Caution in Commercial Construction Markets

Most economists say the United States is slowly emerging from the Great Recession, a view that was confirmed to some extent by an exclusive survey of BD+C subscribers whose views we sought on the commercial construction industry’s outlook on business prospects for 2013.

More Annual Report & Forecast

Construction outlook

Construction equipment fleets

Transportation

Water infrastructure

Home building

Remodeling

The majority (52.2 percent) of respondents—architects, engineers, contractors, buildings owners, and others in the commercial, industrial, and institutional field—said their firms were in at least “good” financial health, compared to 49.7 percent last year—let’s call that flat.

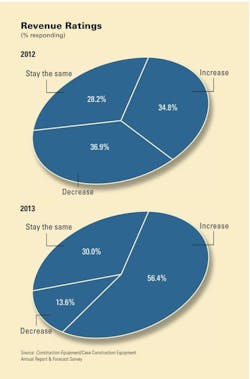

But a markedly strong showing (86.4 percent) said their firms would be up in revenues or would at least hold steady in 2013, vs. 80.2 percent last year—an increase that may be not only statistically significant but also most certainly welcome for an industry that could use cheering.

As was the case last year, more than three-fourths of respondents (75.7 percent) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in the next year—roughly comparable to the 78.4 percent who responded that way last year.

Economy Remains Top Concern

2013 2012 General economic conditions 75.7% 78.4% Competition from other firms 44.9% 40.1% Managing cash flow 37.6% 33.7% Insufficient capital funding for projects 29.7% 34.5% Softness in fees/bids 29.7% 28.0% Government regulations/restrictions 26.6% 23.0% Avoiding layoffs 17.4% 14.3% Price increases (e.g., materials, services) 15.7% 18.1% Keeping staff motivated 14.3% 14.3% Avoiding benefit reductions 11.9% 12.5%

Other factors were largely within the same range as last year. Competition from other firms (44.9 percent) went up slightly (from 40.1 percent last year), while having insufficient capital funding for projects declined a bit, to 29.7 percent, from 34.5 percent the year before. For both years, nearly three in four (73.4 percent this year, 74.8 percent last year) described the current business situation for their firms as “very” to “intensely” competitive—continuing evidence that AEC firms are still struggling for every dollar.

Healthcare, data centers look promising

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” (Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

• Healthcare continued to be the most highly rated sector, with 58.8 percent of respondents (vs. 54.6 percent last year) giving it a good to excellent rating.

• Data centers and mission-critical facilities were also up, with 52.1 percent in the good/excellent category, compared to 45.2 percent last year.

• Senior and assisted-living facilities made a big jump, from last year’s 37.8 percent in the good/excellent category to a majority this year, at 50.5 percent.

• Government and military work was rated good to excellent by 36.1 percent, down slightly from 41.1 percent.

• University/college facilities were rated good to excellent by 37.8 percent vs. 32.3 percent in 2011.

• Retail commercial construction got a slight vote of confidence, with nearly one-fifth of respondents (19.9 percent) stating they thought their firms would have a good to excellent year, nearly double last year’s 11.1 percent.

• Industrial and warehouse facilities might be staging a comeback: One-fourth (25.5 percent) of respondents whose firms engaged in that sector said they expect a good to excellent year in 2013; on the other hand, 35.8 percent said it would be weak or very weak.

Reconstruction—including historic preservation and renovations—accounted for at least 25 percent of work for more than a third (34.6 percent) of respondents’ firms, roughly the same as last year (36.3 percent). Office interiors and fitouts were down, with only 35.7 percent of this year’s respondents saying this sector would be good to excellent, compared to 42.7 percent last year.

The prospects for office buildings looked bleak, however, with only 15.6 percent saying that market would be good to excellent. The majority (55.2 percent) said predicted office buildings would be “weak” or “very weak,” but that’s an improvement from 2011’s 67.3 percent.

The K-12 sector looked flat, with good/excellent responses from 22.9 percent of respondents this year, compared to 23.2 percent last year.