Vocational Firms Hope To Turn Corner

Nonconstruction business was as predicted last year for materials producers and utilities. Mining and energy companies continue their struggle, reporting that 2003 was below expectations.

Materials producers finished 2003 as forecast, but meeting expectations for an "average" year didn't cause undue celebration. Southern Plains led the high side with reports of a "very good" year, but four other regions reported 2003 as an "off" year. For 2004, expectations rise with all but three regions forecasting a "good" year; Southern Plains, again, is more optimistic with a forecast for a "very good" 2004.

Work volume fell just a bit short of what materials producers expected for the year. The percentage increasing volume fell short of that decreasing volume by a net of -8. This differential was greatest in the Great Lakes and Mid Atlantic, where the net was -32 and -30, respectively. With the negative story in 2003, this year's expectations show an overwhelming call for positive volume growth with 38 percent calling for an increase minus 13 percent calling for a decrease for a net of 25. If that plays out, it will be the best year for volume growth since 1999.

Fleet growth was strong in 2003 and is anticipated to continue this year. Last year, 33 percent increased their fleet—in terms of number of machines—and 9 decreased, for a net of 24. The forecast for this year included 25 percent expecting to grow their fleets minus 2 percent that will decrease fleet size for a net of 23. Materials producers have consistently grown fleet sizes since the '90s. The fleet-replacement rate last year was 8.2 percent, the highest since 1999, and is expected to be 8.9 percent this year.

Fleet condition is "excellent" or "very good" for 41 percent of firms, and "fair" or "poor" for 15 percent.

Mining and energy companies came in below expectations for the fourth consecutive year, recording an "off" year in 2003. Firms in the Northern and Southern Plains reported an "average" year, the best report among mining and energy firms. The worst was in the Mid-South, where firms reported a "poor" year.

The last "good" year for business-year ratings was 1997, and this year's forecast is for a "good" year. Mountain states have the most optimistic outlook, but the Mid-Atlantic, Great Lakes and New England regions are not looking past "average" for this year.

Work volume gains in 2003, measured by total machine hours, continued low with 33 percent citing more work minus 24 percent citing less for a net of 9. For this year, 41 percent expect more volume and 9 percent expect less for a net of 32. If this forecast comes to pass, it will be the best year for volume growth since 1996.

The Mid-South is even more optimistic, with a net of 47, but firms in the Great Lakes and Northern Plains regions are projecting less robust work-volume gains with nets of 9 and 4, respectively.

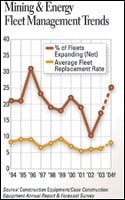

Fleet expansions rebounded last year, returning to near historical levels. The percentage of mining and energy firms reporting fleet growth surpassed that reporting shrinkage by a net of 17. Forecasts for 2004 growth are for a net of 25, a more positive growth outlook than any year since 1996.

The machine-replacement rate turned up in 2003 to 6.3 percent. This was in line with forecast, but still far below the rates recorded in the 1990s. But the aging fleets may be coming due: The forecast replacement rate is 8.1 percent, which is far above rates forecast or actual since 1999.

As far as fleet condition is concerned, 40 percent of firms say their fleet is in "excellent" or "good" shape. Only 4 percent count it as "excellent." Another 14 percent say their fleet is in "fair" condition, with fleets less than $1 million citing an even higher percentage: 34 percent of these fleets are in "fair" condition.

Utility company forecasts were right on again, giving this user group one of the best records for consistently meeting expectations. For 2003, the group had a "good" business year, its third straight. Three regions fell short, reporting "average" business years: Great Lakes, Mid-South and South Atlantic.

The forecast for 2004 is for a continuation of last year: a "good" business year. Strong sewer and water spending will once again provide good opportunity, and an uptick in telecommunications spending will also help the cause.

Work volume, measured in machine hours, stayed at historically low levels last year. Although 34 percent saw more work last year, 15 percent saw less, for a net of 19. This is far below numbers collected throughout the 1990s, and below forecast for the fourth year in a row. For 2004, 33 percent expect more work and 7 expect less, for a net of 26.

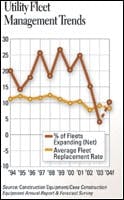

Utility fleet expansions tapered off for the third consecutive year last year. Increased fleet sizes were reported by 19 percent of utility fleets, and decreases for 15 percent for a net of 4. Projections for 2004 are better, recording a net of 10, with 21 percent expecting to increase their fleet sizes minus 11 percent expecting to decrease the number of machines in their fleet.

A more positive trend is on the fleet-replacement-rate numbers. Reversing a four-year slide, utility companies replaced machines at a 9.1-percent pace last year, a rate higher than anticipated. For 2004, expectations are for a replacement rate of 8.4 percent.

In 2001, 62 percent of fleets were reported in "excellent" or "good" condition. Last year, 54 percent reported that their fleet was in good shape. In 2002, 11 percent of the utility fleets reported being in "fair" or "poor" condition; last year, it was only 4 percent.