Upbeat Business Forecast

Rental dealers just missed the business year forecasts from last year, scoring an "average" year v. the "good" predicted. Dealers forecast 2004 to be a "very good" year. Although this year's survey went solely to members of the American Rental Association and to select members of the Associated Equipment Distributors, we feel confident certain trends can be extended.

Volume, for example, also fell short of expectations. Forecast was a net of 29 with 35 percent anticipating growth minus 9 percent expecting shrinking volume. Results for 2003 showed 36 percent growing volume, but 17 percent said it fell for a net of 19. A bullish 2004 is forecast, however, with 44 percent expecting volume to grow minus 2 percent declining for a net of 42.

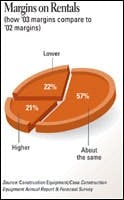

Margins on short-term rentals seem to have leveled for rental dealers. Only 22 percent cited lower margins last year against 23 percent who still saw slippage. More than half of dealers, though, held steady on margins.

Prices remain the single greatest concern among rental dealers, with 24 percent citing it. Once more, though, dealers insist that they will raise rates. Some 43 percent say they will boost rates this year. Last year, only 27 percent were able to push through rate increases. Only 4 percent say they will decrease their rental rates this year, which is far fewer than have cited a similar strategy in years past.

Significant increases in short-term rentals were reported by 35 percent of rental dealers. Additional movement was seen in used-equipment sales, with 26 percent citing significant increases, and in service sales, 29 percent.