Excavators Offer Less Swing, More Machine Control

The market for 40,000- to 60,000-pound crawler excavators has been robust, with shorter tail swing models and integrated machine control offerings finding favor with contractors.

“The 40,000- to 60,000-pound size class has grown by approximately 7.2 percent, compounded annually [CAGR], over the last few years,” says Aaron Kleingartner, marketing manager for Doosan excavators. “Models in this size range account for approximately 35 percent of all large excavators sold. The excavator’s versatility and wide range of potential applications help to bolster this consistency. In 2020, we see a continued trend for these models but likely at somewhat under the CAGR expected the past few years due to various factors.”

Patrick Baker, product manager for JCB excavators, also sees an adjustment on the horizon.

“After a year of strong growth in 2018, the large-excavator market was relatively flat in 2019, and the forecast for 2020 shows a slight decline,” Baker says. “However, even with forecasts for the large excavators being slightly down next year, several construction sectors should still experience growth. The highway and bridge construction sector will remain buoyant. And we expect continued growth in the residential and commercial construction in major urban centers such as Dallas, Atlanta, Orlando, Boston, and Los Angeles.

“Similarly, at JCB we’ve seen explosive growth in demand for large excavators from the oil and gas industry over the last two years and we’re looking for that trend to continue into 2020,” Baker says.

“As the construction industry continues to see success, with new jobs and developments coming out every day, so too does the excavator market,” says Jordan Sonnier, district business manager for KOBELCO excavators. “In particular, [this size class] leads the market place. The strength and growth of both the housing and infrastructure markets lead the charge for this class.

“Contractors today are having to use equipment that is suitable for many different job site applications,” Sonnier says. “Increasingly in the North American market, these versatile machines in this class are no longer, ‘just an excavator,’ but now are moving more towards ‘tool carriers.’ This size excavator is the perfect tool for contractors to be able to adapt to a job site and get the job done quickly and efficiently. These machines are large enough to carry the heavy loads and move material on a job site, yet still able to show finesse and maneuverability.”

Maneuverability drives the popularity of shorter-swing radius machines—machines with specially designed counterweights that are more vertical than horizontal—limiting or eliminating how much the rear of the excavator swings out beyond the tracks as the housing rotates. OEMs have added more of these units in recent years.

“SR or ‘Short Radius’ machines are becoming more and more popular in today’s market because of their ability to work in tight conditions,” Sonnier says. “The ability for a machine to rotate with little to no overhang from its own tracks makes it an ideal machine for working up alongside houses, in heavily populated urban areas, and on road construction, especially as North America moves to update antiquated or dangerous communication, drainage, and water supply systems.

“In today’s road building industry there are road improvement jobs everywhere, which usually involves ripping up new land or old asphalt,” Sonnier says. “Using an SR machine on this type of work allows operators to get right up alongside Jersey barriers without the fear of the machine rotating into traffic over the barrier.”

Transportability also plays a part in the category’s popularity.

“These machines strike a unique balance of being able to do large-scale work, while remaining nimble and easily transportable,” says Brian Stellbrink, product specialist for Caterpillar excavators. “Many contractors are looking to maximize the versatility of a single piece of equipment. That is, use one machine for many different jobs, often in different locations. The ‘load and go’ nature of many machines in this size class make them very popular with contractors on the move.”

What are key purchase considerations for excavators?

Baker says productivity, efficiency, and serviceability are key buying considerations for the size class.

“Owners and fleet managers should consider solid hydraulics with quick, smooth, and responsive controls for better production and operator comfort,” Baker says. “For example, JCB’s 220X features the latest generation Kawasaki hydraulic pump, and the diameters of the Gates hydraulic hoses are increased by a quarter inch, to provide better oil flow to the excavator end.

“Buyers should also look for fuel-saving features like the auto-idle and auto-stop functions on the JCB 220X, and the four dedicated working modes that allow it to be set for optimal productivity and efficiency for the task at hand,” Baker says.

In addition to considering fuel savings features and work modes, it’s a good idea to think about coupling and attachment options.

“The 40,000- to 60,000-pound-size excavator class is still within a group of excavators that may utilize a wide variety of attachments, including buckets, thumbs, and hydraulic breakers,” Kleingartner says. “If customers are considering a purchase in this size class, it’s worth considering a hydraulic quick coupler to make changing attachments easier. Excavator operators can even change non-hydraulic attachments, such as buckets, from inside the cab with the quick coupler. Ease of changing attachments will likely result in the excavator operator choosing the properly sized bucket for a specific excavation or trenching tasks, helping to minimize overdigging.”

The possibility of overdigging, and the seemingly omnipresent shortage of qualified operators, leads manufacturers to urge managers to look at machine control technology when buying.

“When purchasing an excavator today, it’s important to consider the advantages of machine 3D technology such as Intelligent Machine Control and how it can help job site efficiency and operator skill level,” says Andrew Earing, product manager for Komatsu excavators.

