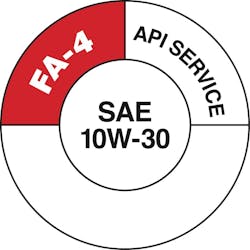

December 1, 2016, marked the official availability of two new diesel engine oils, CK-4 and FA-4. These new oils, as most are aware, were developed to meet the more demanding lubrication and fuel-efficiency requirements of newer engines, whether on-road or off-road.

The thumbnail history of the new oils goes back a number of years, when diesel-engine manufacturers began to question whether some formulations of the then-current oil, CJ-4, introduced in 2006, were capable of functioning adequately in the more hostile working environments of technically advanced engines running with complex emissions-control systems. The American Petroleum Institute (API), a large U.S. trade association for the oil and natural-gas industry, subsequently formed a New-Category Evaluation Team, which determined that the industry would be well-served to move beyond CJ-4.

As a result of these deliberations, two new oil categories were suggested, one that would parallel CJ-4 in terms of viscosity (eventually designated CK-4), and a second (eventually designated FA-4) that would have reduced viscosities in the interest of improved vehicle fuel economy to satisfy increasingly stringent legislation regarding greenhouse-gas emissions from on-highway vehicles. The former would be backward compatible with CJ-4 and its predecessor oils; the latter would initially have limited application, primarily for newer on-highway truck engines.

To ensure that the new oil formulations would meet all expected performance criteria, two new tests were added to the nearly 20 existing API tests used to evaluate CJ-4 oils. New are the Volvo T-13 test (to evaluate an oil’s capacity to protect against oxidation and subsequent bearing corrosion) and the Caterpillar Oil Aeration test (used to calculate the percent of entrained-air volume in the oil at a given pressure and temperature).

With test parameters established for the proposed new oils, oil companies began developing formulations that would satisfy the new API standards and overcome the perceived shortcomings of CJ-4. During the development process, however, oil marketers also had to carefully consider specifications required by individual engine manufacturers.

To illustrate, Ford Motor Co. established its Material Engineering Specification WSS-M2C171-F1 regarding valve-train wear after testing certain prototype formulations and determining that some did not perform as well in this area as CJ-4.

Subsequent to the release of the new oils, Ford issued a position statement saying that “due to its low viscosity, FA-4 should not be used in any Ford diesel vehicles at this time,” and further stating that “Ford will not be recommending the use of CK-4 motor oils in any Ford diesel engines, new or old,” because, “Ford testing has shown some CK-4 type formulations [to have] inadequate wear protection, compared with CJ-4 formulations developed and licensed before 2016.”

We hasten to add, however, that some oil marketers have CK-4 products advertised as meeting the WSS-M2C171-F1 spec, and that Ford has published a list of oils approved for its diesels.

Overall, however, API’s new standards were developed with exacting specifications in mind and aimed especially at encouraging the development of formulations that could better resist oxidation (a process that thickens oil, forms deposits, and promotes corrosion), better control aeration (entrained air impairs heat transfer and retards oil supply to critical components), and enhance shear stability (that is, better resist being “sheared” out of grade and becoming thinner when shear-stabilizing polymers in the oil are broken apart by the engine’s working parts, jeopardizing the required oil-film thickness between engine parts).

“Always check with the truck manufacturer to determine if CK-4 or FA-4 oil is required,” says API’s Ferrick. “Also, be sure to mark tanks, storage, and dispensing tools to avoid comingling different products and misapplication.”

So far, says Ferrick, approximately 600 CK-4 formulations and nearly 80 FA-4 formulations have been licensed, that is, have satisfied API test criteria and are permitted to use the API Service Symbol “donut.”

Those numbers might seem high, but can be explained.

“API considers each viscosity grade and category, or categories, claimed as unique brands,” says Ferrick. “For example, an oil marketer’s Brand X 15W-40 and 10W-30 API CK-4 oils would be considered as two oils on an API license. Formulations are another consideration. Each licensed oil must have at least one approved formulation, but it’s not uncommon for marketers to have more than one formulation for a brand.”

API’s Engine Oil Licensing and Certification System, according to Ferrick, is backed by monitoring and enforcement programs that help ensure that licensees adhere to program requirements, including running physical, chemical, and performance tests on licensed engine oils.

