Compact and smaller wheel loaders under 200 horsepower are riding the current good economy to higher numbers and on some job sites are replacing other equipment categories, particularly skid steer loaders. Understanding current trends will help you choose the right wheel loader for your project.

“The demand for wheel loaders at 200 horsepower and under is up nearly 10 percent in 2019 compared to 2018,” says Doosan marketing manager Aaron Kleingartner.

“The wheel loader market has year-on-year growth, especially in the under 100-horsepower sector where we are seeing global market growth,” says Caterpillar product specialist Andy Massey. “Customers are starting to realize the all-round abilities of compact wheel loaders, especially when configured with hydromechanical tools. Above the 100-horsepower DEF benchmark, the market is very stable with some customers looking for more designed-for-segment machines like waste handlers. The performance expectations of these larger machines have increased in recent years with all machines increasing in size and performance.”

Wheel loader performance, versatility

With added size, performance, and versatility, compact loaders are taking on tasks once reserved for other machine categories.

“Contractors have also increasingly considered these machines to tackle work traditionally done by backhoes, skid steer loaders, and CTLs, which has increased their demand,” says Chris Connolly, product manager for medium wheel loaders at Volvo CE. “As more and more contractors discover the advantages medium and compact wheel loaders provide, their popularity rises.”

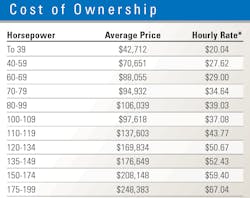

*Hourly rate represents the monthly ownership costs divided by 176, plus operating cost.

Unit prices used in the calculation: diesel fuel at $3.27 per gallon; mechanic’s wage at $58.84 per hour; and money costs at 3.5 percent.

Source: EquipmentWatch.com 800.669.3282

John Deere’s Drew Miller, product marketing manager for utility wheel loaders, says, “We are also seeing growth in compact loaders under 75 horsepower, due to customers transitioning from other machine types.”

Jay Quatro, field application and training specialist for Wacker Neuson, zeros in on the skid steer loader as the prominent victim.

Wheel loader or skid steer loader?

“Some of the growth in the compact wheel loader market should be attributed to sales of small wheel loaders as an alternative to a skid steer loader,” Quatro says. “Another factor that is working in favor of small wheel loaders is the growing realization by business owners in the importance of ROI when making capital investments in machinery. A small wheel loader has productivity and cost-saving advantages with positive effects on the bottom line, such as improved fuel efficiency, increased travel speed, and minimal ground disturbance. They also offer a bevy of ‘soft cost’ benefits such as improved comfort and visibility, serviceability, ease of ingress and egress, and high residual values versus skid steers.

“We see a trend to consider a small wheel loader as a cultural shift in the way we view compact equipment as a way to improve the business’s bottom line rather than as a necessary liability on the balance sheet because of the type of work we do as an industry,” Quatro says.

Equipment market guru Chuck Yengst, president of Yengst & Associates, breaks down current wheel loader sales by size class in this way: 0 to 80 horsepower, 18 percent; 81-150 horsepower, 35 percent; 151 to 200 horsepower, 27 percent. “The balance of wheel loader sales are above 200 horsepower, but most of the sales for 80 to 150 horsepower fall in a spot between 120 and 150 horsepower. Out of roughly 23,700 total wheel loaders sold in North America in 2018, about 19,000 units were in the 0- to 200-horsepower range,” Yengst says.

Renting a wheel loader makes sense

The robust rental market is also playing a role in market growth, according to Hitachi (HCMA) marketing manager Sam Shelton.

“We see our dealers growing their rental inventories. Higher utilization rates make the rental market the wave of the future. With the current volatility of markets, many managers are looking at rentals and RPO (Rental Purchase Orders) rather than outright purchases,” she says. “When bidding on a job, managers do their due diligence and factor in every cost consideration in their budget. Accordingly, many managers will rent a machine for six to eight months and then may purchase it outright if it’s still required for that job, or others in their pipeline.”

Managers have many small wheel loader OEMs to choose from for a purchase or preferred rental brand.

Wheel loader brand options

“There are close to 20 players, most of them importing their machines from Europe, Japan, and China,” Yengst says. “Cat is the leader, followed closely by Kubota and Deere. Then there are a large number of suppliers with 1- to 7-percent shares. Over 80 horsepower, Cat is the leader, again with Deere, Komatsu, Volvo, and Case the primary suppliers. The top five suppliers of 80 horsepower and over wheel loaders account for roughly 85 percent of that segment. Another five to seven players share the remaining 15 percent of machine sales. Others include Hitachi (HCMA, formerly Kawasaki), Doosan, Hyundai, and Liebherr.”

