What does “adequate” mean relative to the status of transportation infrastructure? Is it a general state of good repair? Is it a reduction in traffic congestion? Is it a reduction or outright halt in road traffic fatalities? Is it merely that no bridges collapsed over the past year? Or is it simply a matter of general statistics: less time lost, fewer incident reports, less money burned on avoidable circumstances?

This is a rhetorical question, of course. But one that seems to plague transportation planners and decision makers, as most objectively unanswerable questions might needle at anyone. In Roads & Bridges’ 2019 State of the Industry survey, respondents seemed to struggle with the question of whether they “have enough funds to adequately maintain [their] system in 2020[.]” Less than one-third felt they did (30.2 percent), nearly half did not (46.7 percent), and about a quarter (23.0 percent) had no idea. Considering the preponderance of respondents identified as being involved in heavy/highway construction (including bridges) and/or materials production, it is puzzling, and perhaps mildly alarming, that such a percentage would not be confident of their ability to maintain their own system, to say nothing of the nearly one-quarter of them who seem to not entirely understand what it would even mean to achieve “adequacy” in any case.

Yet, despite this dissonance, business has been looking pretty good. The Fixing America’s Surface Transportation Act, or FAST Act, continues to pump billions into transportation funding, and states have been acting with a fair amount of confidence in bid letting and overall project planning. According to our survey, a combined 88 percent of respondents see 2019 as an at-least “good” year for business, and more than half (52.5 percent) expressed even more optimism. Moreover, they expect 2020 to remain on a more or less even keel (86 percent).

What is the outlook for transportation construction in 2020?

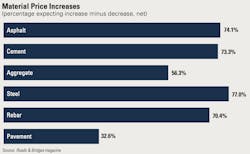

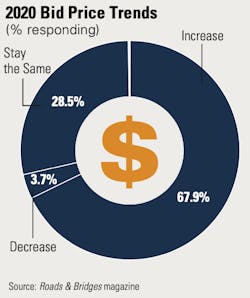

Market competition remains strong, material prices are not expected to go down anytime soon, and bid prices are expected to continue to rise (so say two-thirds of respondents). Still, everything in the market ought to be taken with the proverbial grain of salt. These days hatching a political debate is like trying to race a horse on foot; you’re going to lose and you know that going in. Nevertheless, any optimism surrounding the proposed America’s Transportation Infrastructure Act, which made it out of committee in the Senate by a unanimous vote and is (or at least was) favored by President Trump and would increase funding subsequent to the FAST Act’s Sept. 2020 expiry by 17 percent—in large part due to a user-based fee applied to freight and hauling—is now all but extinguished in the mire of inquiry (of the impeachment variety), scandal, and an election cycle that is more contentious than a Roman arena. And this isn’t even a lame duck situation.

The American Society of Civil Engineers’ Infrastructure Report Card, published every four years, most recently in 2017, gave our national road and bridge transportation system a D+. In its assessment, the ASCE concluded that “reversing the [present] trajectory after decades of underinvestment in our infrastructure requires transformative action from Congress, states, infrastructure owners, and the American people.” It is therefore a gladdening thing to know that there are multiple regulatory considerations presently in play—some of which have already breached the goal line, all of which have real potential to positively impact the procurement and contracting process, which will in turn, of course, empower states to get more work done.

First and foremost is the Federal Highway Administration’s repeal of the Proprietary Products Rule. The rule, which had been immovably on the books since 1916 (before there was even a highway administration or a U.S. DOT), prohibited the use of patented or proprietary products on federal aid highway and bridge projects, unless they qualified for limited exceptions. This regulation was generally seen as stifling innovation and increasing costs. Its revocation calls into question the general anticipation of increased material and bidding costs in the coming year. More than 100 comments were submitted to the FHWA during an open consideration period, and the American Road Transportation Builders Association (ARTBA) played a key role in getting this decision on the rolls.

ARTBA president/CEO Dave Bauer limned the expected impact of this rescission in the near-term. “This archaic rule has obstructed state transportation agencies from utilizing patented or proprietary materials, specifications, or processes on federal-aid highway projects,” Bauer said. “It’s had the practical effect of hindering innovation and development of potentially life-saving technologies for use throughout the nation’s highway and bridge system. The repeal gives states the option to use patented and proprietary products on federal-aid projects if they choose to do so. While the original rule was intended to preserve fair competition, a level playing field must not be confused with celebrating the status quo. States now have the freedom to use federal funds on the full range of transportation products and solutions that best meet their needs.”

Speaking with R&B this past September, former U.S. Transportation Secretary Jim Burnley was even more adamant on how the rule change will benefit states and contractors alike.

“The process for securing approval from the FHWA used to be so convoluted that it was a very effective deterrent to states considering buying and using new and innovative products,” Burnley said. “By eliminating the federal review process, [the ruling] frees up states to use their own procurement processes. DOTs can now do what other state agencies can do under every other federal aid program, from housing to education.”

Among the other more than dozen rules and proposals in play is a reconsideration of the Occupational Safety and Health Administration’s silica exposure rules. In late 2017, OSHA began enforcing rules to tighten existing federal standards for allowable worker exposure to crystalline silica dust. This August, OSHA queried the regulated community to help clarify aspects of the rule related to activities as outlined in what it calls “Table 1,” a list of 18 specific construction tasks that generally generate silica exposure. Should the feedback of industry be accepted and integrated into these specifications, time and cost savings at the planning and design level and reductions in worker out-time due to respiratory related medical complains are expected to have an imminent and direct effect, as a longer, more comprehensive compliance list can aid project planners in heading off potential dangers before they become immediate matters of concern.

Another pair of recent wins has also loosened some tethers for the road and bridge industry. On August 12, the Trump Administration announced an overhaul of the Endangered Species Act, which as it concerns our industry reforms the critical habitat process by placing a priority on areas where species are present, rather than areas where they are suspected to live or have been seen in the past. The aim here was to protect survival, but unburden areas where species are not demonstrably ensconced. Following this a month later, on Sept. 12, the 2015 rule regarding Waters of the U.S., which subjected roadside ditches to the jurisdiction of the Clean Water Act, was formally repealed by both the Environmental Protection Agency and the U.S. Army Corps of Engineers. The impact on any road or bridge construction project with even a moderate amount of earthmoving or slurry production may be presumed.

Also under consideration are alterations to the Buy America regulations, overtime revisions, and hours of service—all, as of this writing, pending, but the overall trend is one of progressive change as it impacts the road and bridge industry. And with more than half of R&B survey respondents observing a decline in the condition of their urban (51 percent) and rural road networks (54 percent), and the struggle to reduce the national cache of “poor” or structurally deficient bridges now an evergreen point of contention, it is hoped that a healthy degree of cautious optimism, married to continued pressure from industry for a reevaluation of outdated federal regulations, can produce a tsunami effect that culminates in long-term, sustainable federal support for transportation development on the near horizon.

--Budzynski is senior managing editor for Roads & Bridges