviewed or changed in 2019.