Patience Is the Watchword

Contractors took the cautious route a year ago when forecasting 2004 business trends. It's hard to believe that we were explaining that caution in terms of the delay to pass a new Federal transportation bill. Nobody expected the delay to last the entire year, yet that's exactly the situation at the end of 2004.

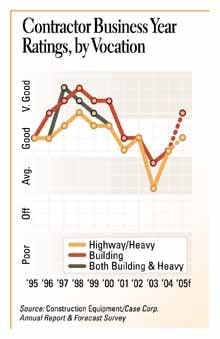

Even so, contractors reported business years that matched up with their expectations, saying 2004 was a "good" year. This was the case for both highway/heavy and building contractors.

Asked to forecast 2005 in late September, 2004, contractors just couldn't shake off the cautious attitude, especially in the middle of a contentious Presidential contest. Immediately after the election, as we're finalizing this report and forecast, expectations for action on reauthorization remain uncertain. At the least, a bill of some sort will move forward now, but the amounts actually designated for highway construction remain much in doubt.

For highway contractors, this meant patience was in order as 2004 wound down. Even with immediate action in Washington, not many new projects will move into the pipeline this year. In light of this, highway/heavy contractors forecast that 2005 will be another "good" year.

For general-building contractors, however, 2005 holds brighter promise. As our economist, Jim Haughey, pointed out in his general economic outlook, spending on nonresidential building construction will follow a strong 2004 with even stronger growth this year. Reed Business Economics projects a growth rate of just over 11 percent in this area. Building contractors expect 2005 to be a "very good" year.

On the heavy-construction side, water and sewer work continue to grow at a solid rate. In addition, two sectors that have fallen off in recent years show signs of picking up: Power and communication work both show growth in spending for 2005.

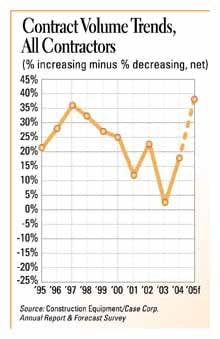

For contractors who have patiently expected volume growth to return, some payoff will come this year. Last year, 41 percent reported increases in contract volume, and 23 percent reported decreases. This left a net of 18 percent on the plus side. For 2005, the net is projected at 38 percent, with 46 percent expecting increases versus 8 percent who foresee volume decreasing.

General-building contractors have an even larger expectation for growth, with a net of 45 percent. By region, volume growth expectations are higher in the Mid-South (66 percent net), South Atlantic (52 percent net), Pacific and Mid-Atlantic (both at 46 percent net).

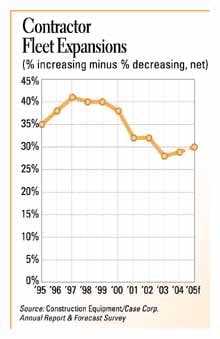

Fleet growth, however, continues. In 2004, 37 percent of contractors expanded their fleets, and 8 percent decreased fleet numbers for a net of 29 percent. Expectations this year are for a net of 30 percent: 34 percent expect to expand; 4 percent expect to decrease.

The rate of fleet replacement—how often machines are turned over—has settled in at about the 9-percent level since contractors reported a high of 12.2 percent in 1996. Last year, contractors dipped below that level to 8.9 percent. Fleets are expected to be replaced at a 9.6-percent rate this year.

Building contractors reported higher rates for both last year and for 2005: 9.3 percent and 9.9 percent, respectively. Larger fleets also replace machines at a rate higher than the overall average. Last year, fleets with estimated replacement values of $25 million or greater replaced at a rate of about 14.5 percent. Projected rate of replacement this year is 13 percent.

Of course, fleets must maintain healthy replacement rates in order to manage overall fleet quality. In 2003, 40 percent of contractors rated their fleets as "excellent" or "very good." Contrast that to the 47 percent in 2001, as the replacement rate was falling below 10 percent.

On the other end of the scale, 12 percent of contractors last year said their fleet was in "fair" or "poor" condition.

When contractors acquire major machines, defined as that with a purchase price greater than $25,000, outright purchase and financed purchase are the most commonly used strategies. Slightly more than half purchase outright, and slightly less than half use financing. Other methods include short-term rental, used by 18 percent of contractors; rental/purchase, 16 percent; lease/purchase, 13 percent; and leasing, 8 percent. Leasing increased in popularity from 5 percent in 2003.

Short-term rental of equipment, regardless of purchase price, is a strategy used by 65 percent of contractors, including all those with estimated fleet-replacement value greater than $100 million and 73 percent of those with values between $25 million and $100 million.

Light-earthmoving equipment is rented by 64 percent of contractors, followed by light equipment (42 percent), air compressors and generators (40 percent), and compaction equipment (38 percent). Heavy-earthmoving machines are rented by 28 percent of contractors.

The new-equipment market remains competitive for contractors. Measuring competition in terms of pricing, model selection and the number of quality brands available, 54 percent of contractors said the market is intensely or very competitive.

Construction-market competition is a different story, with 72 percent of contractors saying competition in markets in which their companies operate is intensely or very competitive.

But competition keeps good companies sharp. About 23 percent of contractors said their company was in top shape ("very good") last year, and an additional 50 percent reported their company was in "good" shape.

Employment issues remain consistent with past years. In 2004, 48 percent of contractors reported stability in overall workforce employment; 33 percent increased employment; 19 percent decreased.

With equipment-related personnel, 16 percent of contractors hired more service and maintenance workers and 22 percent hired more operators.

As contractors expanded in those areas, there were generally workers available. Slightly fewer than half of contractors said they had no problem finding skilled equipment operators. Half of contractors said they had no problem finding equipment technicians. Only one in five cited shortages as a major problem.