Supply Chain Constricts Outlook at Mid Year

What a ride this decade has been. From the high of early 2020, through a pandemic, past the euphoria of an infrastructure bill, to current frustrations with supply and inflation, equipment managers have had no easy task planning for the future. In our 2022 Annual Report & Forecast published in January, fleet managers expressed optimism about 2022 and were planning fleet moves accordingly.

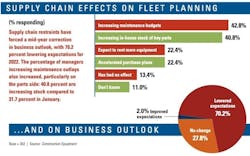

They did, however, acknowledge the threat of supply chain constraints to their fleet plans. Those have not eased, but inflation has added further pressure on budgets as fleets prepare for projects that infrastructure could bring into their pipelines. Midway through 2022, seven of 10 fleet managers say they are lowering business expectations as a result of supply issues, and four of 10 are increasing maintenance spending.

The biggest indicator of the struggle with supply is in fleet expansions. In January, one in three fleets (32.7 percent) expected to increase fleet size for 2022. Half-way through the year, that has declined to 26.9 percent. More worrisome is the forecast for decreases in fleet size: from 5 percent in January to 14.1 percent that expect fleet size to be smaller this year than in 2021.

Overall fleet health has improved, however. In January, 32.7 percent of respondents said that their fleet was in “excellent” or “very good” condition. Mid-year, that percentage has increased to 44.6 percent.

Business expectations for 2022 have also fallen, with 70 percent of respondents saying that they have lowered forecasts due to the supply shortage. In January, 38 percent of respondents expected the year to be “excellent” or “very good.” Mid-year, that percentage has dropped to 30 percent. On the other end of the forecast, 25.5 percent expect business to be “fair” or “poor,” up slightly compared to the 21.7 percent responding in January.

Construction Equipment sent email invitations to select members of our audience who buy, specify, or influence purchases of equipment. We asked about business and equipment-fleet trends. Results and analysis are provided as a service to the industry through the partnership of Construction Equipment and Case Construction Equipment.