Nonresidential Unfazed in Pace

Nine months into the Trump Administration’s international trade war, the nonresidential construction industry stands nearly unfazed by the threat of rising materials prices and a potential market slowdown. Prices for aluminum- and steel-based materials have soared in recent months (steel mill products are up 18.1 percent from a year ago, for example), yet the construction sector continues to charge ahead at a historic pace.

Nonresidential construction spending reached a record-high $767.1 billion in August 2018 (up 8.9 percent over 2017), bolstered by a healthy backlog of work. Even with the impacts from the tariffs factored in, construction industry economists remain largely upbeat with their forecasts for 2019. All but one sector (religious facilities) are expected to expand next year, according to the latest AIA Consensus Construction Forecast, with education (5.2 percent), industrial (4.9 percent), healthcare (4.4 percent), and office (4.1 percent) leading the way.

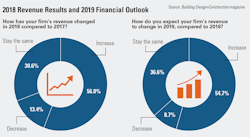

Yet despite the positive indicators for this market, AEC professionals are not exactly brimming with confidence over the growth potential for their firms heading into 2019. In a Building Design+Construction survey, only 56 percent of industry professionals expect higher revenue for their firms in 2018 compared to last year, and 13.4 percent are forecasting a decrease in revenue. And their forecast for 2019 isn’t much rosier: 54.7 percent expect revenue to increase, 8.7 percent call for a drop, and 36.6 percent predict flat revenue next year.

This is a markedly different sentiment than last year’s respondents, who were much more rosy with their forecasts for the upcoming year: 62.0 percent predicted revenue to rise and only 6.1 percent called for it to drop.

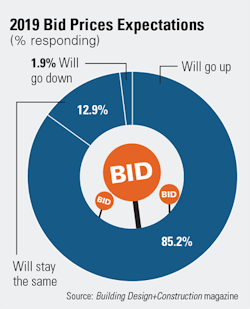

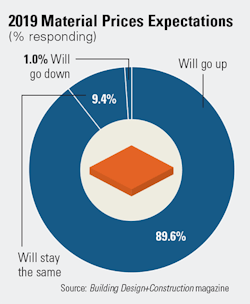

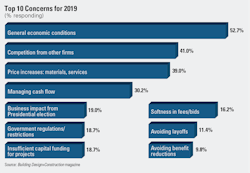

When asked about their top concerns for 2019, the largest number of respondents cited “general economic conditions” (52.7 percent) as a key issue, followed by “competition from other firms” (41.0 percent) and “price increases in materials and services” (39.0 percent). In fact, nearly 90 percent of respondents anticipate construction materials prices to rise in 2019. That’s up from 86 percent in last year’s survey.

To help keep their project pipelines full through 2019, AEC firms are focusing on a number of business development strategies. Selective hires (44.1 percent) and marketing/public relations efforts (42.2 percent) top the list, followed by investments in technology (39.0 percent), staff training/education (35.9 percent), and new services/business opportunities (29.2 percent).

Healthcare facilities and multifamily housing head the list of the hottest sectors heading into 2019. More than half (52.5 percent) indicated that the prospects for healthcare/hospital work were either “excellent” or “good”; 52.4 percent said the same for multifamily housing work. Other strong sectors: senior/assisted living facilities (51.9 percent), office interiors/fitouts (46.9 percent), industrial/warehouse buildings (42.7 percent), hotel/hospitality developments (39.7 percent), university facilities (38.2 percent), government/military buildings (37.5 percent), and office buildings (37.4).