Equipment Investment to Grow 4.6% in 2022: Leasing Group

Low financial stress, an expanding housing sector, and increased federal spending on infrastructure are expected to propel equipment and software investment growth of 4.6 percent for 2022, according to a report from the Equipment Leasing & Finance Foundation.

Annual U.S. GDP growth for 2022 is forecast at 3.5 percent, according to the 2022 Equipment Leasing & Finance U.S. Economic Outlook.

The chair of the Foundation, Nancy Pistorio, president of Madison Capital, said in a prepared statement:

“This report provides a thorough examination of the wide range of conditions that will impact the U.S. economy and business investment next year. Despite uncertainty around new Covid variants, ongoing supply chain issues, and inflation, positive factors should outweigh the headwinds. Robust consumer demand, a strong labor market, and increased equipment and software investment—the lifeblood of the equipment finance industry–look promising. We can look forward to ‘getting back to business’ in 2022, provided supply chain issues ease significantly and the pandemic is effectively curbed.”

2022 leasing trends

- Although equipment and software investment is forecast to grow 4.6 percent (annualized) in 2022, supply chain constraints, high inflation, and tighter monetary policy are key headwinds to growth.

- The U.S. economy slowed in fall 2021 as the pandemic worsened and supply chain constraints snarled global trade and drove inflation to multi-decade highs. However, growth in Q4 has likely rebounded, and the economy appears poised for an above-average year in 2022.

- The U.S. manufacturing sector should continue to expand at a healthy rate in 2022, although supply chain issues, hiring difficulties, and high inflation could dampen industrial sector output, particularly during the first half of the year.

- On Main Street, the outlook has grown increasingly cloudy. Small firms are more susceptible to surging input costs and labor scarcity than large firms, which may weigh on small businesses as the new year gets underway. On the positive side, consumer demand remains robust, and the winter months should be smoother this year than last.

- The Federal Reserve officials recently shifted their positions in response to new data and now acknowledge that inflationary pressures are likely here to stay. The Fed is now expected to end quantitative easing earlier than planned and raise interest rates at least once by mid-2022. Multiple rate hikes are possible in 2022, particularly if job growth stays on track.

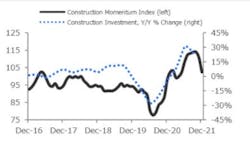

Construction investment to slow in 2022

A separate index, the Foundation-Keybridge U.S. Equipment and Software Investment Momentum Monitor, indicates a slowdown in investment in construction equipment. Although investment rose 20 percent in the third quarter of 2021 and is 24 percent above the 2020 level, the Construction Momentum Index dropped from 110.7 in November to 102.5 in December.

Shipments of construction equipment fell 4.6 percent in October, according to the Monitor, leading the Foundation to suggest “decelerating construction machinery investment growth over the coming two quarters, though growth will likely remain in positive territory.”

Source: Equipment Leasing & Finance Foundation