“This technology not only helps improve productivity by digging straight to grade, but it also allows novice operators to operate at a higher skill level with the use of auto grade assist,” Earing says. “With concerns of a growing labor shortage, this technology can greatly help contractors gain a leading edge in the market. This 3D technology has also proven to help lower job site costs and reduce project timelines.”

How does machine control help excavators?

The benefits of using machine control to dig on grade are myriad, Earing says.

“For example, in utility applications, Intelligent Machine Control on excavators prevents overdigging, which saves time and reduces the need for compaction. It also greatly reduces the amount of pipe bedding material used, which can be expensive,” he says.

“Typically, in the past, for mass excavation a dozer with 3D technology worked in conjunction with an excavator to maintain grade and shape the project’s design,” Earing continues. “Now with similar technology on the excavator, companies can free up that support dozer to use in a production situation to make them money, ultimately lowering the overall cost to move material and move it faster. Both examples also reduce machine operating time, which equates to less wear and tear on the equipment and prolonged service intervals.”

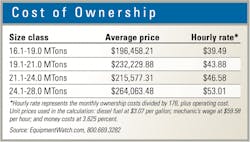

Another way to manage costs is looking at the big picture, according to Volvo’s Sung Sook Kim, product manager for excavators. “One of the biggest factors that help excavator customers feel more confident in their purchase is comparing the initial price to the total cost of ownership (TCO) or the costs over the life of the machine,” Kim says. “Focusing solely on a low initial purchase price may cost a lot more in the long run because it doesn’t account for things like residual value, fuel costs, warranty, durability, maintenance, and many other items that factor into TCO.”

Features that combat excess fuel consumption can also play a role.

“Once an excavator reaches a job, there are a number of things that can be done to help keep operating costs down,” Baker says. “For example, setting the auto idle and auto engine stop options will save fuel consumption and reduce operating costs. And following the manufacturer’s scheduled service program and keeping up with general maintenance will save the owner money and reduce the chance of downtime in the future. [Using a] telematics system can help an owner or operator stay on track with scheduled service and maintenance needs and help reduce the risk of having a major mechanical issue result in downtime and loss of revenue.”

Marcus Barnes, product manager for Liebherr excavators, focuses on idling and its effects.

“Managers can help keep operating cost down by making sure operators are not letting equipment idle unnecessarily when it is not being used,” Barnes says. “They can do this by taking advantage of the automatic shutdown function most excavators have. This function cuts the machine off after a predetermined amount of time, usually around five minutes. This function can help save fuel, plus help in preventing the clogging of your DPF if your excavator has a DPF for its emission technology.”

Managers should also pay attention to the basics such as operator behavior—operators should be specifically trained to use the cost-saving features available.

“There are several important actions that contractors can take to help keep operating costs down,” Stellbrink says. “Proper operating technique and job site set-up have a significant impact on lowering operating costs. Doing so helps increase fuel efficiency and can help lower repair and maintenance costs, as well. Minimizing idle time is also important in lowering fuel-related costs, as well as taking advantage of newer product features such as Smart Mode on the Cat Next Gen Excavators. Smart Mode takes the guesswork out of the equation and automatically adjusts power levels to the job demand.”

Similar to other machine categories, telematics systems can show owners where cost-saving opportunities may be missed.

“Fleet managers can help reduce excavator operating costs by properly training operators on the importance of turning off the machine when it’s not working,” Kleingartner says. “Excessive excavator idling wastes fuel and is not ideal for the Tier-4-compliant diesel engines and the aftertreatment systems installed in the machine to meet Tier 4 emission requirements. Telematics makes it possible for fleet managers to use data to coach operators on how to properly operate machines, including the potential savings for the company by reducing unnecessary fuel usage.”

Kim also points to work modes. “Ensuring operators are using the right work mode can also have a big impact on operating costs by helping operators balance power and controllability while burning as little fuel as possible. Operators tend to select the highest mode regardless of application, but higher rpm does not always equate to more productivity.

“Volvo excavators have nine settings within four work modes: Idle, Fine (F), General (G), and Heavy (H),” Kim says. “The G modes are excellent for digging and excavation while the two F mode settings are ideal for fine finish work such as grading. H is the heavy mode and provides maximum power while helping save fuel,” Kim says.

“We’ve found one of the best ways to educate operators and managers on work modes is through training programs like our Eco Operator Training classes. These classes take place at the customer’s facility and usually last two days,” Kim says. “Operators learn the best techniques on how to maneuver and run equipment to lower fuel and maintenance costs and improve all-around efficiency. In a follow-up session a few months after the class, the results can be checked. Customers can see their fuel consumption drop and less wear on machines, but their productivity remains the same or increases. Another way to spot work mode issues is with the monthly reports Volvo ActiveCare Direct customers receive. These reports highlight potential machine misuse, including using the wrong work modes. Owners can then use this data to train operators.”