Transportation Faces Unclear 2021

What a year, huh?

One is tempted to consider the past several months alone as a testament to human fortitude and folly in equal measure, akin to social behaviors as reported from a more feudal period of history. And yet, from a strictly professional perspective—despite concerns that are deep, many, and true—there is nonetheless cause for optimism. As the dust settles on the 2020 national elections, we don’t have enough to conjecture how support for the cause of national infrastructure will play out.

So let’s start with what we have.

Budzynski is senior managing editor, Roads & Bridges

According to a report recently released by the American Road & Transportation Builders Association (ARTBA), 94 percent of all transportation investment ballot measures nationwide were passed in this election cycle, representing $14 billion in one-time and recurring revenue for transportation improvements. This represents the highest level of such approval in the 20 years ARTBA has tracked such statistics. Among the notable results is an increase in sales tax in Arkansas, a state historically wary of tax increases of any kind, projected to generate $205 million for state highways and a further $44 million for local roads and bridges; a 20-year extension of a 25-cent sales tax increase in Sonoma County, California, expected to raise $520 million; a “special purpose” tax in Georgia that will go into effect in 2022 and generate an estimated $330 million for a cash-starved rural landscape in desperate need of local and state road improvements; and, on an even grander scale, a $7.1 billion bond (approved by a two-thirds majority) in Austin, Texas, that will fund the initial and ongoing costs of Project Connect, a transit plan anchored by two high-capacity light rail lines serving the city’s densest neighborhoods.

This past summer, Roads & Bridges, in partnership with civil engineering firm Tensar, published the results of a multi-part industry survey on Covid-19 and its impacts—both present and estimated—on transportation planning and construction.

Front of mind for all contractors and governmental agencies, as a matter of diligence and operational concern, is safety. With the need for improved social and workplace safety nets, one major question is what will be the long-term impact to infrastructure costs due to the pandemic. After all, everyone has little choice but to put more skin in the game in this regard.

Utah DOT materials manager Bill Lawrence sees a double-sided coin.

Read the complete industry report in 2021 Annual Report & Forecast.

“Our construction program continues to move forward, though the way business is being handled is different. There are some instances of less efficiency, but there are others that have shown to be more efficient, such as teleworking.”

James Bailey, SVP of Skanska Civil USA, was more optimistic, saying, “The construction industry is generally quick to adapt to new safety standards after initial resistance, e.g., the new silica standards. The biggest struggle adapting to the pandemic has been the ability to procure the required PPE and supplies. We will certainly see an increased cost to purchasing safety supplies and requirements to sanitize tools, equipment, and areas, but I believe we will overcome these productivity-related impacts in the long term.”

With construction remaining an “essential” industry throughout the country, it is generally expected that this—along with returning, as close as is practical, to a full economic reopening—will be key to keeping construction inflation in check.

As to what 2021 might bring by way of a long-term federal bill, Jeff Lackey, VP of TranSystems, says:

“I do expect to see increases in design/build. History has shown us with stimulus packages that alternative delivery has been a part of that process. I would anticipate that would be the case with any new [bill] that would be passed.”

It is presumed that “business as usual” construction is, in essence, now a thing of the past, even if such presumption is not yet universally accepted. Yet there are many in the industry who see this disturbance to the norm as a positive: perhaps a harbinger of long overdue change. ARTBA VP of regulatory affairs Nick Goldstein is among them:

“There are positive outcomes resulting from the pandemic, and those include a heightened awareness of health risks that can arise from everyday working conditions. We’ve learned we can and should do more to protect our health, whether those are health pathogens or hazardous chemicals or other contaminants. The required use of face coverings has helped workers better overcome resistance to wearing such PPE, and the consequences for not doing so are more acute and real.”

Still, some see state and local budgets in disarray and worry that workforce adaptation will fall behind the curve set by the pandemic, in which modes of construction and materials development will, like the virus itself, be novel. To this end, Ken Simonson, chief economist for the Associated General Contractors, says, “With possibly fewer onsite workers at any time and more use of offsite manufacturing...it is not clear factories will be able to attract and train workers or have the flexibility to supply diverse project needs.”

The idea of diversity in choosing and prioritizing projects has also been in the scrum since the federal economic stimulus package was released earlier this year. State and local agencies across the country have had to significantly reduce or outright eliminate capital improvement programs due to reduced revenues needed to support program costs. Although every state and locality has its own unique “wish list,” the single most common and perhaps most important through-line in all of it is ROI.

“Data suggests every dollar spent in infrastructure investment returns many more dollars to the economy,” says David Lawry, director of municipal services for Chastain & Associates. “Our nation’s infrastructure was in crisis before Covid-19 and the pandemic has only made the crisis worse.”

This opinion was echoed by TransSystem’s Lackey, who went on to say, “Life cycle cost needs to be part of any discussion. Projects that provide expansion opportunity, spur development, and help ease pressure on state annual budgets are also prime candidates.”

Nebraska DOT geotechnical engineer Mark Lindemann summed it up best: “We must get the most benefit out of every dollar spent.”

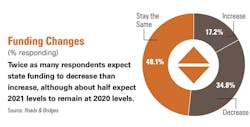

Roads & Bridges also ran its own survey to take the pulse of the industry, and what we discovered was that, by and large, road conditions are continuing to suffer. Even though the general reduction in traffic levels would seem to make all but obvious the opportunity to start on a plethora of maintenance projects, 56 percent of rural roads and 68 percent of urban roads are in only “fair” condition or worse—and respondents are not hopeful this will improve in the coming year. More than two-thirds saw conditions worsen through 2020. This can be attributed to the unfortunate conflation of a large backlog on state of good repair and timidity sourced from the federal government’s inability to pass a long-term, sustainable funding package to follow the FAST Act. Only state-maintained highways looked close to good, and that due to marginally stronger funding streams.

Although the extension of FAST Act funding levels into 2021 does offer some respite, the fact remains that it is a Band-Aid over a hemorrhage. Any contractor or DOT engineer knows that when projects take years—plural—to design, approve, and build, what is needed is the confidence that three or four years down the road there will be dollars at the ready. Until there is, however, there will continue to be shakiness. There will continue to be large-scale projects that are only partially funded and may have to lay dormant or half-finished, until funding can be had. Added to this is the nationwide reduction in gas-tax generated revenue, which many suggest begs the question: Is our reliance on the gas-tax model finally failing? Is a nationally adopted vehicle-miles-traveled model going to replace it? This may be, in coming years, the single most significant impact of the pandemic-related recession.

It is likely that we will not feel the full impact of the economic downturn resulting from the coronavirus pandemic and the restrictions it has imposed on operations until 2022. No matter the trends suggested in various industry analyses or the cautious optimism proffered by industry experts, a pall hovers above everything like a layer of blue smoke in a barroom, that all the talk about what the future may hold is just so much sound and fury, signifying nothing. Although it is a frustrating conclusion, the only honest one to draw is that what happens next is anyone’s guess.