Construction Starts Grow 19% in August

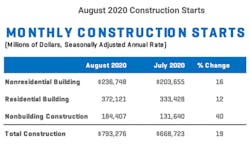

Total construction starts rose 19 percent in August to a seasonally adjusted annual rate of $793.3 billion, according to Dodge Data and Analytics. Gains were seen in all three major building sectors compared to July.

Nonresidential building starts rose 16 percent in August, and residential building climbed 12 percent. Nonbuilding construction jumped 40 percent over July starts.

Year-to-date starts were 14 percent lower than in the same period in 2019. Nonresidential starts were 24 percent lower and nonbuilding starts were down 20. Residential starts were down less than 1 percent.

For the 12 months ending August 2020, total construction starts declined 6 percent from the 12 months ending August 2019. Nonresidential building starts fell 13 percent and nonbuilding starts were 9 percent lower. Residential building starts rose 3 percent.

In August, the Dodge Index rose 19 percent to 168 (2000=100) from the 141 reading in June. The Dodge Index was down 8 percent compared to a year earlier and 6 percent lower than its pre-pandemic level in February.

“Construction starts continue to make up ground following the nadir in activity in April,” said Richard Branch, chief economist, in a prepared statement. “Residential and commercial construction are driving the gains, while the public side of building construction is proving to be a drag on growth.

“The regional pattern has also evened out with gains in starts seen in every region but the Midwest in August—somewhat muting the concern over the potential impact of rising Covid cases in the South and West. The nascent recovery in starts, however, will face challenges as summer turns to fall. The expiration of enhanced unemployment insurance benefits and small business loans that were provided in the CARES Act, the budget crises facing state and local governments, and the impending expiration of the FAST Act on September 30 will all have a dampening effect on starts.”

Nonbuilding construction posted a 40 percent gain in August to a seasonally adjusted annual rate of $184.4 billion nearly reversing the sizable decline in the previous month as two large projects pushed activity higher. Starts in the utility/gas plant more than doubled, environmental public works posted an 89-percent gain, and highway and bridge starts moved up 13 percent. Miscellaneous nonbuilding starts lost 5 percent.

The largest nonbuilding project to break ground in August was the $1.3 billion Wastewater Control Plant in San Francisco. Also starting during the month were the $888 million Dania Beach Clean Energy Center in Dania Beach, Florida, and the $310 million new Aztec Stadium at San Diego State University in San Diego, California.

Through the first eight months of the year, total nonbuilding starts were down 20 percent compared to the same period in 2019. Starts in the highway and bridge category were up 1 percent, the environmental public works category dropped 15 percent, the miscellaneous nonbuilding sector fell 34 percent, and the electric power/gas plant category plunged 45 percent. On a 12-month rolling basis, total nonbuilding starts were down 9 percent in the most recent year compared to the 12 months ending August 2019. Starts in the street and bridge category dipped 2 percent, and starts in the electric power/gas plant category were down 12 percent. Environmental public works starts pulled back 8 percent, and miscellaneous public works starts dropped 21 percent.

Nonresidential building starts in August were also aided by large projects in the office and manufacturing sectors leading to an increase of 16 percent to $236.7 million. Removing these projects, however, would not have prevented an increase in nonresidential building starts. Commercial starts rose 36 percent, and manufacturing starts soared 201 percent. Institutional starts, however, fell 7 percent despite small gains in education and healthcare.

The largest nonresidential building project started in August was the $1.0 billion Facebook Data Center (Project Woolhawk) in Gallatin, Tennessee. Also starting during the month was the $740 million Texas Instruments Fabrication Plant in Richardson, Texas, and a $700 million mixed-use office and hotel project in Boston.

On a year-to-date basis, total nonresidential building starts were 24 percent lower than in the first eight months of 2019. Institutional building starts dropped 16 percent, commercial starts slid 27 percent, and manufacturing starts were 47 percent lower than a year earlier. Over the 12 months ending August 2020, total nonresidential building starts were down 13 percent from the 12 months ending in August 2019. Commercial starts were 16 percent lower, institutional starts were down 13 percent, and manufacturing starts slipped 1 percent.

Residential building starts moved 12 percent higher over the month in August to a seasonally adjusted annual rate of $372.1 billion. Multifamily building starts increased 62 percent, and single family starts fell 3 percent.

The largest multifamily structure to break ground in August was the $549 million Mana’olana Place Mixed Use in Honolulu. Also starting in August were the $500 million Pacific Park Mixed Use Development in Brooklyn, New York, and a $250 million condominium building at the Union Theological Seminary Space in New York City.

Through the first eight months of 2020, residential construction starts were down less than one percent versus a year earlier. Single family starts grew 4 percent, and multifamily starts slid 11 percent. For the 12 months ending in August 2020, total residential starts gained 3 percent with single family starts up 6 percent but multifamily starts down 4 percent.

Source: Dodge Data & Analytics