EV tires slow to develop for construction equipment

In this article, you will learn:

- How tires wear on electric off-road equipment.

- How tire makers are responding to EV wear.

- How off-road tires differ from on-road.

Some optimistic experts estimate that by the end of this decade almost half of all new passenger cars and light trucks will be powered in one variety or another by electricity. Off-road, equipment manufacturers are moving prototype electrified machines into production reality.

Tire makers are responding to the electric vehicle (EV) market with purpose-built tires that complement the performance and idiosyncrasies particular to today’s on- and off-road construction machines. Tire engineers are balancing the performance features of instant acceleration with road wear, battery weight with range, and silent motors with tire noise.

Conexpo 2023 featured an impressive lineup of prototype electric construction equipment ranging from compact landscaping machines to full-size excavators. Tire makers are moving toward supporting new electric off-road equipment, some with a limited variety of EV-specific tires and some repurposing their current tire’s definitions as they transition towards purpose-built EV tires.

Kevin Rohlwing, chief technical officer at the Tire Industry Association (TIA), says that although the on-road EV tire segment is fairly robust, the market for tires specifically built for electric off-road equipment is growing at a slower pace. Rohlwing cites several reasons hampering off-road tire development.

Interested in more on EVs in construction?

Developing new off-road tires is expensive and takes time. Unlike tires for passenger cars and light trucks, which exhibit performance and production similarities that tire manufactures can use as a development foundation, off-road tires must be engineered to match the machine as well as the task. For example, a wheel loader tire requires a different configuration than a grader tire or a wheeled excavator tire.

Why doesn't off-road equipment have EV tires?

Tire manufacturers are telling Rohlwing that they need a longer and deeper data history to analyze how and why a machine’s configuration, tasks, and performance under a variety of conditions affects tire wear. In many ways, tire makers are starting from scratch.

These are early days for construction-tire makers to determine what the off-road EV market will demand. Purpose-built tires are engineered for specific machines and applications, whether powered by batteries or fossil fuels, but Rohlwing says the core issue for tire manufacturers is the limited number of electrified earthmovers operating in the field.

Equipment manufacturers offer a limited number of battery-powered prototypes, and product supply is limited.

End users are still evaluating electric off-road equipment’s potential total cost of ownership (TCO)—which a McKinsey report says can be 20% less compared to an internal combustion engine (ICE) machine—with the cost and availability of charging support infrastructure.

“There just isn’t enough EV construction equipment out there to buy and use right now,” Rohlwing says. “Until there is a pretty good population of electric equipment out there, tire makers don’t have enough accumulated data history to effectively analyze and predict what the new EV machines will require of their tires as they come to market.”

Some information can be pulled from the agriculture market’s smaller EVs, and Rohlwing says the mining sector has done a good job archiving and analyzing their electric haul vehicle and autonomous vehicle data. “The mining industry has reached the point where they can predict tire wear and usage, but that is in part because of the predictable and repetitive nature of how those vehicles perform their tasks,” he says. Heavy equipment owners want that same forecasting ability for their EV tires.

Understandably, tire manufacturers want some degree of confidence and guarantee of acceptance by the construction market before making significant investments in new EV tires.

“From the manufacturing standpoint, it takes a lot to develop and produce new construction tires,” Rohlwing says. “It is an expensive and time-consuming process that involves re-engineering each task-specific machine. Current off-road tires used on diesel machines are already proven to be effective handling tough and varying off-road conditions while carrying additional weight.”

For that reason, Rohlwing says, tire makers sometimes suggest their proven reliable standard diesel models are a compatible choice for new EVs. This approach should guide fleet managers deciding how they will balance their diesel and EV tire inventories.

For example, there is only a 154-pound difference between Volvo’s L20 1.05-yard battery-powered compact wheel loader and its similar L20H 0.9-yard diesel loader. Standard tires that fit the L20H wheel loader will provide adequate performance on the electric L20, yet rapid acceleration due to electric torque capabilities could cause additional sidewall stress. Rohlwing cautions fleet managers to ensure operators understand safe operating procedures.

Other tire manufacturers are adding marketing cues such as sidewall load indexes and electric compatibility codes to their current tire inventories. Goodyear says its Powerload tires are “electric drive ready” and work well with battery electric vehicles. Yokohama says its Galaxy Hulk tire’s super-strong sidewalls and casing match with heavier EV battery weight. Continental says its ContiEarth Digital tire sensor technology helps owners monitor to ensure tire inflation and temperatures are acceptable under the demands of an EV.

