Electrical Steel Costs Rise: Report

Engineering and construction costs rose for the fourteenth consecutive month in December, according to IHS Markit and the Procurement Executive Group (PEG).

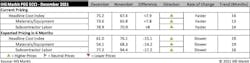

The December 2021 headline IHS Markit PEG Engineering and Construction Cost Index rose from 67.4 in October to 75.2 in December. The sub-index for materials and equipment costs drove the increase, rising 7.8 index points to 73.6. The subcontractor labor index rose another 8.0 index points to 78.9 in December.

Shipping rates rose for the sixteenth consecutive month in December; the sub-index for ocean freight costs from both Europe and Asia to the United States rose once again, to 85.0 from 77.8 last month. The sub-index for copper-based wire and cable prices rose to 62.5 from 55.0 in November. The electrical equipment sub-index increased from a sub-index reading of 59.1 in November to 86.4 in December.

“Amidst the limited availability for certain input materials, their high prices and logistic constraints, electrical machinery manufacturers are now struggling to negotiate supply contracts with steel mills for 2022, particularly for electrical steel,” said John Anton, director, pricing and purchasing, IHS Markit, in a prepared statement. “Producers have been notified that they will be on allocation, essentially rationing, for electrical steel for all of next year, with most expecting to get only 80 to 90 percent of purchase requirements. The impact of the electrical steel shortage could potentially be as damaging to the global economy in 2022 and 2023 as the semiconductor shortage is this year. If electrical machinery companies do not get the electrical steel they need, buyers will have to deal with much longer lead times and higher prices.”

The sub-index for current subcontractor labor costs came in at 78.9 in December, an increase from November’s index figure of 70.9. According to survey responses, labor costs continued to rise in all regions of the United States and Canada.

The six-month headline expectations for future construction costs index totaled 61.0 in December, as respondents still expect prices to continue increasing through the middle of 2022, though perhaps at a less intense pace. The six-month expectations index for materials and equipment came in at 54.1, 14.2 index points lower than in November. The six-month expectations index for sub-contractor labor recorded a reading of 77.2, with respondents expecting labor costs to increase robustly in all regions of the United States and Canada; this sub-index total is 17.2 index points lower than last month’s reading of 94.4.

Survey respondents reported less shortages for materials this month, but still cited tight availability for input metals and tubing for equipment. Proposal activity remains high, as the index reached 75.0 in December. This reading is lower than November’s 81.8 total.

Source: IHS Markit