In 2018, water and wastewater professionals lamented the lack of an infrastructure bill that could inject money into the industry. Although new construction was not on the docket for most, upgrading facilities was, and that continues to be the case for 2020.

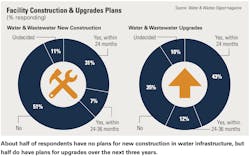

In fact, 56 percent of respondents to the 2019 Water & Wastes Digest State of the Industry Survey said they were not planning new construction for 2020. But 57 percent said they were planning to upgrade within the next 36 months. Even more impressive, 44 percent of respondents said those upgrades would occur in the next 24 months, which suggests immediacy.

It would seem that despite the slow movement at the federal level on funding resources, projects are still being completed. The industry is surprisingly resilient to economic downturn due to the critical functions of water and wastewater management in society. Also, state-level action and funding programs are seeing an uptick in replacement of federal programs.

Paul Turgeon has led several water treatment companies in his career and served as a board director for Anue Water Technologies, BWA Water Additives, U.S. Water, and MFG Chemical among others.

“At the end of the day, the products are still needed to keep plants running or to keep producing water, so while there may be a drop in demand for consumer goods or the other aspects and issues that occur with a recession, we are fairly insulated from it,” Turgeon said.

State-level legislation and regulation efforts are increasing year-over-year, according to Megan Glover, CEO and co-founder of 120WaterAudit.

In just this past year, she witnessed “an increase of over 100 percent if not a 200-percent increase in the bills that were proposed last year.”

In 2018, smart water made a big splash at the American Water Works Assn. Annual Convention & Exhibition. That messaging continued and intensified in 2019.

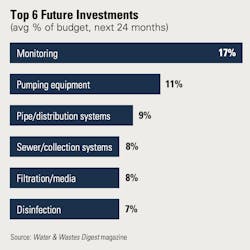

Respondents indicated the percentage of their budget to be spent on equipment. The correlation between the smart water messaging and these budget allocations seems to strongly suggest smart water is not only an exciting prospect for manufacturers, but it also is desirable for utilities.

What is the outlook for smart water systems?

The desire for smart water systems does not stop at the public or municipal market, however. Private industrial systems—such as oil refineries, mining operations, and food and beverage facilities—also want to be smarter. Kevin Milici, VP of marketing and technology for U.S. Water, said smart cities technology also makes for smart businesses, and when the bottom line is top of mind like it is in private business, using data to better drive water usage has become a larger talking point.

Solutions providers are jumping at the chance to be the next big tech start up with machine learning and artificial intelligence platforms or integration systems. But smart water is going nowhere. The primary challenges and barriers to implementing these smart systems are the speed of evolving technology and the vast number of products and services available. With so many solutions, utilities are in decision paralysis.

For a utility trying to effectively and properly manage its taxpayer money, not investing in smart water can be an easier decision than potentially making a costly investment in the wrong service or product.

As often is the case during an election year, most movement in Washington, D.C., stalls while elected officials hit the campaign trails and pause on any legislation unless it will bolster their re-election chances.

Turgeon said that in recent board meetings he has attended, the mention of a focus on state-level action has become a talking point. Because so little is likely to happen at the federal level, it follows that the focus falls upon the states. And as already noted by Glover, state-level regulations and legislation are already on the rise.

Turgeon said prevalent water issues hit close to home, and that aligns with Glover’s comments as she expects the focus on states will continue in 2020 as regional water quality and infrastructure issues continue to gain importance.

“I do think at a federal level we will reach a standstill,” Glover said. “At the state level, that’s where all the action is going to happen, both proactive as well as reacting to the Lead and Copper Rule revision. In my opinion, what we’re going to see over the next quarter is probably all we’re going to see at the federal level.”

Glover said some last minute funding pushes leading into 2020 could make for a good strategic move on the part of incumbents. And that seems to be the case as the House of Representatives recently held a markup session of House Resolution 1497. This early draft includes language that would introduce $16.68 billion to the Clean Water State Revolving Fund over the next five years. Although the bill would be handed down from the federal level, the state level involvement cannot be ignored.

There have been several regulatory changes or updates of note this year at the federal level, but the proposed revisions of the Lead and Copper Rule are perhaps a more immediate concern for municipal leaders and plant operators.

Among these revisions are five key areas of change, according to Glover:

- Population levels that require lead sampling requirements;

- Mandated lead service line inventory, both private and public;

- Required lead sampling in every school and childcare facility, both private and public, within a utility’s jurisdiction;

- Customer notification and data transparency rules; and

- Oversite teams for primary agencies.

Of these five elements, Glover said the mandate of pipe inventory and lead sampling in schools and childcare facilities are the two greatest undertakings. For one, many rural systems are lacking a map or tools to determine where the pipes in their networks are or what materials comprise them.

“Quite frankly, the data just does not exist currently for both sides of material type,” Glover said. “Even the best of utilities that have been doing asset management plans and [have been] tracking their material are certainly not tracking the private side. So this is going to be a massive undertaking for not only the water systems but also the agencies that are now responsible for auditing annual checks for these inventories.”

This presents a market opportunity for companies that cannot only find the pipe, but also determine its material. And this would also have to be done with pipe on private property as well, which leads to the revision on sampling schools and childcare facilities. Glover said utilities may not know the exact locations of these facilities or how many there are within their districts. Although the revision says sampling will scale—20 percent each year until 100 percent are tested annually—the cost of conducting these tests would stress many utilities.

As for customer notification and data transparency, Glover said many water utilities use paper records, and showing audit trails and public transparency of results and timelines could be an added burden for those utilities.

Lastly is the effect on the primacy agencies that will oversee the Lead and Copper Rule. This poses questions on process, logistics, and execution. As burdensome as it is for a water agency to comply with the revisions, the auditing agencies reviewing that documentation also will have a tremendous amount of work to review.

Bringing the issue back to the state level, Glover said what states do with the Lead and Copper Rule revision—how they’ll tailor it to fit local needs—will have a lasting impact on the future.

“What the states do with the Lead and Copper Rule revisions, that is going to be very interesting to follow,” Glover said. “We believe that there are many states that will go further than the proposed Lead and Copper Rule revisions and create stricter standards at the state level.”

--Crossen is managing editor of Water & Wastes Digest