Years of Decline Turned Around for Vocational Firms

Nonconstruction firms have turned the corner, it seems, as each of the three vocations—materials producers; mining and energy; and utility—expect solid years this year. Even so, some caution is seen within individual forecasts. Results for each of these nonconstruction vocations is reported individually.

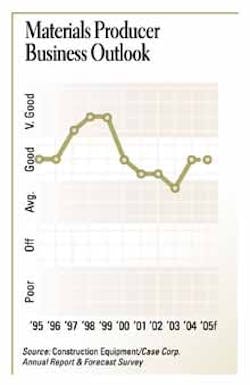

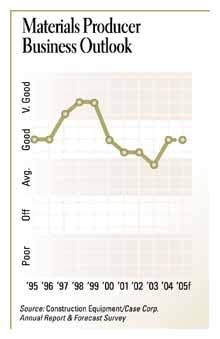

Last year was slightly better than forecast for materials producers, and they expect a similar year this year: "good." It's indeed good news after the slight dip experienced in 2003.

Regionally, materials producers shone in the South Atlantic and Northern Plains ("very good"), but suffered a bit in the Great Lakes, Mid-South and Pacific ("average"). Expectations are optimistic for all regions but the Mid-South.

Contract volume numbers also met the forecast made last year. Volume in 2004 increased for 43 percent of materials producers and declined for 20 percent, leaving a net of 23 percent. Several regions reported increases among more than half of the materials producers responding, with the largest net recorded by the Mountain (43 percent) and Mid-Atlantic (42 percent) regions. For 2005, optimism abounds as 43 percent expect increased contract volume and only 10 percent expect declines for a net of 33 percent.

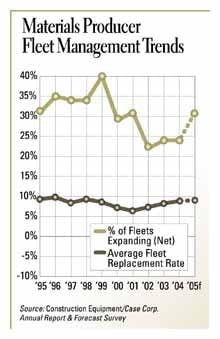

Fleet growth has rebounded for materials producers to levels not seen since 2001. Some 36 percent say the number of machines in their fleet increased in 2004, and only 7 percent recorded decreases for a net of 29 percent. This year, projections result in a net of 33 percent. Replacement rates also rose, with 2004's rate of 9.0 percent being the highest since 1998. This year, materials producers expect to replace fleet at a 9.2-percent pace.

This bodes well for fleet condition. About two in five materials producers say their fleet is in "excellent" or "very good" shape.

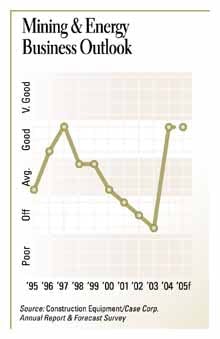

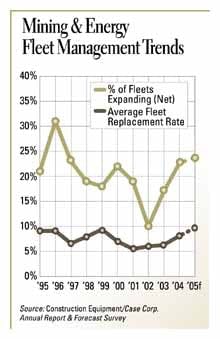

Business reports for 2004 were well above forecasts for mining and energy fleets. Although they expected an "average" year, these fleets reported 2004 to be "good." In fact, 2004's numbers were the best since 1997. Expectations for 2005 are the same, with mining and energy fleets expecting a similar year.

Companies in the Southern Plains, New England, and Great Lakes regions reported even more robust numbers, calling 2004 a "very good" year. South Atlantic was the only region reporting an "average" business year in 2004. For 2005, "very good" is the forecast for Great Lakes, South Atlantic and Mountain regions.

Work volume, measured in total machine hours, increased for 44 percent of firms and decreased for 15 percent, leaving a net of 29 percent, just below the projections. Once again, these numbers returned to a level not seen for eight years. For 2005, volume is expected to increase for 35 percent and decrease for 14 percent for a net of 21 percent. In the Great Lakes, 57 percent expect increases minus only 4 percent decreases for a net of 53 percent.

Fleets grew for 32 percent of mining and energy firms, and they decreased for 9 percent for a net of 23 percent. This is an upturn from the past few years, and the same level of expansion is expected for 2005. Some 30 percent will grow their fleets, and only 6 percent will shrink them, leaving a net of 24 percent.

This year will also see a return to aggressive fleet replacement. Although 2004's replacement rate of 7.5 percent indicates a rebound from four consecutive years of decline, it appears to be surpassed by the amount of replacement coming in 2005. The rate is forecast to be 9.6 percent this year, well above recent levels.

The combination of expansion and replacement has resulted in more fleets in "excellent" or "very good" condition. Among mining and energy fleets, 44 percent said things were well with their fleets. On the other hand, 13 percent still report fleet condition as "fair" or "poor." Expect fleet condition to improve this year, if companies follow through on their replacement plans.

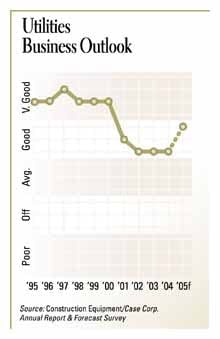

Utility companies reported a solid "good" year for 2004, consistent with their forecast made last year. Although utilities have maintained a consistent level of business since 2000, they have not bounced back to the "very good" levels reported in the 1990s. Yet, they should return there if 2005 expectations pan out.

The regional star for 2004 was the Southern Plains, which did report a "very good" year. Every other region reported solid "good" years. For 2005, Great Lakes and Mid-South companies will join the Southern Plains with "very good" years.

Work volume, on the other hand, bounced back strongly in 2004 and expectations are even better for this year. About four in 10 utility fleets said volume, measured in total machine hours, increased in 2004. With 9 percent reporting volume decreases, the net for last year was 30 percent, almost double the net in 2003. This year, 42 percent of fleets are projecting increased volume and only 6 percent say it will decrease, giving a net for 2005 of 36 percent. If this projection becomes a reality this year, it will be the best net reported since 2001.

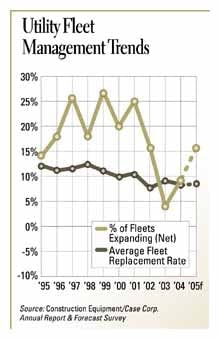

Fleet expansions have not quite caught up with the optimism exhibited elsewhere. Utility companies reported a net of only 9 percent (21 percent increased fleet size; 12 percent decreased). Projections for this year are also below historical levels. For 2005, 22 percent of fleets expect to grow their fleet size versus 6 percent forecasting it to shrink. This gives utilities a net of 16 percent.

Machine replacement is also sluggish. In fact, the replacement rate dropped slightly from 2003 and will not increase much in 2005. Last year, about 8.4 percent of utility fleets were replaced, compared to the 9.1 percent replacement rate of 2003. This year, utilities expect to replace 8.5 percent of their fleets.

Fleet-replacement rates, however, may just stay at these slightly lower historical levels, as fleet condition remains positive. "Excellent" or "very good" describes 57 percent of the utility fleets responding.