Caterpillar 2021 Sales Up 22%

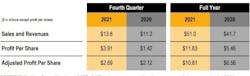

Caterpillar reported 2021 sales and revenues of $51.0 billion, up 22 percent from 2020 sales of $41.7 billion.

Caterpillar credited the increase to higher end-user demand for equipment and services and the impact from changes in dealer inventories. Dealers decreased their inventories $2.9 billion in 2020, but inventories remained about flat in 2021. Operating profit margin for the year was 13.5 percent, up from 10.9 percent for 2020. Full-year profit was $6.5 billion in 2021, up from $3.0 billion in 2020.

“I’m proud of our global team’s continued resilience in what proved to be a challenging and dynamic operating environment,” said Jim Umpleby, chairman/CEO, in a prepared statement. “We delivered adjusted operating profit margins and ME&T free cash flows consistent with our long-term targets established during our 2019 Investor Day. Amid ongoing supply chain constraints, our team continues to execute our strategy for long-term profitable growth while striving to meet customer demand.”

For the full year of 2021, enterprise operating cash flow was $7.2 billion. During the year, the company repurchased $2.7 billion of Caterpillar common stock and paid dividends of $2.3 billion. Liquidity remained strong with an enterprise cash balance of $9.3 billion at the end of 2021.

Sales for the fourth quarter were $13.8 billion, up 23 percent from the $11.2 billion reported in Q4 2020.

The company’s Construction Industries segment reported fourth quarter sales of $5.7 billion, up 27 percent from Q4 2020 with sales of $4.5 billion. Profit for the segment was $788 million, up 25 percent from the $158 million reported in Q4 2020.

In North America, Construction Industries sales increased due to higher sales volume and favorable price realization. Higher sales volume was driven by the impact from changes in dealer inventories as dealers decreased inventories more during the fourth quarter of 2020 than during the fourth quarter of 2021.

In reporting the segment’s results, the company cited higher manufacturing costs—primarily higher freight, material, and labor costs—higher sales volumes, and favorable price realization.

Watch a video presentation below.

Source: Caterpillar