“An applicant must run the engine and bench tests required by an API engine-oil standard before applying for licensing,” says Ferrick. “In practice, some oil marketers run their own tests, and some rely on testing conducted by additive suppliers. No matter how the testing is completed, applicants must submit portions of the data as part of the application process and must be prepared to submit a complete data package, or CDP, if requested by API.”

Basic information that must be submitted to API, says Ferrick, includes elemental analysis results and physical properties—including volatility (how much of an oil evaporates at high temperatures), MRV (mini rotary viscometer), cold-crank results, high-temperature/high-shear results, and TBN (total base number). Also required is additive information with treat rates, base-oil information, and engine-test results. API holds this proprietary information in strict confidence, says Ferrick.

Developing oils for licensing

Before developing its first new formulation for qualification, says Dan Arcy, OEM technical manager at Shell Global Solutions, the company conducted more than 9,000 bench tests and extensive testing in on-road and off-road engines.

Extended Oil-Drain Intervals

Given what some in the industry call the “more robust” nature of the new CK-4 and FA-4 formulations, in terms of high-quality base oils and advanced additive packages, most equipment owners assumed that extended drain intervals would be among the benefits. Indications are that the assumption will prove generally true, but caution is advised. Although the new formulations do have enhanced protection qualities, some caution that newer engines with advanced technology might stress oils in ways that older engine technologies did not—especially FA-4 formulations.

Overall, however, the industry is taking a positive stance on drain intervals.

“We anticipate the enhanced properties of both CK-4 and FA-4 to have a significant impact on drain intervals, due to changes to the additive system,” says Shawn Whitacre, senior staff engineer, Chevron. “The new oils must pass a new and very stringent test that measures oxidation performance, which, in many instances, is the parameter that determines the oil-drain interval.”

“When Shell began developing the new oils,” says Arcy, “testing in the lab allowed us to investigate every single aspect of an oil and provided what we might call ‘directional-performance’ data. For example, we could take some of one anti-oxidant and combine it with a second anti-oxidant to get an idea of how they might work in combination in terms of the oil’s overall anti-oxidant performance. In some instances, we did find that certain combinations of additives had a synergistic effect—the combination performed better than each additive used alone—sort of a one-plus-one-equals-three situation.”

Although pre-formulation testing is a necessity to determine how a new oil might perform in late-model engines with advanced combustion and emissions-control systems, these new formulations, if intended to be backward compatible, must also perform adequately in older engines.

“As early in the process as possible,” says Barnaby Ngai, category portfolio manager, heavy-duty engine and driveline oils, Petro-Canada Lubricants, “oil marketers will not only develop oils to meet the needs of the new engines, but in parallel with this work, they will perform trials of the newer oil in the field in older equipment. We know by design that newer API CK-4 oils are compatible and expected to perform in older engines, but the true measure of how well they will perform is through field trials.”

In addition to field trials, says Ngai, the API testing matrix incorporates tests with older engines under controlled conditions, where supervised tear-downs occur, and parts are rated by those trained to do so.

“By the time a new oil category is launched in the marketplace,” says Ngai, “oil companies can bring to the end-user community a certain knowledge of the performance level of the new oils in older engines.”

Base-oil basics

The new CK-4 and FA-4 oils that have so far been licensed are available as conventional (mineral oil), synthetic, or synthetic-blend formulations. These designations essentially refer to a formulation’s base oil, that is, the fluid into which additives are blended to achieve the desired performance characteristics. Keep in mind that definitions for the term “synthetic” are sometimes debated in the oil industry, so the following brief discussion uses concepts and terms generally accepted.

New-Oil Testing

The official release of new CK-4 and FA-4 oil formulations in December 2016 was preceded by intensive testing, both in the lab and in the field. According to Chevron’s Shawn Whitacre, senior staff engineer, the development cycle might require as long as five years.

“At the early stages of product development, the focus is on passing specification tests,” says Whitacre. “These are prescribed tests under controlled conditions, designed to evaluate oils quantitatively in an accelerated fashion. Because of that, the testing provides valuable information, but might not necessarily reflect what the oils will actually encounter in the field.”

