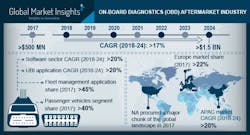

On-board Diagnostics Aftermarket Will Beat $1.5 Billion by 2024

According to a research report by Global Market Insights, a market research and strategy consulting firm, the On-board Diagnostics (OBD) aftermarket is set to surpass $1.5 billion by 2024.

The increasing emphasis on developing connected vehicle solutions and the growing adoption of IoT technology in the automobile sector are driving the growth of the OBD aftermarket; however, the fleet-management segment still dominates.

The fleet-management segment of the OBD aftermarket in 2017 had a market share of over 45 percent and is expected to maintain the dominance throughout the forecast period. The use of OBD in fleet-management software offers effective management of fleet operations and provides access to the real-time data regarding the vehicle’s location. It also monitors the driving patterns and helps in early diagnosis and mitigation of any malfunction in the vehicle components.

With the significant growth in the electric vehicle technology, the demand for OBD telematics systems for managing and controlling the vehicle components is expected to increase significantly. The fleet-management software in electric vehicles helps in increasing the fleet efficiency and reducing the operational costs.

North America held a major share of the OBD aftermarket in 2017. The proliferation of OBD dongle-based solutions is estimated to grow at a faster pace in the region between 2018 and 2024. The automobile sector in this region continues to record a steady growth due to the high penetration of advanced technologies in the transportation systems and the increased momentum of autonomous vehicles.

The presence of some major global automobile players and the increasing investments by foreign auto suppliers in their respective manufacturing facilities are driving the region’s automobile market growth. For instance, in January 2018, Ford planned to invest $11 billion in electric vehicles to have 40 hybrid and fully electric vehicles in its model lineup by 2020. Similarly, in April 2016, Nissan made strategic investments in its U.S. operations to meet the growing need of the U.S. consumers. The company has invested around $10.8 billion in its U.S. operations since 1981.

Companies operating in the On-board Diagnostics aftermarket focus on offering new products along with strategic acquisitions to leverage their mutual technological capabilities and create innovative offerings.

For instance, in April 2018, Quartix launched a new installation option: plug and track. The new tracking device can be easily installed into the OBD port and it eases the installation and flexibility when moving the tracking function from one vehicle to another without disconnecting the hardwiring. In April 2017, SiriusXM acquired Automatic, the maker of the Automatic Pro and Automatic Lite connected car OBD II ports accessories for $10 million. The acquisition enabled the company to expand and improve its connected vehicles services.

Some of the key players operating in the OBD aftermarket are Continental, Automatic Labs (SiriusXM), Magneti Marelli, Tom Tom, Geotab, Danlaw, CalAmp, Verizon, Mojio, Intel, Metromile, ERM Telematics, Azuga, Xirgo Technologies, AVL Ditest, Vector Informatik, Bosch Diagnostics, and Autel.

Source: Global Market Insights