When purchasing a small loader, Case Construction Equipment wheel loader product marketing manager Andrew Dargatz cites productivity and comfort as two key considerations.

“It comes down to productivity, and the first step is selecting the right-sized machine for the job,” Dargatz says. “The equation to calculate the ideal loader size is simple: It comes down to understanding what is being loaded and what that material is being loaded into. Business owners and fleet managers need to understand factors such as material weights, truck height or hopper height, and target bucket size. These factors will help determine the size of the loader needed.

“Operator comfort also can significantly impact productivity,” Dargatz says. “Rear-view cameras and LED lights help to improve visibility. Features like climate control, air suspension seats, and ride control can help combat operator fatigue. Also, selecting the various application-specific options such as axles and transmission type will more directly impact cycle times and maximize production.”

Be sure to take stock of where the loader will be working, as well, Deere’s Miller says. “Managers should consider if they have any lift height requirements, and if they need a high-lift linkage, in addition to what type of material they are moving, and the quantity. They should also consider the space they are working within,” he says. “There is a very broad range of loaders that offer many machine sizes and capabilities to maneuver work sites, which could also help identify the right loader for the customer.”

The sizing of buckets and attachments is also important, says Doosan’s Kleingartner.

“A fleet manager should consider the size of bucket to best match the item being lifted,” Kleingartner says. “Regarding wheel loader attachments, it’s critical for fleet managers to properly match the bucket to the right size of wheel loader. If done improperly, the material may weigh too much for the machine and cause premature wear, leading to machine downtime. Managers should also consider how often the operator will change attachments. Does a wheel loader quick coupler make sense for the application if the operator regularly changes buckets or switches from a bucket to a pallet fork?”

Hitachi’s Shelton stresses that managers should always keep fuel economy, long-term savings, and resale value in mind when purchasing small wheel loaders.

“In the 100- to 200-horsepower range, the major competitive design difference is only hydrostatic drive versus mechanical drive,” Shelton says. “There are four suppliers with hydrostatic drives as high as the 150 to 175 horsepower class. Others have mechanical drive powertrains.

“Many other features and specifications are shared by most,” Shelton says. “So, from a technical standpoint, that’s the biggest thing to consider. In general, since this is the biggest class of machines, relative resale values and versatility are very good. Quick couplers make the machines versatile, and many manufacturers, including Hitachi, now have ISO-style couplers making the attachments interchangeable between brands.”

Shelton says a wide range of considerations greet buyers specific to the 40- to 100-horsepower class. Many have to do with comparing small loaders with other compact equipment.

“First is the choice between a skid steer, a CTL, and a compact loader,” Shelton says. “However, even between compact loaders there is a wide range of technical differences to consider. All have hydrostatic drive, so that is not a major consideration. Only some offer high-speed, 20+ mph-travel on larger models, while others stay at a 10 to 12 mph top speed. This can affect productivity significantly in certain applications. Others have conventional rear axle oscillation, while some have oscillating rear chassis designs, unique in wheel loaders. This affects the operator perspective and can affect side-to-side stability in some conditions.”

Emissions are another important consideration to keep in mind when purchasing a wheel loader, Shelton says. “Some compact loaders utilize a DPF emission system, while others only use a DOC to meet Tier 4-F levels. This is a major consideration keeping in mind that compact loaders often don’t work for long periods. For instance, they may load out trucks in a mulch yard. Once the truck is loaded, they stop the machine. It may not even have enough time to come up to temperature. This is bad for a DPF-style system.”

Hitachi regional business manager Dustin Hoogeveen adds, “We don’t run a DPF filter in any of our machines, from the smallest to the largest loader. As a result, our machines breathe properly and run cooler, and managers gain fuel economy and increased engine life.”

There are more design differences and choices in smaller loader models than in those over the 100-horsepower threshold.

“Compacts still offer open ROPS canopies from some suppliers, so in the sunbelt areas, this can be very desirable,” Shelton says. “It allows the operator more visibility and allows for better communications with ground personnel. And within the compact loader range, there’s a wide variety of lift arm and linkage designs. Many use the conventional Z-bar linkage used on most wheel loaders, but you find other styles of linkages that don’t even exist in larger loaders. Some suppliers offer all-wheel-steer versions and even extendable boom versions. So, where loaders above 100 horsepower have reached a level of commonality in major design areas, the compact loaders are still developing. This gives a customer a lot more to consider when looking at this class of machines.”

About the Author

Frank Raczon

Raczon’s writing career spans nearly 25 years, including magazine publishing and public relations work with some of the industry’s major equipment manufacturers. He has won numerous awards in his career, including nods from the Construction Writers Association, the Association of Equipment Manufacturers, and BtoB magazine. He is responsible for the magazine's Buying Files.