To determine how a proposed oil will perform in the real world, says Whitacre, extensive field testing is conducted, involving a broad range of OEM engine brands, equipment brands, and operating conditions. Chevron, says Whitacre, field-tested its new formulations in more than 900 engines, some of which were eventually disassembled and inspected to assess oil performance. Along the way, he says, frequent oil sampling allowed monitoring specific aspects of the oil’s performance and breakdown tendencies.

Definitions aside, oil formulators do agree that investigating the interaction between base oils and additives is a critical step in oil development.

“Additives are a factor,” says Shell’s Arcy, “because some perform better in mineral oil than they would in a synthetic, and vice versa. So, you actually have to tailor additives—for example, the type of anti-oxidant—to the base oil. Changes in one component can have a positive or negative effect on product performance.”

Base-oil chemistry is complex, but the condensed version is that base oils are classified by API into five groups: I, II, III, IV (sometimes called polyalphaolefins, or POAs), and V.

“Groups I, II, and III are refined from crude oil,” says Petro-Canada’s Ngai, “but Groups II and III are further refined, resulting in progressively higher-quality base stocks. In general, in order to meet the high-performance demands of the CK-4 category and related OEM specifications in terms of volatility and oxidation resistance, high-quality Group II base oils are required for most non-synthetic CK-4 oils. It differs for each oil marketer, with each making a selection of base-stock components to meet specific requirements.”

In many instances, Group III base oils have molecules that are completely reformed by different types of refining or catalytic processes, says Shell’s Arcy. The resultant oil molecules are so closely designed and so uniform, he says, that oil formulators can more accurately predict how additives are going to work, and the overall formulation will provide much more predictive performance responses.

Petro-Canada’s Ngai adds that, in North America, oil formulated with API Group III base stocks can be marketed as “synthetic.”

Some in the oil industry say that from a lab-testing perspective, Group III base stocks are difficult to distinguish from Group IV synthetic POAs, which are loosely described as man-made oils based on natural constituents. Ultra-premium engine oils might be marketed as “full-synthetic,” because they use a POA base stock. Group V includes all other types of base stocks, including esters, which are basically fluids made from acids and alcohols.

“Synthetic blends,” says Arcy, “are usually a mix of a Group II base oil with a Group III base oil, or with a PAO or ester—or some other synthetic-type base. By replacing a certain volume of Group II base oil with a synthetic, there might be some improvement in some of the properties, but not always. When Shell looks at blends, it formulates them to give increasingly high performance.”

Petro-Canada’s Ngai is of similar opinion.

“Engine-oil formulations are a balance of many performance factors and are the result of years of research and development,” says Ngai. “We believe the focus should be less on the proportion of the base oils [synthetic versus non-synthetic in blends] and more on the benefits the synthetic blend can offer—be it added durability in stop-and-go operating cycles, extended drains, or the ability to handle extreme loads or cold temperatures.”

In some instances, the grade of the oil might determine its base-oil formulation. A 5W-30 formulation, for example, might require the qualities of a full-synthetic base oil to meet standards set for CK-4. Oil manufacturers generally develop viscosity grades that meet the demands of the marketplace as determined by engine manufacturers, says Ngai. At present, he says, the main-volume grade is 15W-40, but with a movement towards lower-viscosity grades, such as 10W-30.

At this point, diesel-engine users are being advised to strictly follow the equipment/truck manufacturer’s recommendations for both grade and oil type, whether CK-4 or FA-4. As API’s Ferrick cautions, managers of mixed fleets, if using both CK-4 and FA-4, should take every precaution to keep the products separate.

In some instances, managers with diverse fleets are opting to use CK-4 across the board, reasoning that standardizing on CK-4 in a grade sanctioned by the engine manufacturer will afford the best protection all around—the only compromise being, perhaps, giving up a bit of fuel economy in newer trucks that can use FA-4.

If consolidating the number of oils used in a particular operation is a concern, then fleet managers should consult both with the vehicle/engine OEM and a knowledgeable oil-company rep to determine if oil options given by the OEM would allow consolidating on one oil type and grade. Same goes when considering whether the more robust formulation of the new oils will permit longer drain intervals, which, as always, are application dependent and guided by consistent oil analysis.

About the Author

Walt Moore

Moore was a senior editor for Construction Equipment from 1983 through 2019.