Over the past couple of years, the equipment industry has experienced pricing and supply pressures the likes of which our generation has never seen. Despite new equipment prices climbing to all-time highs, sales did not slow down. In fact, equipment was being sold at a record pace and often before it could even be produced. Meanwhile, parts and components were just as scarce, forcing companies to buy up what they could, which further exacerbated the shortage.

Many see the need to prepare for a downturn in 2023 and 2024. With the additional uncertainty in the mix, asset managers will need options that will keep the fleet of equipment working and the organization on sound financial footing.

Inflation and climbing interest rates will impact financials and profitability for years to come, even if equipment were bought today. If efforts to lower costs from the external market, including pricing concessions from vendors, have been exhausted, it may be time to consider the extension of economic life for certain machine assets.

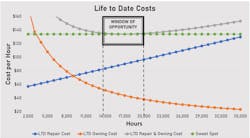

Although radical for some, the idea has merit if the economics of managing equipment are understood, particularly in understanding owning and operating costs and the sweet spot. Given that equipment is an important part of the operation, then the economics of managing this depreciable commodity reveal that these assets have a finite life. The principles of mathematics indicate that within these finite lives there will be a point in time where the total costs of owning and operating each piece will be at their lowest: the “sweet spot.”

Identifying this sweet spot allows managers to make decisions that minimize the risk of over-spending to reach the finish line, the machine’s useful life. Identifying the sweet spot also reveals a small window of time immediately before and immediately after that low point: the “Window of Opportunity.” In looking through the Window of Opportunity, a manager not only sees the precise sweet spot approaching, but also points in time where the combined owning and operating costs are marginally higher on a total cost basis.

In the nearby example, the precise sweet spot of $134.09 is reached at 17,000 hours. If, however, the machine continued to operate an additional 3,000 hours (20,000 hours cumulative), the life-to-date (LTD) cost would be $135.07—an increase of less than 1 percent, or $0.98 per hour, over the sweet spot.

These marginally increased costs in the belly of the curve might just be lower for the business than buying new would be. The caveat, of course, is that although capital expenditures (capex) can be deferred, it cannot be denied (See “Defer but Don’t Deny,” May 2015), so eventually the money will need to be invested.

A collaborative and data-driven approach will enable the clearest view through the Window of Opportunity.

First, work with the Accounting department to obtain and review the latest report on the book values of your equipment. Highlight the units that are or will be fully depreciated within the next year (assuming your depreciation policy is closely aligned with the sweet spot principle).

Then ask the Maintenance group to review the maintenance history, including inspection and condition assessments, for Accounting’s list of unit numbers. Ask Maintenance to break this list into three groups:

- Units that are in good condition and should easily make another six to 12 months if monitoring/inspection programs are maintained.

- Units that are in fair condition and could work another six to 12 months if increased inspections or a small repair or investment was made. Specify the acceptable cost of “small.”

- Units that are in poor condition and should be disposed as planned or risk an investment unlikely to be recovered. re-coup. Specify the cost of that risk.

The chances of rejection to this idea are far less when departments work together to narrow the field of candidates and set up goalposts by examining the economic lives and specifying the monetary thresholds.

The last meeting is with the person responsible for capex to quantify the capital savings for the next year, as well as the resulting increases to the following years.

Finally, review and summarize this list of units and the resulting impacts to capital and operating costs in preparation for a meeting with upper management to make recommendations. Do not forget to calculate the total increase in operating hours this asset life extension provides.

Do’s and don’ts for extending useful life

- DO review Net Book Values and Residual/Salvage values. Identify assets that are at or will reach their residual values within the next 12 months.

- DO set a target, no more than a six- to 12-month or 5- to 10-percent extension in life without good data.

- DO carefully consider the maintenance history, machine health, and component life of each asset or asset class.

- DO create a watchlist of units that must be hyper-vigilantly managed.

- DO involve Accounting/Finance early as they can help quantify the impactsand will be able to confirm the details.

- DO calculate the impact to the fleet’s average age. Expect to see a small increase.

- DO update capex plans. It’s ok to defer but never deny capex.

- DON’T assume that all pieces of equipment of the same age or model will be in a similar condition.

- DON’T charge $0 for equipment even if it's fully depreciated. This short-sighted decision is difficult for companies to recover from.

- DON’T revise capex policies. This is a unique situation that should not cause a burden for future lifecycle decisions when the market corrects itself.

- DON’T deny capital investment.

- DON’T ignore the death spiral. Equipment reliability is connected to the cost curve, and as costs increase your availability will decrease.

- DON’T forget to involve Accounting/Finance once the decision has been made. They will want to update the system to reflect the lowered asset residuals and increase the remaining economic lives, or (worst case) manually accrue additional depreciation for assets that continue to work once their target life is reached.

Normally, extending asset lives is not recommended. But these are unique times, and it is best to be prepared with options. If extending the lives of the fleet’s assets make sense, be sure to tighten up pre-use inspection and condition-based monitoring programs to watch for early signs of failure. Don’t push equipment so far that it misses the Window of Opportunity.

About the Author

Craig Gramlich

Craig has extensive experience in equipment management across transportation, heavy lifting, civil projects, mining, and construction sectors. Driven by a passion for cost and data analysis, he excels in enhancing equipment accounting, rate modeling, and developing programs for rate escalation and transfer pricing.

Through Lonewolf Consulting, Craig effectively unites Equipment, Operations, and Accounting departments, leveraging his extensive field experience to help companies streamline operations and find cost savings, significantly boosting ROI.

He holds a Bachelor of Commerce from the University of Alberta and a Certified Equipment Manager (CEM) certification, along with a variety of professional development courses, showcasing his commitment to ongoing professional growth.