“Until off-road and heavy equipment tire makers see there is a large enough EV population to be concerned with and what—if any—changes need to be made to meet EV needs, they are taking a wait-and-see approach before committing large investments in the electric heavy equipment tire market,” Rohlwing says.

How do tires differ for on-road EVs?

The faster-developing EV tire market supports light and heavy truck segments. Battery technology significantly increases the truck’s operating weight compared to a similarly sized ICE vehicle. Although using standard tires on an EV is possible, doing so is proving to be an inefficient choice.

Read also: Keep tire techs safe

First, an EV’s weight and immediate acceleration affect almost everything asked of the tires. Tires are a compromise of properties, says Rohlwing, and EV tire makers are charged with balancing the EV’s friction and energy performance from the tires up.

For example, a Ford F150 gas-powered pickup truck weighs between 4,021 and 5,740 pounds, depending on the package. Its F150 Lightning XLT EV pickup carries a 1,500-pound battery, bringing the electric pickup’s weight between 6,015 and 6,893 pounds. At the higher end of the comparison, the Lightning is 1,153 pounds heavier than its gas-powered sibling. To put this in perspective, the Lightning battery’s extra poundage accounts for about a quarter of the EV pickup’s total curb weight.

The Lightning’s dynamic mass relies on its tire grip.

“If the tire has gripping traction enough to handle higher torque acceleration without wheel spin and has adequate braking performance to stop without cargo shifting, it may not have the stiffness needed to offer good rolling resistance,” Rohlwing says. “Good gripping traction translates into better curve handling, but high rolling capabilities can impact safety features such as traction control.” Additionally, EV tire configurations count on traction grip in wet/slick conditions when there can be less driver control over conditions.

Safe handling comes first, but with traction comes wear. EV owners are reporting a 20% to 40% wear increase on electric cars running standard tires, in part because EVs have more weight to control and drivers are relearning how to take advantage of accelerating wisely to avoid excessive tread wear.

The EV battery’s energy efficiency is also governed by its tire.

“If the tire’s design creates more traction to accommodate torque and weight, that can cause the vehicle to pull more power from the battery, shortening how far and how long the EV can drive,” says Rohlwing. Pirelli Tires estimates that up to 40% of an EV’s range depends on its tire engineering.

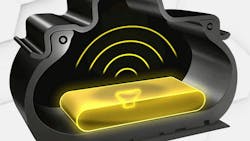

An attractive benefit of an electric vehicle is the lack of engine noise, but without the growl of the combustion engine, tire noise in EV cabs is more noticeable. To deaden cabin noise, Pirelli developed a noise-cancelling system to dampen vibrations created by air compression inside the tire cavity. The noise caused by the vibrations within the tire are transmitted inside the vehicle, so Pirelli places an open cell polyurethane foam sponge inside the tire void to absorb the resonant air waves. Pirelli says its noise-cancelling system reduces cavity noise by up to 3 dB(A), which reduces the in-cabin perceived noise by half.

Tire manufacturers are also using these early days of EV tire development to redefine and newly brand their inventories under green categories such as renewable materials, tire emission containment, and eco-friendly synthetic base materials. Increased amounts of tire particulate pollution has been suggested as an unanticipated side effect of EVs using both standard and purpose-built EV tires.

Tire management in large fleets

Ryder Systems is driving its commitment to electric vehicles with a holistic approach to EV maintenance and tire management. Ryder’s nationwide maintenance and repair training is a high priority and puts special emphasis on the rapidly expanding EV maintenance and repair service segment.

Recognizing that EV tire wear and maintenance involves multiple factors, Ryder has developed an internal training curriculum for drivers and technicians that provides foundational guidance on EV operations, tire service, and safety to the company’s 5,000-plus technicians. In addition, Ryder offers hands-on EV training for drivers and technicians at a customer’s location when the customer implements electric vehicles into their fleet. For example, Ryder trains customers how to load and balance cargo to safely bring the truck to a stop and accelerate with the least amount of friction to lessen tire wear. The company’s internal tracking system monitors EV repair histories to assess any trends that suggest higher maintenance or repair costs for EV tires.

Ryders’s new fleet of field maintenance trucks, themselves all-electric, are equipped to service EV fleets with state-of-the-art equipment and expertly trained technicians.