Craig Gramlich touts benefits of zero-based budgets

Those who manage fleets of construction equipment are familiar with the concept of budgeting. It is a standard practice, usually based on last year’s performance. Zero-based or break-even budgets, however, provide an opportunity to streamline cost management, enhance accountability, engage in more productive conversations, and ultimately increase profits.

A budget is simply a tool that measures financial performance over a specific period. Budgets can be used as a plan and roadmap for spending, including the allocation of resources and the timing of revenues or expenses. Most equipment-intensive organizations are divided into “profit-centers” and “cost-centers.” Simply put, it is the job of the profit-center to maximize profitability by generating revenue that exceeds costs, and it is the job of the cost-center to incur, track, and control the costs within an organization. The real profitability of the organization is only realized when you combine the profit-centers and cost-centers.

Equipment and maintenance departments are commonly structured as cost-centers because they cost the organization money to operate and do not directly add profit. But what happens to this cost center’s budget when equipment usage changes? Under the historical method, the budget would remain static regardless of changes to equipment usage. The entire department’s performance for the year would be gauged against this budget, so users are more focused on trying to hold spending, headcount, and any other work activities to these values that were arguably wrong the moment usage changed. This occurs because accountants need to report on the company’s financial state and the change in usage is not able to be captured or quantified yet.

Read also: How deep to go with financial details

The good news is that there is another way to handle budgeting for this dynamic area of business. Be prepared, however, as there is more upfront work to implement, but in the long term, budgets will be far simpler to administer and manage. Budgets and cost management are all about What, Why, and When: What costs are you incurring, why are you incurring them, and when are you incurring them?

Let’s start with a zero-based budget exercise. Grab a blank sheet of paper (a fresh Excel tab also works) and make a list of your cost items. Don’t worry about how organized you are because the list will be refined as you go. The key to this step is to keep a fresh mindset and focus on the “what.” If nothing comes to mind, think about the three largest costs: equipment, people, and facilities. Here are a few mind ticklers to start with depreciation, lease, salaries, training, team building, fuel, parts, and insurance. Again, do not worry about this list being perfect, just write down whatever comes to mind.

Next, think of “why” these costs are incurred and identify the specific activity or event that most directly affects the amount of resources consumed and the resulting costs incurred. And while the “why” is fresh in your mind, think of “when” these costs are incurred or charged to you. Cost frequency is all about the rate or frequency at which each cost event occurs.

Although a cost driver focuses on the factors that cause a change in costs, cost frequency refers to the frequency or rate at which a cost event occurs. The list should now look something like this:

| Cost Item (What) | Cost Driver (Why) | Cost Frequency (When) |

| Depreciation | Fleet count | Monthly |

| Lease | No. of leases | Monthly |

| Salaries | Headcount | Monthly |

| Training | Headcount | Monthly |

| Team building | Event | Monthly |

| Fuel | Equipment usage | Equipment hour |

| Parts | Equipment usage | Equipment hour |

| Insurance | Insurable value | Monthly |

Here is where the list gets organized and moved into a spreadsheet to become a usable budget format. In doing so, take a moment to assign titles or headers to group these cost items. Here are suggested titles: overhead costs, ownership costs, operating costs, and recoveries.

Now, incorporate three additional columns to the right: one for Quantity, one for Cost Per, and one for their multiplied value labeled Total Cost. Enter the quantities and dollar amount per cost driver into the spreadsheet. If you aren’t sure where these numbers come from, ask your team: human resources and payroll for headcount and labor costs, corporate/risk for insurance, accounting for depreciation, etc. This may take some time to collect and translate the cost data, but it will simplify and save all parties time in the future.

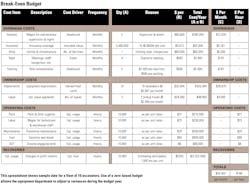

When complete, the budget spreadsheet should look similar to the example at the top.

Put it to the test

Consider this exercise: What are the recoveries required to break even for this cost-center using the zero-based budget? Most companies discard all the diligent effort they have invested and simply take the total department budget of $2,322,040 and divide it into months or $/hour. They then use these values ($193,503 or $232.21 respectively) to project and evaluate spending and department performance. Both values become inaccurate, however, the moment the budget is finalized because conditions change.

If we looked at the same data from a slightly different perspective—if we focus on the two columns on the far right-hand side of spreadsheet—we can observe that this company, operating a fleet of 10 identical excavators, will consistently incur fixed costs of $53,503 per month plus $168 per machine hour for every hour worked. Adopting this budgeting approach simplifies the identification and calculation of variances, which essentially represent the effects of changing conditions. These variances significantly enhance the quality of conversations and enable users to see and quantify the measurable impacts of their actions.

For instance, let’s assume you budgeted $90 per hour for fuel but the actual comes in at $100 per hour. This discrepancy prompts a discussion about the reasons ‘why.” It could be due to a higher cost per gallon (price variance), the machines used more (consumption variance), or a large fuel delivery arrived at the end of the month (supply variance).

Furthermore, this budgeting approach is scalable and adaptable as the company grows. It can easily transition into measuring impacts in terms of dollars per person or dollars per unit in case those values also undergo changes during the year.

Zero-based budgets provide a clean slate by reassessing expenses from the ground up, disregarding any hidden pitfalls in historical data. On the other hand, break-even budgets enable a quick determination of whether the equipment budget is overspent or underspent, enabling efforts to be directed toward analyzing and explaining variances rather than comparing them to arbitrary benchmarks such as last year’s expenditures.

About the Author

Craig Gramlich

Craig has extensive experience in equipment management across transportation, heavy lifting, civil projects, mining, and construction sectors. Driven by a passion for cost and data analysis, he excels in enhancing equipment accounting, rate modeling, and developing programs for rate escalation and transfer pricing.

Through Lonewolf Consulting, Craig effectively unites Equipment, Operations, and Accounting departments, leveraging his extensive field experience to help companies streamline operations and find cost savings, significantly boosting ROI.

He holds a Bachelor of Commerce from the University of Alberta and a Certified Equipment Manager (CEM) certification, along with a variety of professional development courses, showcasing his commitment to ongoing professional growth.