Rental's on the Upswing

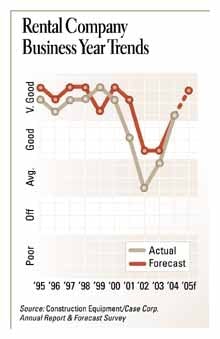

Rental dealers exhibited a certain prescience last year; it's almost as if they knew what was coming. As a group, they forecast 2004 would be a "very good" year, and they nailed it, according to the actuals. Expectations for next year are even higher.

Rental dealers, members of either the American Rental Association or the Associated Equipment Distributors, also accurately foresaw volume increases. Last year, the forecast for volume increases netted out at 42 percent; the 2004 figures reveal a net of 46 percent, with 56 percent of rental dealers reporting "significant volume increases" over 2003. The rental outlook remains high, too, with a net of 41 percent forecast for 2005 volume increases.

Rental dealers reported significant increases last year in new-equipment sales, used-equipment sales, and short-term rentals.

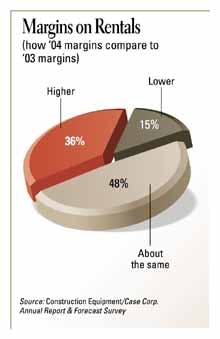

Although about half of rental dealers said margins on short-term rentals remained constant in 2004, the percentage reporting higher margins was nearly double what it was in 2003. Some 36 percent reported margin boosts last year.

Even with margin growth, though, rental dealers cite increasing competition as their No. 1 business concern. In fact, 68 percent said rental-market competition in their area was "very intense" or "intense." Other business concerns are rising interest rates, machine shortages, and declines in rental prices.

In spite of the competitive atmosphere, rate increases will continue to be pushed by rental dealers. Six of 10 expect to increase rates this year, after 48 percent bumped rates in 2004. There's no doubt that rates will change, either; 38 percent expect to lower rates.