Gap in Water Infrastructure Spending to Grow in 2013

As we prepare to turn the page on a fourth consecutive year burdened by a slowly recovering economy and grueling budget cuts, it is hard to chart what possible challenges and opportunities await the water industry in 2013.

More Annual Report & Forecast

Construction outlook

Construction equipment fleets

Transportation

Home building

Remodeling

Nonresidential

But even the murky water conditions of the past year cannot prevent us from seeing that the state of our nation’s water infrastructure continues to decline.

At the beginning of 2012, the American Water Work Association (AWWA) released a report indicating that $1 trillion will be needed for repairs and expansion of U.S. water infrastructure over the next 25 years. The report, titled “Buried No Longer: Confronting America’s Water Infrastructure Challenge,” takes various factors into consideration, including timing of water main installation and life expectancy, materials used, replacement costs, and shifting demographics.

According to the report, infrastructure needs across the nation are evenly divided between replacement and expansion.

Rising water costs

The growing urgency to meet new regulatory requirements and update century-old buried infrastructure, coupled with the growing funding gap, have pressured municipalities into spending conservatively. As the pool of financial assistance to fix, upgrade or build new water and wastewater systems continues to shrink, municipalities are beginning to revise the rates of water and sanitation services.

A number of municipalities raised their rates in 2012. According to a recent report in an ongoing national survey conducted by Circle of Blue, water prices in 30 major U.S. cities jumped 18 percent over the past two years and 7 percent in 2012 alone. Chicago residents, for example, faced the steepest rate increase in 2012: 24.9 percent across all consumption levels. The city is raising funds to replace 900 miles of its water distribution network as part of a $1.4 billion investment in its water and sewer system.

Although water and sewer rates are rising fast, the actual cost in dollars is not so significant. On average, U.S. consumers continue to pay about $4 to $5 per 1,000 gallons—less than a penny per gallon.

Furthermore, rate increases do not necessarily translate into higher bills. Other factors, such as water conservation due to high rates or drought restrictions, can curb water use and affect utilities’ balance sheets.

Despite these challenges, the water industry continues to weather the storm, according to Water & Wastes Digest’s (WWD) 2012 State of the Industry survey.

Approximately 78 percent of respondents expect a good, very good or excellent business year in 2013, in comparison to 16 percent who predict 2013 will be mediocre and 6 percent that it will be poor.

Additionally, about 62 percent of respondents rate the overall health of their organization as good or very good, in comparison to 28 percent who rate it as average and 10 percent who rate it as weak or very weak.

This positive feedback is echoed in respondents’ projections for municipal water and wastewater budgets. Although 50 percent of survey respondents do not expect budget changes in 2013, 36 percent are projecting a budget increase and only 14 percent are expecting a decrease.

Most respondents expect that total municipal operating costs will continue to go up. Fifty-one percent of respondents reported that their 2012 operating costs were up from the previous year by approximately 10 percent.

Where water investment will be spent

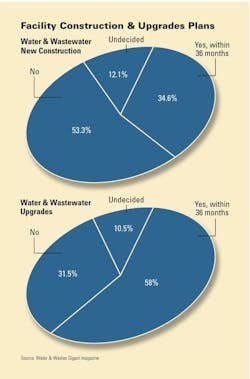

Reflecting municipal concerns over outdated and crumbling water infrastructure, the largest percentage of respondents’ budgets will be invested in sewers/collection systems and pipe and distribution. This will account for 28 percent of budget expenditure, followed by monitoring (10 percent) and storm water/erosion control (7 percent) over the next 24 months.

By surveying the industry landscape, it appears that the water industry will remain on a steady and stable course in 2013. Diminishing funding and failing infrastructure will continue to test the resilience of municipalities across the nation. Some will turn to better conservation and efficiency practices, while others will focus on recycling and reuse, and maybe even warm up to public-private partnerships, but one thing is inevitable: Water and sewer prices will continue to go up.